Region:North America

Author(s):Geetanshi

Product Code:KRAB5208

Pages:84

Published On:October 2025

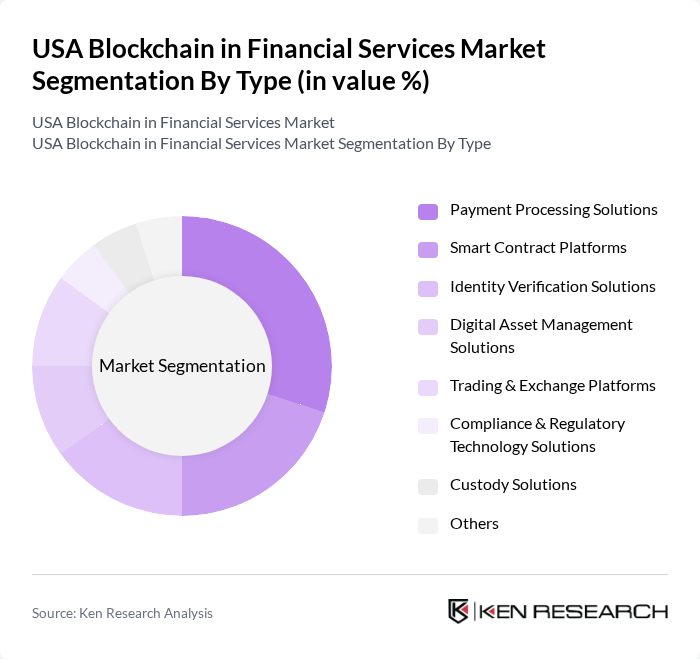

By Type:The market is segmented into various types, including Payment Processing Solutions, Smart Contract Platforms, Identity Verification Solutions, Digital Asset Management Solutions, Trading & Exchange Platforms, Compliance & Regulatory Technology Solutions, Custody Solutions, and Others. Each of these sub-segments plays a crucial role in the overall market dynamics.

The Payment Processing Solutions sub-segment is currently dominating the market due to the increasing demand for faster and more secure transaction methods. Businesses are increasingly adopting blockchain technology to streamline payment processes, reduce transaction fees, and enhance security against fraud. The rise of e-commerce and digital payments has further accelerated the adoption of these solutions, making them essential for financial institutions looking to remain competitive in a rapidly evolving landscape. Blockchain-enabled payment gateways now account for 27% of cross-border payment volume globally, a figure expected to rise to 35% by 2025.

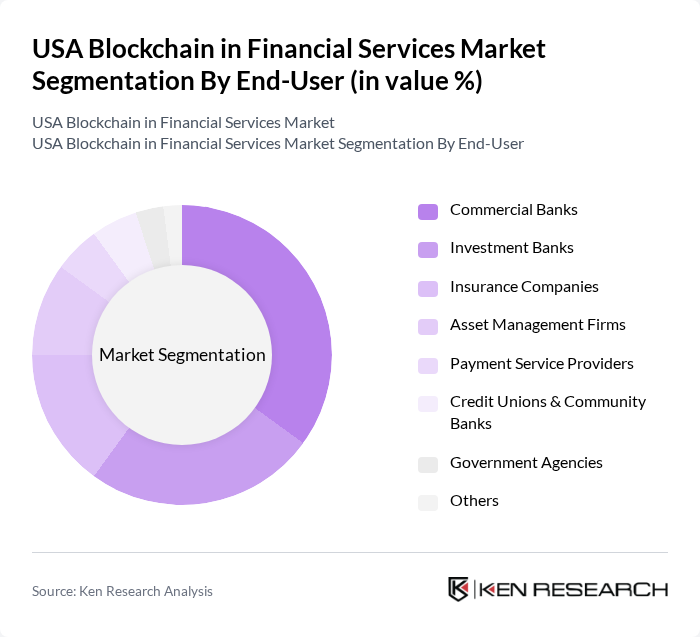

By End-User:The market is segmented by end-users, including Commercial Banks, Investment Banks, Insurance Companies, Asset Management Firms, Payment Service Providers, Credit Unions & Community Banks, Government Agencies, and Others. Each end-user category has unique requirements and applications for blockchain technology.

Commercial Banks are leading the end-user segment, driven by their need to enhance operational efficiency and security in transactions. The integration of blockchain technology allows these institutions to streamline processes such as cross-border payments and compliance reporting. Additionally, the growing trend of digital banking and the need for real-time transaction processing are pushing commercial banks to adopt blockchain solutions more aggressively.

The USA Blockchain in Financial Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Accenture plc, Ripple Labs Inc., ConsenSys Inc., Chain, Inc., Blockstream Corporation, R3 LLC, Digital Asset Holdings, LLC, Bitfury Group Limited, Circle Internet Financial, LLC, Paxos Trust Company, LLC, Hyperledger Foundation, Binance.US (BAM Trading Services Inc.), Kraken (Payward, Inc.), Coinbase Global, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of blockchain in the financial services sector appears promising, driven by technological advancements and increasing acceptance among consumers and institutions. As regulatory frameworks evolve, more financial entities are expected to adopt blockchain solutions to enhance transparency and security. Additionally, the rise of decentralized finance (DeFi) platforms is likely to reshape traditional banking models, fostering innovation and competition. The integration of blockchain with artificial intelligence and machine learning is anticipated to further streamline operations and improve customer experiences in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Payment Processing Solutions Smart Contract Platforms Identity Verification Solutions Digital Asset Management Solutions Trading & Exchange Platforms Compliance & Regulatory Technology Solutions Custody Solutions Others |

| By End-User | Commercial Banks Investment Banks Insurance Companies Asset Management Firms Payment Service Providers Credit Unions & Community Banks Government Agencies Others |

| By Application | Cross-Border Payments & Remittances Trade Finance & Supply Chain Finance Fraud Detection & Prevention Regulatory Compliance & Reporting Digital Identity Management Tokenization of Assets Clearing & Settlement Others |

| By Deployment Model | Public Blockchain Private Blockchain Consortium/Hybrid Blockchain |

| By Distribution Channel | Direct Sales Online Platforms Strategic Partnerships with Financial Institutions |

| By Investment Source | Venture Capital Private Equity Government Grants Corporate Investments |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Blockchain in Payment Processing | 100 | Payment Executives, Financial Technology Managers |

| Smart Contracts in Insurance | 60 | Insurance Underwriters, Risk Management Officers |

| Identity Verification Solutions | 50 | Compliance Officers, IT Security Managers |

| Blockchain for Asset Management | 40 | Portfolio Managers, Investment Analysts |

| Decentralized Finance (DeFi) Applications | 45 | Fintech Entrepreneurs, Blockchain Developers |

The USA Blockchain in Financial Services Market is valued at approximately USD 5 billion, driven by the increasing adoption of blockchain technology for transaction security, cost reduction, and enhanced transparency in financial transactions.