Region:Asia

Author(s):Dev

Product Code:KRAB5533

Pages:83

Published On:October 2025

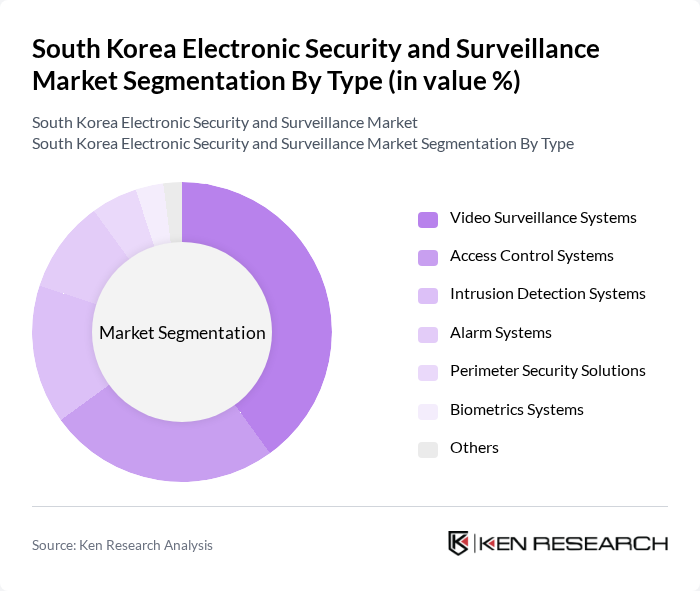

By Type:The segmentation by type includes various systems that cater to different security needs. The subsegments are Video Surveillance Systems, Access Control Systems, Intrusion Detection Systems, Alarm Systems, Perimeter Security Solutions, Biometrics Systems, and Others. Among these, Video Surveillance Systems dominate the market due to their widespread adoption in both commercial and residential sectors, driven by technological advancements and decreasing costs of high-definition cameras.

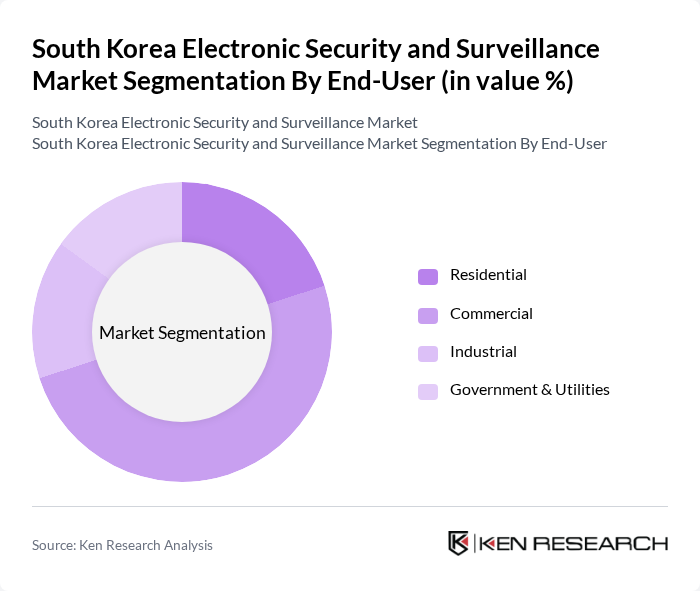

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The Commercial sector is the largest end-user, driven by the need for enhanced security in retail, banking, and corporate environments. The increasing focus on protecting assets and ensuring safety in public spaces has led to a significant rise in the adoption of electronic security solutions in this sector.

The South Korea Electronic Security and Surveillance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Techwin, Hanwha Techwin, LG Electronics, Hikvision, Dahua Technology, Axis Communications, Bosch Security Systems, Honeywell Security, Tyco Integrated Security, ADT Security Services, Pelco, Avigilon, Genetec, FLIR Systems, ZKTeco contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean electronic security and surveillance market is poised for significant evolution, driven by technological advancements and increasing consumer awareness. As AI and machine learning technologies become more integrated into surveillance systems, their effectiveness and appeal will grow. Additionally, the rise of smart home solutions will further influence consumer preferences, leading to a shift towards more sophisticated, user-friendly security options. This dynamic environment presents opportunities for innovation and expansion within the market, fostering a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Video Surveillance Systems Access Control Systems Intrusion Detection Systems Alarm Systems Perimeter Security Solutions Biometrics Systems Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Retail Security Transportation Security Banking and Financial Services Critical Infrastructure Protection |

| By Distribution Channel | Direct Sales Online Sales Distributors and Resellers |

| By Region | Seoul Busan Incheon Daegu |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Security Solutions | 100 | Security Managers, Store Operations Directors |

| Banking and Financial Security | 80 | Risk Management Officers, IT Security Managers |

| Public Safety and Surveillance | 70 | City Planners, Law Enforcement Officials |

| Residential Security Systems | 90 | Homeowners, Property Managers |

| Industrial Security Applications | 60 | Facility Managers, Safety Compliance Officers |

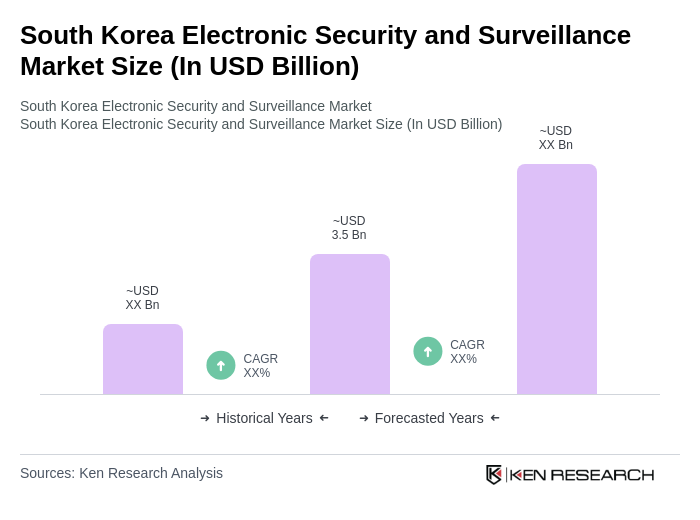

The South Korea Electronic Security and Surveillance Market is valued at approximately USD 3.5 billion, reflecting a significant growth trend driven by urbanization, rising crime rates, and the demand for advanced security solutions across various sectors.