Region:Europe

Author(s):Geetanshi

Product Code:KRAB6320

Pages:89

Published On:October 2025

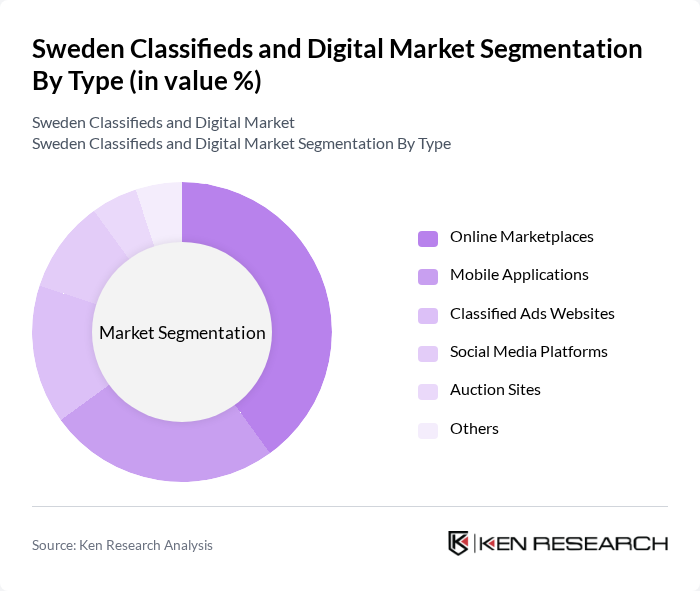

By Type:The market is segmented into various types, including online marketplaces, mobile applications, classified ads websites, social media platforms, auction sites, and others. Among these, online marketplaces have emerged as the dominant segment due to their user-friendly interfaces and extensive product offerings. The convenience of browsing and purchasing items from the comfort of home has led to increased consumer adoption, making this segment a key player in the market.

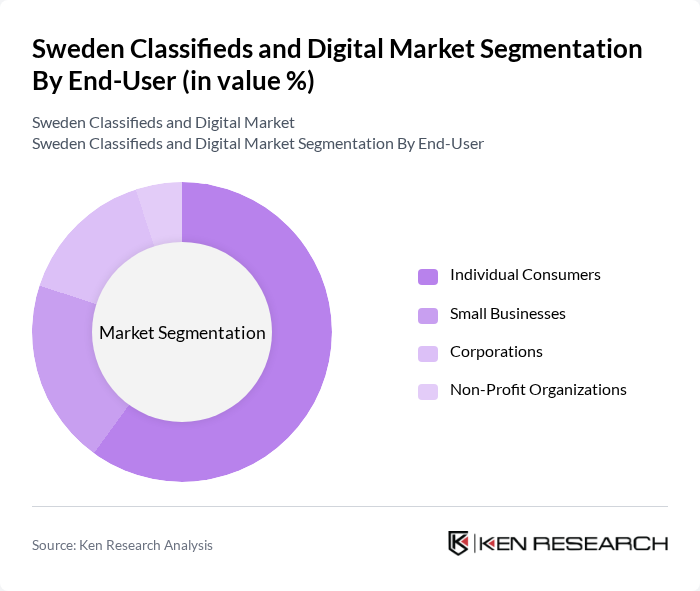

By End-User:The end-user segmentation includes individual consumers, small businesses, corporations, and non-profit organizations. Individual consumers represent the largest segment, driven by the growing trend of online shopping and the convenience of accessing a wide range of products and services. This segment's dominance is attributed to the increasing number of consumers who prefer online platforms for purchasing goods, leading to a significant shift in buying behavior.

The Sweden Classifieds and Digital Market is characterized by a dynamic mix of regional and international players. Leading participants such as Blocket AB, Tradera AB, Facebook Marketplace, Hemnet AB, Bostadsdeal.se, Bytbil.com, Lendo AB, Zettabyte AB, Marketplace Sweden AB, Blocket Jobb, Eniro AB, KVD Kvarndammen AB, Sellpy AB, Trovit AB, Shpock AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Sweden classifieds and digital market appears promising, driven by technological advancements and evolving consumer preferences. As mobile commerce continues to grow, businesses will need to adapt their strategies to enhance user experience and engagement. Additionally, the increasing focus on sustainability will likely shape product offerings, encouraging platforms to integrate eco-friendly practices. Companies that leverage data analytics and AI to personalize services will be well-positioned to capture market share and foster customer loyalty in this dynamic environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Marketplaces Mobile Applications Classified Ads Websites Social Media Platforms Auction Sites Others |

| By End-User | Individual Consumers Small Businesses Corporations Non-Profit Organizations |

| By Sales Channel | Direct Sales Affiliate Marketing Partnerships with Local Businesses Others |

| By Product Category | Real Estate Automotive Electronics Home Goods Services Others |

| By Geographic Focus | Urban Areas Suburban Areas Rural Areas Others |

| By Pricing Model | Free Listings Paid Listings Subscription-Based Models Others |

| By User Demographics | Age Groups Income Levels Geographic Distribution Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Real Estate Listings | 100 | Real Estate Agents, Property Managers |

| Automotive Sales | 80 | Car Dealership Owners, Automotive Sales Managers |

| Job Listings | 120 | HR Managers, Recruitment Consultants |

| Consumer Goods Sales | 90 | Small Business Owners, E-commerce Entrepreneurs |

| Service Offerings (e.g., home repairs) | 70 | Service Providers, Freelancers |

The Sweden Classifieds and Digital Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increased internet penetration, mobile device usage, and a shift towards online shopping and services.