Region:Europe

Author(s):Geetanshi

Product Code:KRAA3703

Pages:93

Published On:September 2025

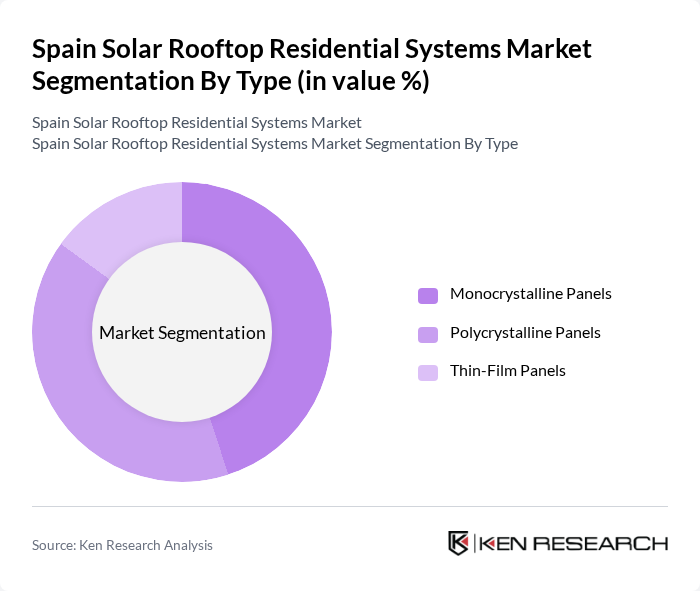

By Type:The market is segmented into three main types of solar panels:Monocrystalline Panels, Polycrystalline Panels, and Thin-Film Panels. Monocrystalline panels are recognized for their high efficiency and compact design, making them especially attractive for homeowners with limited roof space. Polycrystalline panels, while slightly less efficient, offer a more cost-effective solution and remain widely adopted. Thin-film panels are gaining attention due to their lightweight and flexible properties, suitable for diverse residential applications and innovative architectural designs .

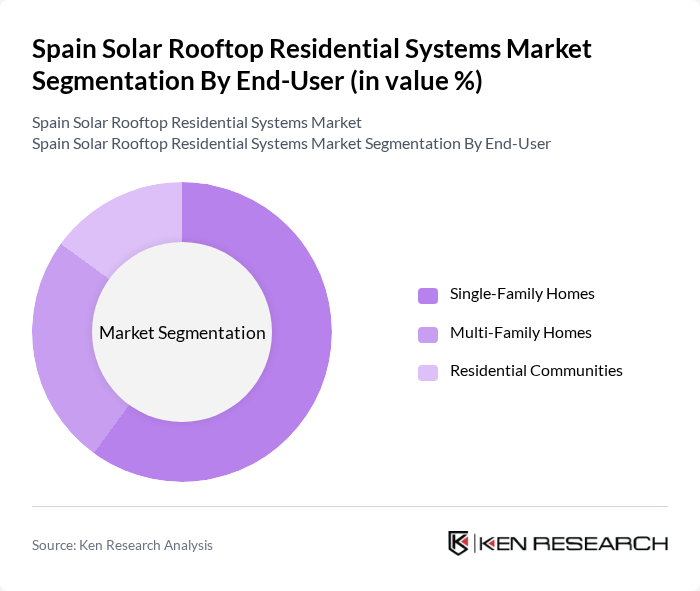

By End-User:The residential solar market is primarily segmented intoSingle-Family Homes, Multi-Family Homes, and Residential Communities. Single-family homes account for the largest share, driven by a growing number of homeowners seeking energy autonomy and cost savings. Multi-family homes are increasingly integrating solar solutions as developers and property managers respond to sustainability trends and regulatory incentives. Residential communities are emerging as a viable segment, with collective self-consumption and shared solar installations gaining popularity .

The Spain Solar Rooftop Residential Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Iberdrola, Endesa, Acciona, Solaria Energía y Medio Ambiente S.A., Fotowatio Renewable Ventures (FRV), Grenergy Renovables, EDP Renováveis, Green Eagle Solutions, Enel Green Power España, X-Elio, Repsol Solar, Plenitude Solar, Soltec Power Holdings, Q CELLS, Canadian Solar, Trina Solar, JinkoSolar, REC Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the solar rooftop residential systems market in Spain appears promising, driven by increasing energy costs and a strong push for sustainability. As technological advancements continue to lower installation costs and improve efficiency, more homeowners are likely to adopt solar solutions. Additionally, the integration of smart home technologies and energy storage systems will enhance the appeal of solar energy, making it a more viable option for energy independence and resilience against fluctuating energy prices.

| Segment | Sub-Segments |

|---|---|

| By Type | Monocrystalline Panels Polycrystalline Panels Thin-Film Panels |

| By End-User | Single-Family Homes Multi-Family Homes Residential Communities |

| By Installation Type | Roof-Mounted Systems Ground-Mounted Systems |

| By Grid Type | On-Grid Systems Off-Grid Systems |

| By Financing Model | Cash Purchase Solar Loans Power Purchase Agreements (PPAs) Leasing |

| By Component | Inverters Batteries Mounting Systems Monitoring Systems |

| By Sales Channel | Direct Sales Online Sales Distributors |

| By Policy Support | Subsidies Tax Exemptions Grants Net Metering |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar System Installations | 100 | Homeowners, Solar System Installers |

| Energy Consumption Patterns | 60 | Energy Consultants, Home Energy Auditors |

| Government Policy Impact | 40 | Regulatory Officials, Policy Analysts |

| Financing Options for Solar Systems | 50 | Financial Advisors, Mortgage Brokers |

| Consumer Attitudes Towards Solar Energy | 70 | General Public, Environmental Advocates |

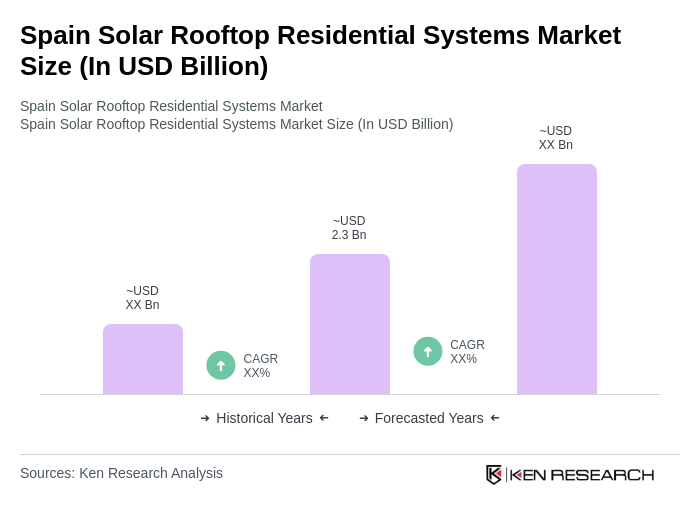

The Spain Solar Rooftop Residential Systems Market is valued at approximately USD 2.3 billion, reflecting significant growth driven by rising electricity costs, government incentives, and increased consumer awareness regarding sustainability and energy independence.