Region:Asia

Author(s):Shubham

Product Code:KRAB5001

Pages:100

Published On:October 2025

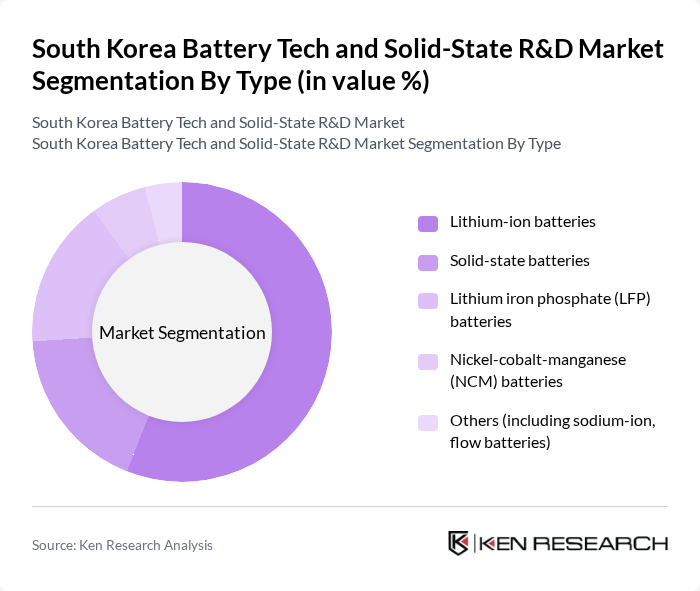

By Type:The market is segmented into various types of batteries, including Lithium-ion batteries, Solid-state batteries, Lithium iron phosphate (LFP) batteries, Nickel-cobalt-manganese (NCM) batteries, and Others (including sodium-ion and flow batteries). Among these, Lithium-ion batteries dominate the market due to their widespread use in electric vehicles and consumer electronics. The demand for solid-state batteries is increasing, driven by their potential for higher energy density, improved safety, and longer lifecycle. South Korean firms are also investing in next-generation chemistries, including LFP and sodium-ion, to diversify supply chains and address raw material constraints .

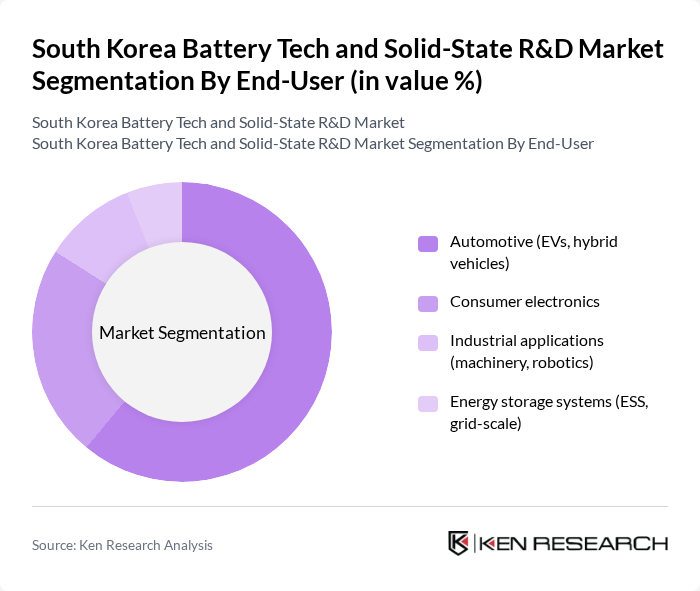

By End-User:The end-user segmentation includes Automotive (EVs, hybrid vehicles), Consumer electronics, Industrial applications (machinery, robotics), and Energy storage systems (ESS, grid-scale). The automotive sector is the leading end-user, reflecting the global shift toward electric mobility and South Korea’s position as a major EV battery exporter. Consumer electronics remain a significant segment, while demand for industrial and grid-scale energy storage is rising due to renewable integration and grid modernization .

The South Korea Battery Tech and Solid-State R&D Market is characterized by a dynamic mix of regional and international players. Leading participants such as LG Energy Solution, Samsung SDI, SK On, Hyundai Mobis, POSCO Future M, EcoPro BM, Samsung Electronics, Hanwha Q CELLS, Doosan Corporation, Korea Electric Power Corporation (KEPCO), SKC Co., Ltd., Iljin Materials, LG Chem, Soulbrain Co., Ltd., and Standard Energy contribute to innovation, geographic expansion, and service delivery in this space .

The South Korean battery technology landscape is poised for transformative growth, driven by increasing investments in R&D and a strong push towards sustainable energy solutions. As the government implements stricter emission regulations and incentivizes electric vehicle adoption, the demand for advanced battery technologies will rise. Collaborations between automotive and tech companies are expected to accelerate innovation, particularly in solid-state batteries, enhancing performance and safety. This dynamic environment will likely attract further investments, positioning South Korea as a leader in the global battery market.

| Segment | Sub-Segments |

|---|---|

| By Type | Lithium-ion batteries Solid-state batteries Lithium iron phosphate (LFP) batteries Nickel-cobalt-manganese (NCM) batteries Others (including sodium-ion, flow batteries) |

| By End-User | Automotive (EVs, hybrid vehicles) Consumer electronics Industrial applications (machinery, robotics) Energy storage systems (ESS, grid-scale) |

| By Application | Electric vehicles Renewable energy integration Portable electronics Grid storage |

| By Component | Anodes Cathodes Electrolytes (liquid, solid-state) Battery management systems (BMS) |

| By Sales Channel | Direct sales Distributors Online platforms Retail outlets |

| By Investment Source | Private investments Government funding Venture capital Corporate investments |

| By Policy Support | Subsidies for R&D Tax incentives for manufacturers Grants for sustainable projects Regulatory support for innovation |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electric Vehicle Battery Manufacturers | 100 | R&D Managers, Product Development Engineers |

| Consumer Electronics Battery Suppliers | 60 | Supply Chain Managers, Technical Directors |

| Energy Storage System Developers | 50 | Project Managers, Systems Engineers |

| Academic Research Institutions | 40 | Research Scientists, Professors in Materials Science |

| Government Regulatory Bodies | 40 | Policy Analysts, Regulatory Affairs Specialists |

The South Korea Battery Tech and Solid-State R&D Market is valued at approximately USD 7.5 billion, driven by increasing demand for electric vehicles, advancements in battery technology, and government initiatives promoting sustainable energy solutions.