Region:Europe

Author(s):Geetanshi

Product Code:KRAB5715

Pages:86

Published On:October 2025

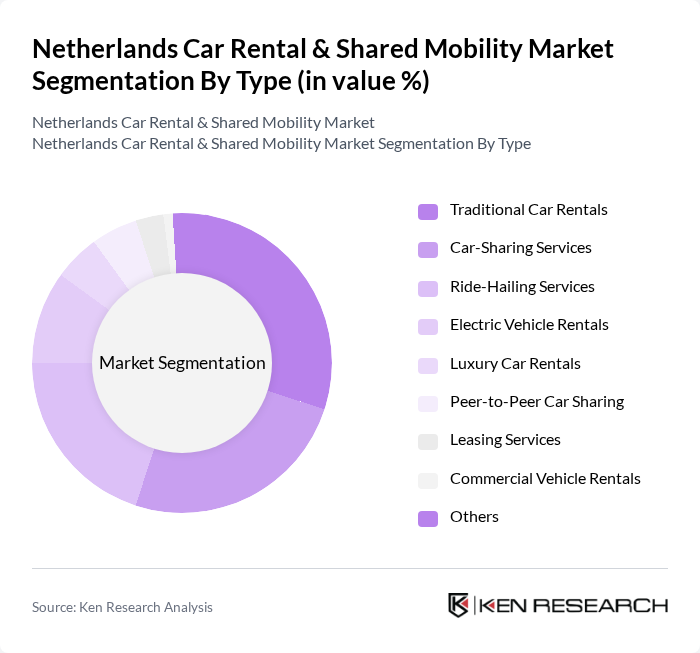

By Type:The market is segmented into Traditional Car Rentals, Car-Sharing Services, Ride-Hailing Services, Electric Vehicle Rentals, Luxury Car Rentals, Peer-to-Peer Car Sharing, Leasing Services, Commercial Vehicle Rentals, and Others. These segments address a broad spectrum of consumer mobility needs, from short-term tourist rentals and business travel to peer-to-peer sharing and eco-friendly options, reflecting the Netherlands’ diverse and evolving transportation landscape .

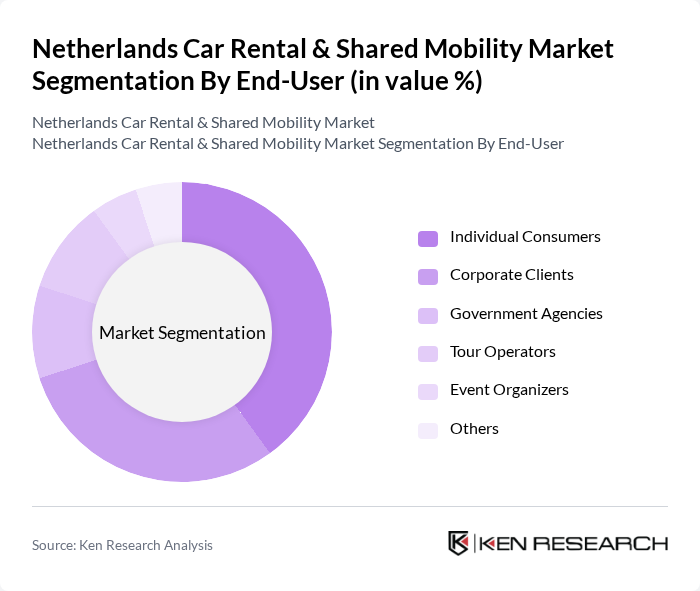

By End-User:The market is segmented by end-user categories, including Individual Consumers, Corporate Clients, Government Agencies, Tour Operators, Event Organizers, and Others. This segmentation highlights the distinct mobility demands of various customer groups, with individual consumers and corporate clients comprising the largest shares due to the prevalence of tourism and business travel in the Netherlands .

The Netherlands Car Rental & Shared Mobility Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hertz Netherlands, Sixt Rent a Car, Europcar Nederland, Greenwheels, SnappCar, MyWheels, KINTO Share, Budget Rent a Car, Enterprise Rent-A-Car, Alamo Rent A Car, National Car Rental, TUI Cars, Avis Budget Group, LeasePlan Corporation N.V., Arval Nederland, CarNext, Drivus, Green Motion, B2B Car Rental, and Global TIP Holdings Two B.V. contribute to innovation, geographic expansion, and service delivery in this space.

The Netherlands car rental and shared mobility market is poised for significant transformation driven by technological advancements and changing consumer preferences. As urbanization continues, the demand for flexible mobility solutions will rise, particularly in metropolitan areas. The integration of electric vehicles and the expansion of subscription-based services will likely reshape the market landscape, offering consumers more sustainable and convenient options. Additionally, partnerships with tech firms will enhance service delivery, making mobility more accessible and efficient for users across the country.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Car Rentals Car-Sharing Services Ride-Hailing Services Electric Vehicle Rentals Luxury Car Rentals Peer-to-Peer Car Sharing Leasing Services Commercial Vehicle Rentals Others |

| By End-User | Individual Consumers Corporate Clients Government Agencies Tour Operators Event Organizers Others |

| By Rental Duration | Short-Term Rentals Long-Term Rentals Leasing (Annual Rentals) |

| By Vehicle Type | Economy Cars SUVs Vans Luxury Vehicles Electric Vehicles Others |

| By Payment Model | Pay-Per-Use Subscription Models Prepaid Rentals Postpaid Rentals |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Customer Segment | Business Travelers Leisure Travelers Local Residents Tourists |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Car Rental Users | 120 | Frequent Travelers, Business Executives |

| Shared Mobility Users | 100 | Urban Commuters, College Students |

| Fleet Managers | 65 | Logistics Coordinators, Operations Managers |

| Policy Makers | 45 | Transportation Planners, City Officials |

| Industry Experts | 40 | Consultants, Academic Researchers |

The Netherlands Car Rental & Shared Mobility Market is valued at approximately USD 2.5 billion, driven by urbanization, tourism, and a growing preference for flexible and sustainable transportation options among consumers.