Region:Africa

Author(s):Rebecca

Product Code:KRAB5989

Pages:95

Published On:October 2025

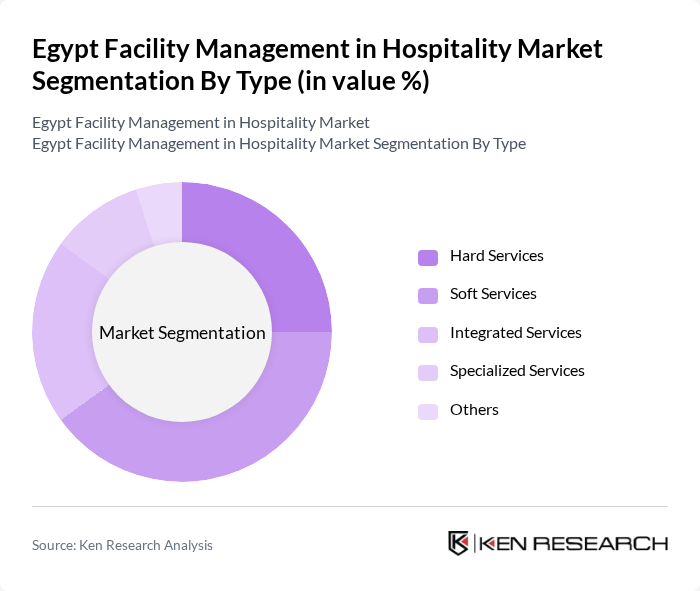

By Type:The facility management services in the hospitality sector can be categorized into several types, including Hard Services, Soft Services, Integrated Services, Specialized Services, and Others. Hard Services encompass essential maintenance and repair tasks, while Soft Services focus on non-technical support such as cleaning and catering. Integrated Services combine both hard and soft services for a comprehensive approach. Specialized Services cater to unique needs, and Others include miscellaneous services that do not fit into the primary categories. Among these, Soft Services dominate the market due to the increasing emphasis on customer experience and satisfaction.

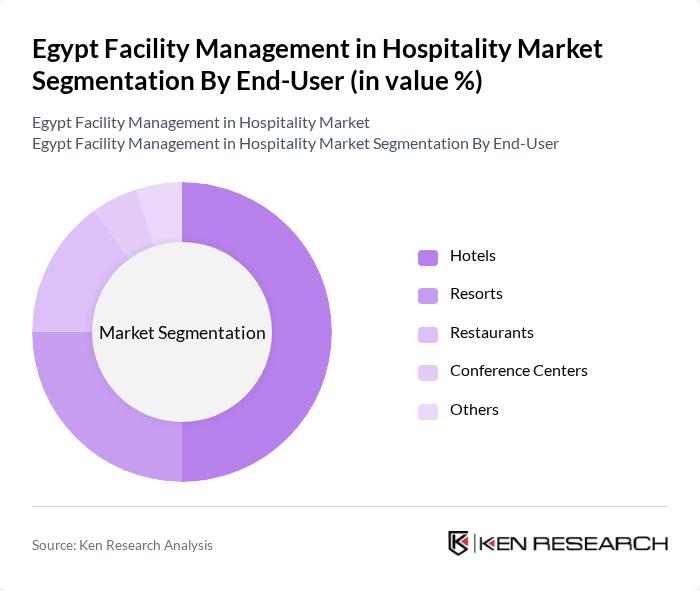

By End-User:The end-users of facility management services in the hospitality sector include Hotels, Resorts, Restaurants, Conference Centers, and Others. Hotels and Resorts are the primary consumers, driven by the need for maintaining high standards of service and guest satisfaction. Restaurants also require facility management to ensure cleanliness and operational efficiency. Conference Centers, which host various events, rely on these services to provide a conducive environment. The Hotels segment leads the market due to the sheer volume of establishments and the critical need for consistent service quality.

The Egypt Facility Management in Hospitality Market is characterized by a dynamic mix of regional and international players. Leading participants such as EFS Facilities Services, Amlak Facilities Management, Al-Futtaim Engineering, Emcor Facilities Services, JLL (Jones Lang LaSalle), CBRE Group, Transguard Group, ISS Facility Services, G4S Facilities Management, Serco Group, Cofely Besix Facility Management, Mace Group, Cushman & Wakefield, SODEXO, Apleona contribute to innovation, geographic expansion, and service delivery in this space.

The future of the facility management market in Egypt's hospitality sector appears promising, driven by increasing tourism and a focus on service quality. As the government continues to promote tourism, investments in facility management are expected to rise. Additionally, the integration of smart technologies will enhance operational efficiency. However, service providers must navigate challenges such as economic fluctuations and competition to capitalize on these opportunities and ensure sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Integrated Services Specialized Services Others |

| By End-User | Hotels Resorts Restaurants Conference Centers Others |

| By Service Model | Outsourced Services In-House Services Hybrid Services |

| By Region | Cairo Alexandria Sharm El Sheikh Hurghada Others |

| By Service Duration | Short-Term Contracts Long-Term Contracts Project-Based Contracts |

| By Pricing Model | Fixed Pricing Variable Pricing Performance-Based Pricing |

| By Customer Segment | Corporate Clients Individual Clients Government Entities Non-Profit Organizations |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel Facility Management | 100 | Facility Managers, Operations Directors |

| Mid-range Hotel Services | 80 | General Managers, Maintenance Supervisors |

| Resort Management Practices | 70 | Resort Managers, Guest Services Coordinators |

| Hospitality Technology Integration | 60 | IT Managers, Facility Management Consultants |

| Environmental Sustainability in Hospitality | 90 | Sustainability Officers, Compliance Managers |

The Egypt Facility Management in Hospitality Market is valued at approximately USD 1.2 billion, driven by the growth in tourism, the hospitality sector, and the demand for efficient facility management services to enhance guest experiences and operational efficiency.