North America Classifieds and Digital Market Overview

- The North America Classifieds and Digital Market is valued at USD 23 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing penetration of the internet and mobile devices, along with a shift in consumer behavior towards online platforms for buying and selling goods and services. The rise of e-commerce and digital transactions has further fueled the demand for classified services.

- Key players in this market include major cities such as New York, Los Angeles, and Toronto, which dominate due to their large populations and high levels of internet connectivity. These urban centers serve as hubs for commerce and trade, attracting both buyers and sellers to digital marketplaces. The presence of diverse demographics also enhances the variety of listings available, making these cities pivotal in the classifieds landscape.

- The Federal Trade Commission Act, Section 5, 2021 issued by the Federal Trade Commission provides comprehensive consumer protection measures for online marketplaces. This regulation establishes requirements for transparency in pricing and authenticity of listings, mandates data privacy and security protocols, and sets enforcement mechanisms for unfair or deceptive practices. The regulation applies to all digital marketplace operators with annual revenues exceeding USD 10 million and requires compliance with specific disclosure standards and user verification processes.

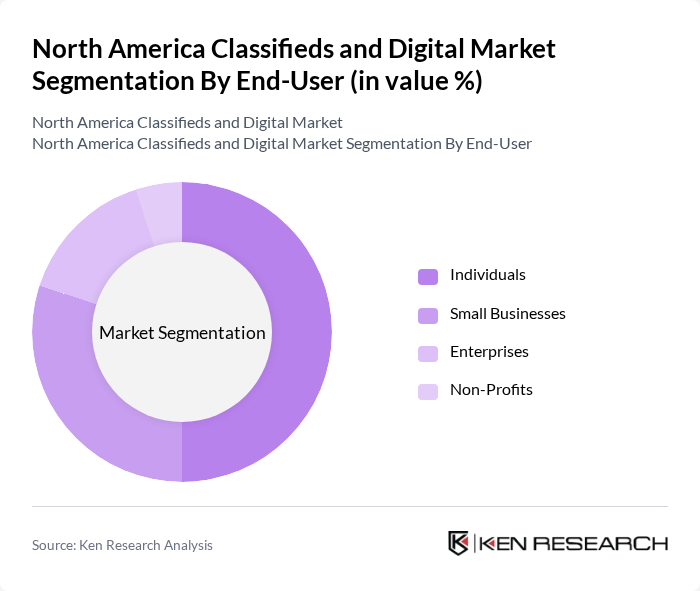

North America Classifieds and Digital Market Segmentation

By Type:The market is segmented into various types, including Online Classifieds, Mobile Classifieds, Social Media Marketplaces, Niche Marketplaces, and Print Classifieds. Among these, Online Classifieds dominate the market due to their accessibility and convenience, allowing users to browse and post listings from anywhere. Mobile Classifieds are also gaining significant traction as smartphone adoption continues to increase across North America, with users preferring mobile-first experiences for transactions. Social Media Marketplaces leverage existing social networks to facilitate buying and selling, while Niche Marketplaces cater to specific interests, enhancing user engagement. Print Classifieds continue to decline as digital alternatives offer superior reach and cost-effectiveness.

By End-User:The end-user segmentation includes Individuals, Small Businesses, Enterprises, and Non-Profits. Individuals are the largest segment, utilizing classifieds for personal transactions such as buying and selling items. Small businesses leverage these platforms for cost-effective advertising and reaching local customers, particularly benefiting from the high digital literacy and purchasing power characteristic of North American consumers. Enterprises use classifieds for recruitment and large-scale sales, while Non-Profits utilize them for fundraising and community outreach. The increasing trend of individuals and small businesses turning to digital platforms for transactions is driving growth in this segment.

North America Classifieds and Digital Market Competitive Landscape

The North America Classifieds and Digital Market is characterized by a dynamic mix of regional and international players. Leading participants such as Craigslist, eBay Classifieds (now part of Adevinta/Rebranded as Kijiji in Canada), Facebook Marketplace, OfferUp, Kijiji, Nextdoor, Indeed, Realtor.com, Autotrader, CarGurus, ClassifiedAds.com, Geebo, Oodle, VarageSale, 5miles contribute to innovation, geographic expansion, and service delivery in this space.

North America Classifieds and Digital Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:As of future, North America boasts an internet penetration rate of approximately 93%, with over 330 million users actively engaging online. This widespread access facilitates the growth of digital classifieds, as more consumers turn to online platforms for buying and selling goods. The increasing availability of high-speed internet, particularly in rural areas, further enhances market accessibility, driving user engagement and expanding the potential customer base for digital marketplaces.

- Shift Towards Digital Transactions:In future, digital transactions in North America are projected to exceed USD 1 trillion, reflecting a significant shift from traditional cash-based transactions. This trend is driven by consumer preferences for convenience and security, with approximately 70% of consumers indicating a preference for online payment methods. As more businesses adopt digital payment solutions, the classifieds market is likely to see increased transaction volumes, enhancing overall market growth and user trust in digital platforms.

- Rise of Mobile Applications:By future, mobile applications are expected to account for over 60% of all digital classifieds transactions in North America. With smartphone penetration reaching approximately 85%, users increasingly rely on mobile apps for convenience and accessibility. This trend is supported by the growing number of mobile-friendly platforms, which enhance user experience and engagement. As mobile usage continues to rise, classifieds platforms that prioritize mobile optimization will likely capture a larger share of the market.

Market Challenges

- Intense Competition:The North American classifieds market is characterized by fierce competition, with over 200 platforms vying for user attention. Major players like Craigslist and Facebook Marketplace dominate, making it challenging for new entrants to gain traction. This saturation leads to price wars and reduced profit margins, compelling companies to innovate continuously and differentiate their offerings to attract and retain users in a crowded marketplace.

- Data Privacy Concerns:With increasing scrutiny on data privacy, North American classifieds platforms face significant challenges in compliance. In future, nearly 80% of consumers express concerns about how their data is used, leading to heightened regulatory pressures. Companies must navigate complex regulations, such as the California Consumer Privacy Act, which imposes strict guidelines on data handling. Failure to comply can result in substantial fines and damage to brand reputation, complicating market operations.

North America Classifieds and Digital Market Future Outlook

The North American classifieds and digital market is poised for transformative growth, driven by technological advancements and evolving consumer behaviors. As mobile applications and AI integration become more prevalent, platforms will enhance user experiences and streamline transactions. Additionally, the increasing focus on localized services will cater to specific community needs, fostering deeper connections between users and businesses. Companies that adapt to these trends will likely thrive, positioning themselves as leaders in an increasingly competitive landscape.

Market Opportunities

- Expansion into Emerging Markets:North American classifieds platforms have significant opportunities to expand into emerging markets, where internet penetration is rapidly increasing. By future, regions like Latin America are expected to see a 15% growth in internet users, presenting a lucrative avenue for expansion. This growth can lead to increased user bases and revenue streams for companies willing to adapt their offerings to local preferences and needs.

- Integration of AI and Machine Learning:The integration of AI and machine learning technologies presents a substantial opportunity for classifieds platforms to enhance user experience. By future, AI-driven personalization is expected to improve user engagement by up to 30%, allowing platforms to offer tailored recommendations and streamline search functionalities. This technological advancement can significantly boost user satisfaction and retention, driving long-term growth in the market.