South Korea Luxury Retail and Fashion Market Overview

- The South Korea Luxury Retail and Fashion Market is valued at USD 15 billion, based on a five-year historical analysis. This growth is primarily driven by increasing disposable incomes, a rising middle class, and a growing appetite for luxury goods among consumers. The market has seen a significant uptick in demand for high-end fashion, accessories, and beauty products, reflecting changing consumer preferences and lifestyle choices.

- Key cities such as Seoul, Busan, and Incheon dominate the luxury retail landscape due to their vibrant urban culture, high population density, and status as economic hubs. Seoul, in particular, is a focal point for luxury brands, attracting both local and international consumers with its upscale shopping districts and luxury department stores, making it a prime location for luxury retail growth.

- In 2023, the South Korean government implemented regulations aimed at enhancing consumer protection in the luxury retail sector. This includes stricter guidelines on product authenticity and transparency in pricing, ensuring that consumers are well-informed about the products they purchase. Such regulations are designed to foster trust and confidence in the luxury market, ultimately benefiting both consumers and retailers.

South Korea Luxury Retail and Fashion Market Segmentation

By Type:The luxury retail and fashion market is segmented into various types, including apparel, footwear, accessories, jewelry, handbags, fragrances, and others. Among these, apparel is the leading segment, driven by the increasing demand for high-quality clothing and the influence of fashion trends. Footwear and accessories also hold significant market shares, as consumers seek to complement their outfits with stylish and branded items. The jewelry and handbag segments are growing steadily, reflecting a shift towards investment in luxury items that signify status and personal style.

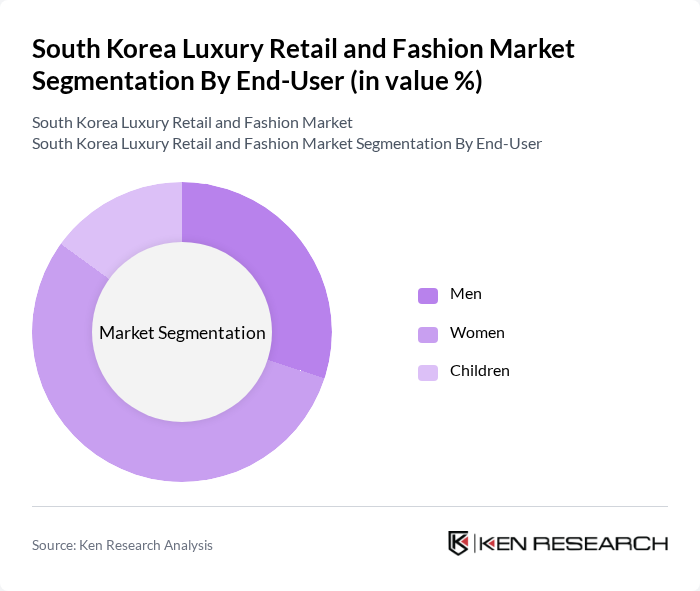

By End-User:The market is also segmented by end-user demographics, including men, women, and children. Women represent the largest consumer group in the luxury retail sector, driven by a strong interest in fashion and beauty products. Men's luxury fashion is gaining traction, particularly in formal wear and accessories, as societal norms evolve. The children's segment, while smaller, is growing as parents increasingly invest in high-quality, branded items for their children, reflecting a trend towards luxury consumption across all age groups.

South Korea Luxury Retail and Fashion Market Competitive Landscape

The South Korea Luxury Retail and Fashion Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung C&T Fashion Group, LG Fashion, Hyundai Department Store, Shinsegae International, Lotte Shopping, Amorepacific Corporation, F&F Co., Ltd., Kolon Industries, E-Land Group, Daehong Communications, Hanjin Transportation, The Hyundai Group, KOLON Global, TNGT, 8Seconds contribute to innovation, geographic expansion, and service delivery in this space.

South Korea Luxury Retail and Fashion Market Industry Analysis

Growth Drivers

- Rising Disposable Income:The average disposable income in South Korea reached approximately 3,400,000 KRW (around $2,800) per month in future, reflecting a steady increase from previous years. This rise in disposable income enables consumers to allocate more funds towards luxury goods, driving demand in the luxury retail sector. As the economy continues to grow, the purchasing power of consumers is expected to further enhance their ability to invest in premium fashion items, thereby boosting market growth.

- Increasing Demand for Premium Products:In future, the luxury goods market in South Korea is projected to exceed 16 trillion KRW (approximately $13.3 billion), driven by a growing appetite for high-end products. This demand is fueled by affluent consumers seeking exclusivity and quality, particularly in fashion and accessories. The trend is further supported by the rise of affluent millennials and Gen Z consumers, who prioritize brand prestige and are willing to spend significantly on luxury items.

- Influence of K-Pop and Korean Culture:The global popularity of K-Pop and Korean culture has significantly impacted consumer behavior in South Korea. In future, the K-Pop industry is expected to generate over 11 trillion KRW (around $9.2 billion), creating a strong association between music, fashion, and luxury brands. This cultural phenomenon drives consumers to emulate their favorite idols, leading to increased sales of luxury fashion items that are often showcased in music videos and performances, thus enhancing market growth.

Market Challenges

- Intense Competition:The South Korean luxury retail market is characterized by fierce competition, with over 200 international luxury brands vying for market share. This saturation leads to aggressive pricing strategies and marketing campaigns, making it challenging for new entrants to establish themselves. In future, the competition is expected to intensify further, as brands invest heavily in digital marketing and influencer partnerships to capture the attention of discerning consumers, complicating market dynamics.

- Economic Uncertainty:South Korea's economy faces potential headwinds in future, with GDP growth projected at 2.5%, down from 2.6% in previous year. Factors such as global inflation and geopolitical tensions may impact consumer confidence and spending habits. As economic uncertainty looms, luxury retailers may experience fluctuations in sales, as consumers become more cautious about discretionary spending, posing a significant challenge to sustained market growth.

South Korea Luxury Retail and Fashion Market Future Outlook

The South Korean luxury retail market is poised for continued evolution, driven by technological advancements and changing consumer preferences. As digital transformation accelerates, brands are expected to enhance their online presence, offering personalized shopping experiences. Additionally, sustainability will become a focal point, with consumers increasingly favoring eco-friendly products. The integration of experiential retail concepts will also reshape the shopping landscape, providing immersive experiences that resonate with younger consumers, ultimately fostering brand loyalty and market resilience.

Market Opportunities

- Expansion of Online Retail:The online luxury retail segment in South Korea is projected to grow significantly, with e-commerce sales expected to reach 7 trillion KRW (approximately $5.8 billion) in future. This growth presents an opportunity for brands to enhance their digital strategies, leveraging social media and online platforms to reach a broader audience and cater to the increasing preference for online shopping among consumers.

- Sustainable Fashion Initiatives:With sustainability becoming a key concern for consumers, luxury brands that adopt eco-friendly practices are likely to gain a competitive edge. In future, the market for sustainable fashion in South Korea is anticipated to grow to 1.2 trillion KRW (around $1 billion), as consumers increasingly seek products that align with their values, presenting a lucrative opportunity for brands to innovate and differentiate themselves.