Region:Europe

Author(s):Geetanshi

Product Code:KRAB1351

Pages:94

Published On:October 2025

By Type:The facility management market in hospitality can be segmented into various types, including Hard Services, Soft Services, Integrated Services, Specialized Services, and Others. Each of these segments plays a crucial role in ensuring the smooth operation of hospitality establishments.

The Hard Services segment is currently dominating the market due to the essential nature of technical building operations in maintaining the infrastructure of hospitality establishments. This includes critical systems such as HVAC, plumbing, and fire safety, which are vital for operational efficiency and guest safety. The increasing complexity of building systems and the need for compliance with safety regulations further drive the demand for these services. As hotels and restaurants strive to enhance guest experiences, the focus on maintaining high operational standards through hard services becomes paramount .

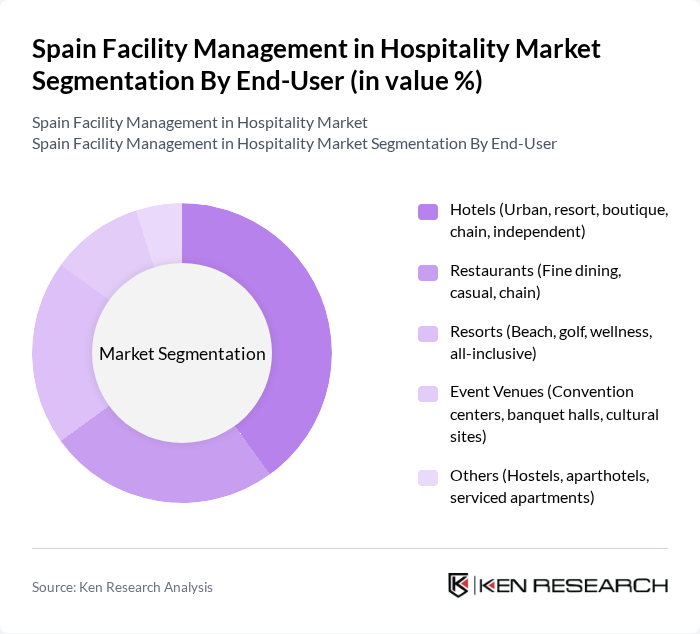

By End-User:The end-user segmentation of the facility management market in hospitality includes Hotels, Restaurants, Resorts, Event Venues, and Others. Each category has unique requirements and contributes differently to the overall market dynamics.

The Hotels segment is the largest end-user in the facility management market, driven by the sheer volume of establishments and the need for comprehensive management services. Urban hotels, in particular, require robust facility management to cater to high guest expectations and operational demands. The focus on guest satisfaction and operational efficiency in hotels leads to increased investments in facility management services, making this segment a key driver of market growth .

The Spain Facility Management in Hospitality Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services, Sacyr Facilities, Ferrovial Servicios, Clece, Eulen Group, OHL Servicios Inmobiliarios, Saint-Gobain PAM, Bureau Veritas España, Dussmann Service, Peybernes Facility Services, Acciona Facility Services, Licuas SA, CBRE Group, The Mail Company, ISS Global contribute to innovation, geographic expansion, and service delivery in this space.

The future of facility management in Spain's hospitality sector appears promising, driven by ongoing technological advancements and a growing emphasis on sustainability. As the hospitality industry continues to recover post-pandemic, the demand for integrated facility management solutions is expected to rise. Additionally, the increasing focus on health and safety standards will further propel the adoption of innovative management practices, ensuring that facilities meet evolving guest expectations while optimizing operational efficiency and cost-effectiveness.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services (Technical building operations: HVAC, electrical, plumbing, fire safety) Soft Services (Administrative and support: cleaning, security, catering, concierge) Integrated Services (Combined hard and soft FM, end-to-end solutions) Specialized Services (Energy management, waste management, sustainability consulting) Others (Ad-hoc, project-based services) |

| By End-User | Hotels (Urban, resort, boutique, chain, independent) Restaurants (Fine dining, casual, chain) Resorts (Beach, golf, wellness, all-inclusive) Event Venues (Convention centers, banquet halls, cultural sites) Others (Hostels, aparthotels, serviced apartments) |

| By Service Model | Outsourced Services (Third-party providers, bundled/integrated contracts) In-House Services (Directly managed by hospitality operator) Hybrid Model (Mix of in-house and outsourced, often for critical vs. non-critical services) |

| By Region | Northern Spain (Catalonia, Basque Country, Galicia) Southern Spain (Andalusia, Costa del Sol, Murcia) Eastern Spain (Valencia, Balearic Islands) Western Spain (Madrid, Castile and León, Extremadura) |

| By Contract Type | Fixed-Term Contracts (Defined duration, scope, and price) Service Level Agreements (SLAs, performance-based, often with penalties/rewards) Time and Material Contracts (Pay-as-you-go, flexible scope) |

| By Pricing Model | Cost-Plus Pricing (Costs plus agreed margin) Fixed Pricing (Flat fee for defined services) Performance-Based Pricing (Tied to KPIs, savings, or outcomes) |

| By Technology Adoption | Traditional Methods (Manual processes, paper-based) Digital Solutions (CAFM, CMMS, mobile apps) Smart Technologies (IoT sensors, AI-driven analytics, predictive maintenance) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel Facility Management | 60 | Facility Managers, Operations Directors |

| Mid-range Hotel Services | 50 | General Managers, Maintenance Supervisors |

| Restaurant Facility Operations | 40 | Restaurant Managers, Facility Coordinators |

| Event Venue Management | 40 | Event Coordinators, Venue Managers |

| Tourism and Hospitality Consulting | 50 | Consultants, Industry Analysts |

The Spain Facility Management in Hospitality Market is valued at approximately USD 15 billion, driven by the increasing demand for efficient operational management, sustainability, and cost optimization within the hospitality sector.