Region:Europe

Author(s):Rebecca

Product Code:KRAB1723

Pages:92

Published On:October 2025

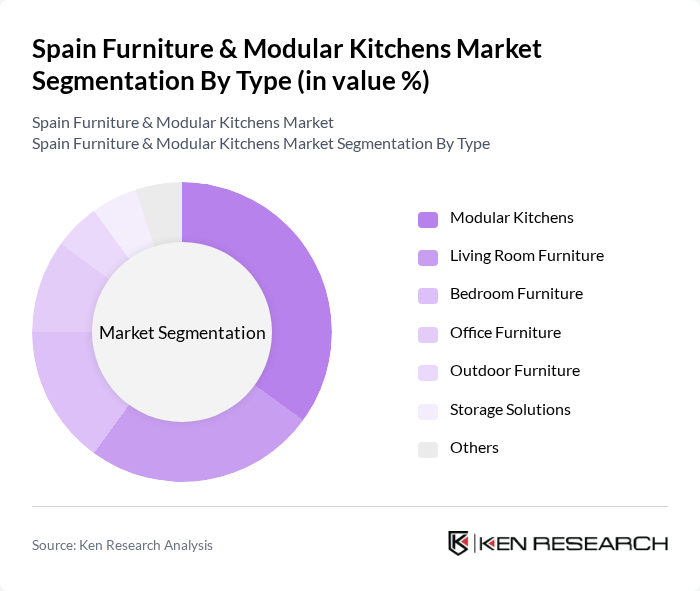

By Type:The market is segmented into Modular Kitchens, Living Room Furniture, Bedroom Furniture, Office Furniture, Outdoor Furniture, Storage Solutions, and Others. Modular Kitchens are gaining significant traction due to their space-saving designs, advanced customization options, and integration of smart appliances, appealing to modern consumers who prioritize both functionality and aesthetics. Living Room and Bedroom Furniture remain core categories, with increasing demand for multi-functional and sustainable designs. Office Furniture is also seeing growth, supported by the hybrid work trend and demand for ergonomic solutions .

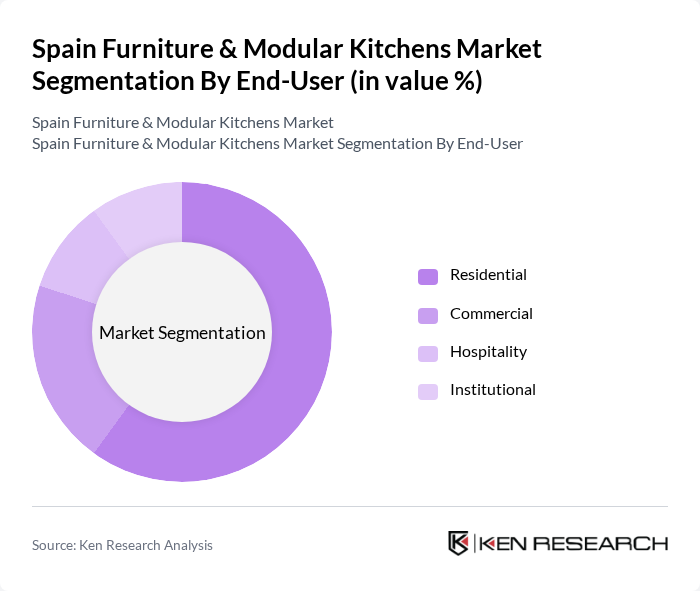

By End-User:The market is categorized into Residential, Commercial, Hospitality, and Institutional segments. The Residential segment is the largest, driven by increasing home renovations, the growing trend of modular kitchens, and a focus on personalized, functional living spaces. Commercial and Hospitality segments are also expanding, supported by investments in real estate, hotels, and office refurbishments, while Institutional demand is steady, particularly in education and healthcare facilities .

The Spain Furniture & Modular Kitchens Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Leroy Merlin, Conforama, El Corte Inglés, Muebles Dico, Maisons du Monde, Habitat, Kvik, Bricor, Muebles La Fábrica, Muebles Rey, Muebles Mago, Muebles Montalvo, Muebles Muro, and Muebles Mistral contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Spain furniture and modular kitchens market appears promising, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for innovative, space-saving solutions will likely increase. Additionally, the integration of smart technologies into furniture design is expected to gain traction, appealing to tech-savvy consumers. Companies that adapt to these trends and focus on sustainability will be well-positioned to capture market share and drive growth in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Modular Kitchens Living Room Furniture Bedroom Furniture Office Furniture Outdoor Furniture Storage Solutions Others |

| By End-User | Residential Commercial Hospitality Institutional |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Wholesale |

| By Material | Wood Metal Glass Plastic |

| By Price Range | Budget Mid-range Premium |

| By Design Style | Contemporary Traditional Rustic Industrial |

| By Functionality | Multi-functional Fixed Modular Customizable |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Furniture Sales | 120 | Store Managers, Sales Representatives |

| Modular Kitchen Installations | 80 | Kitchen Designers, Installation Supervisors |

| Consumer Preferences in Furniture | 140 | Homeowners, Interior Design Enthusiasts |

| Market Trends in Sustainable Furniture | 60 | Sustainability Consultants, Product Development Managers |

| Online Furniture Retail Insights | 100 | E-commerce Managers, Digital Marketing Specialists |

The Spain Furniture & Modular Kitchens Market is valued at approximately USD 9.1 billion, reflecting a robust growth trajectory driven by urbanization, rising disposable incomes, and a trend towards home renovation and stylish furniture solutions.