Region:Asia

Author(s):Shubham

Product Code:KRAB5670

Pages:96

Published On:October 2025

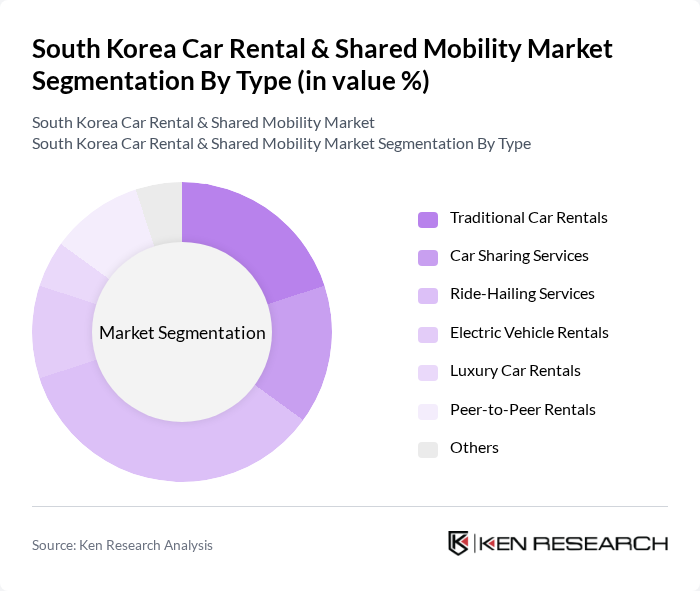

By Type:The market is segmented into various types, including Traditional Car Rentals, Car Sharing Services, Ride-Hailing Services, Electric Vehicle Rentals, Luxury Car Rentals, Peer-to-Peer Rentals, and Others. Among these, Ride-Hailing Services have gained significant traction due to the convenience they offer consumers, particularly in urban areas where public transport may not be as accessible. The increasing smartphone penetration and the rise of app-based services have further fueled the growth of this segment.

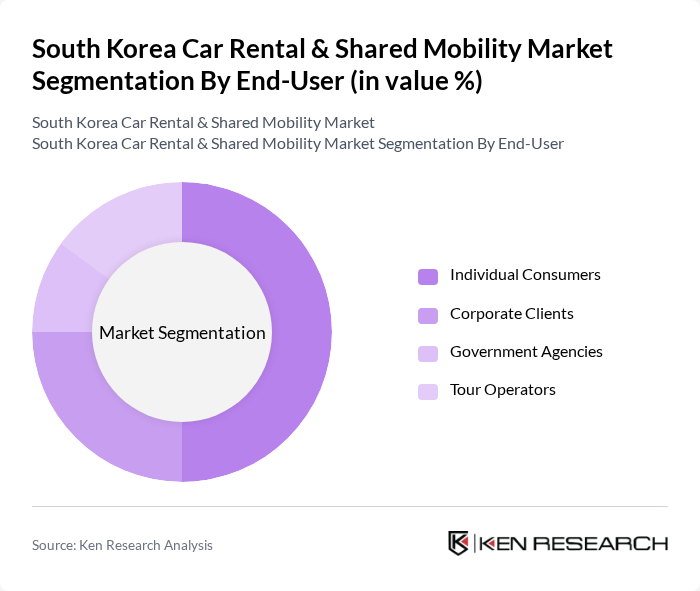

By End-User:The market is segmented by end-users, including Individual Consumers, Corporate Clients, Government Agencies, and Tour Operators. Individual Consumers dominate the market, driven by the increasing trend of urban mobility and the need for flexible transportation solutions. The rise in the gig economy and the growing number of young professionals seeking convenient travel options have significantly contributed to the demand from this segment.

The South Korea Car Rental & Shared Mobility Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lotte Rent-a-Car, AJ Rent-a-Car, SK Rent-a-Car, Green Car, Kakao Mobility, T Map Mobility, Hertz Korea, Avis Korea, Sixt Rent a Car, Rent-A-Car Korea, Carrot Mobility, SoCar, Tada, DriveNow, Zipcar contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean car rental and shared mobility market is poised for significant transformation driven by technological advancements and changing consumer preferences. As urbanization continues, the demand for flexible mobility solutions will rise, particularly in metropolitan areas. The integration of electric vehicles and smart technologies will enhance service offerings, while partnerships with tech firms will foster innovation. Additionally, sustainability initiatives will shape the market, aligning with global trends towards greener transportation solutions, ensuring a dynamic future for the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Car Rentals Car Sharing Services Ride-Hailing Services Electric Vehicle Rentals Luxury Car Rentals Peer-to-Peer Rentals Others |

| By End-User | Individual Consumers Corporate Clients Government Agencies Tour Operators |

| By Vehicle Type | Sedans SUVs Vans Electric Vehicles |

| By Rental Duration | Short-Term Rentals Long-Term Rentals |

| By Pricing Model | Hourly Pricing Daily Pricing Subscription Pricing |

| By Distribution Channel | Online Platforms Offline Agencies |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Car Rental Services | 150 | Rental Company Managers, Fleet Operations Directors |

| Shared Mobility Platforms | 100 | Product Managers, Marketing Executives |

| Consumer Preferences | 200 | Frequent Renters, Occasional Users, Urban Commuters |

| Regulatory Impact Assessment | 80 | Policy Makers, Transportation Analysts |

| Future Mobility Trends | 70 | Urban Planners, Sustainability Experts |

The South Korea Car Rental & Shared Mobility Market is valued at approximately USD 3.5 billion, driven by urbanization, tourism growth, and the increasing popularity of shared mobility solutions among consumers seeking convenience and cost-effectiveness.