Region:Asia

Author(s):Shubham

Product Code:KRAB4473

Pages:99

Published On:October 2025

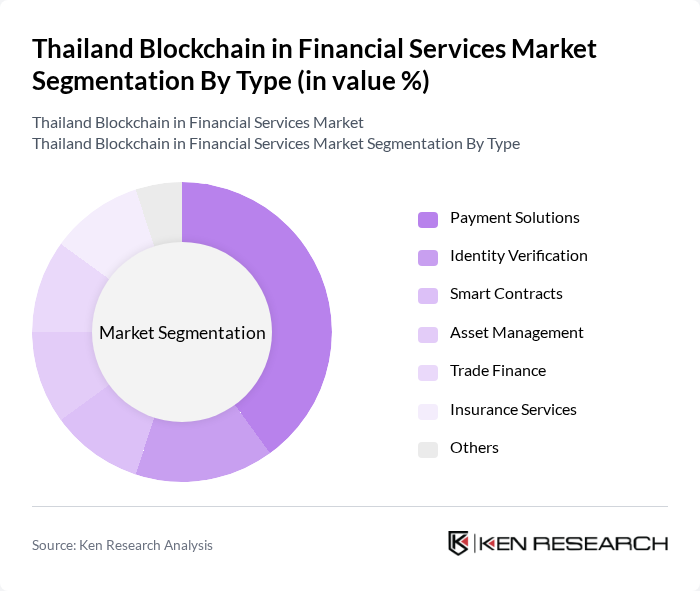

By Type:The market is segmented into various types, including Payment Solutions, Identity Verification, Smart Contracts, Asset Management, Trade Finance, Insurance Services, and Others. Among these, Payment Solutions is the leading sub-segment, driven by the increasing demand for efficient and secure transaction methods. The rise of e-commerce and digital payments has significantly contributed to the growth of this segment, as businesses and consumers seek faster and more reliable payment options.

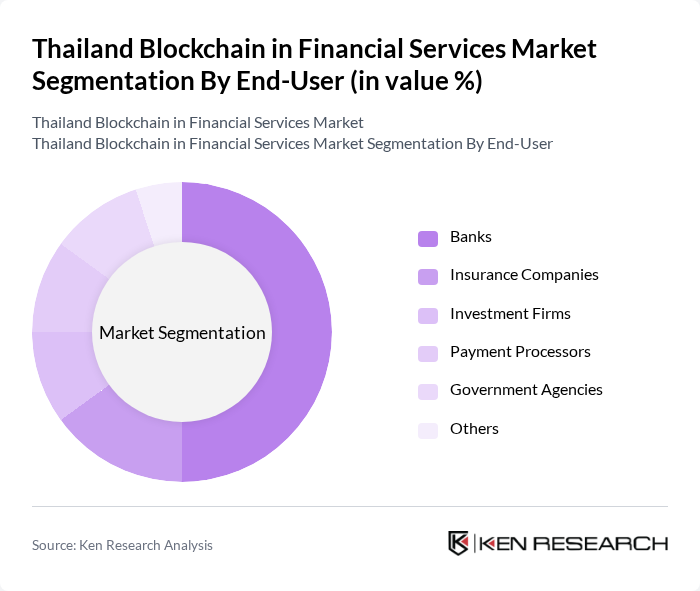

By End-User:The end-user segmentation includes Banks, Insurance Companies, Investment Firms, Payment Processors, Government Agencies, and Others. Banks are the dominant end-user in the market, leveraging blockchain technology to enhance operational efficiency, reduce fraud, and improve customer service. The increasing focus on digital transformation within the banking sector has led to a surge in blockchain adoption, making it a critical component of their strategic initiatives.

The Thailand Blockchain in Financial Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siam Blockchain Co., Ltd., Bitkub Online Co., Ltd., TCC Technology Co., Ltd., Omise Holdings, Inc., SCB 10X, Kasikornbank Public Company Limited, Bangkok Bank Public Company Limited, Krung Thai Bank Public Company Limited, True Corporation Public Company Limited, PTT Public Company Limited, Thai Digital Asset Exchange (TDAX), Digital Ventures Co., Ltd., KASIKORN Business-Technology Group, MTL Blockchain, Thai Fintech Association contribute to innovation, geographic expansion, and service delivery in this space.

The future of blockchain in Thailand's financial services sector appears promising, driven by increasing collaboration between banks and technology firms. As institutions seek to enhance operational efficiency and customer experience, the adoption of decentralized finance (DeFi) solutions is expected to rise. Additionally, the Thai government is likely to introduce clearer regulations, fostering a more conducive environment for blockchain innovation. This evolving landscape will enable financial institutions to leverage blockchain for improved transparency, security, and cost-effectiveness in their services.

| Segment | Sub-Segments |

|---|---|

| By Type | Payment Solutions Identity Verification Smart Contracts Asset Management Trade Finance Insurance Services Others |

| By End-User | Banks Insurance Companies Investment Firms Payment Processors Government Agencies Others |

| By Application | Cross-Border Payments Remittances Fraud Prevention Regulatory Compliance Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Financial Institutions Others |

| By Investment Source | Venture Capital Private Equity Government Grants Others |

| By Regulatory Compliance | KYC Compliance AML Compliance Data Privacy Compliance Others |

| By Technology | Public Blockchain Private Blockchain Consortium Blockchain Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Blockchain Adoption | 100 | IT Managers, Blockchain Project Leads |

| Fintech Innovations Using Blockchain | 80 | Product Managers, Business Development Executives |

| Regulatory Perspectives on Blockchain | 50 | Regulatory Affairs Specialists, Compliance Officers |

| Consumer Attitudes Towards Blockchain in Finance | 120 | Retail Banking Customers, Digital Wallet Users |

| Investment Firms Exploring Blockchain Solutions | 70 | Investment Analysts, Portfolio Managers |

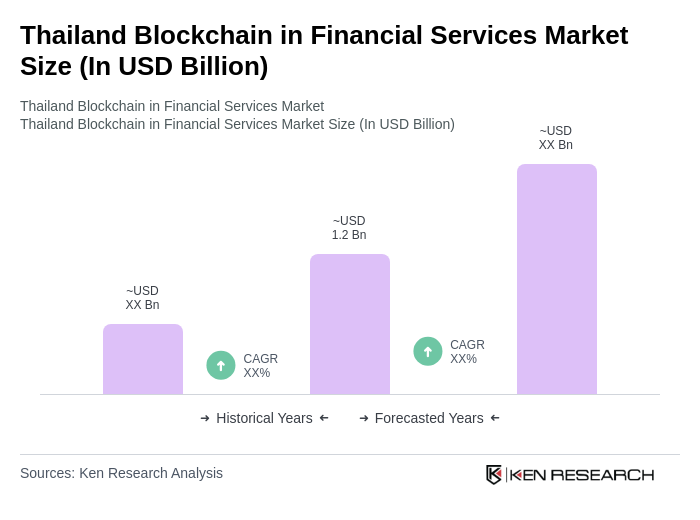

The Thailand Blockchain in Financial Services Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of blockchain technology across various financial applications, including payment solutions and identity verification.