Region:Asia

Author(s):Dev

Product Code:KRAA5426

Pages:92

Published On:September 2025

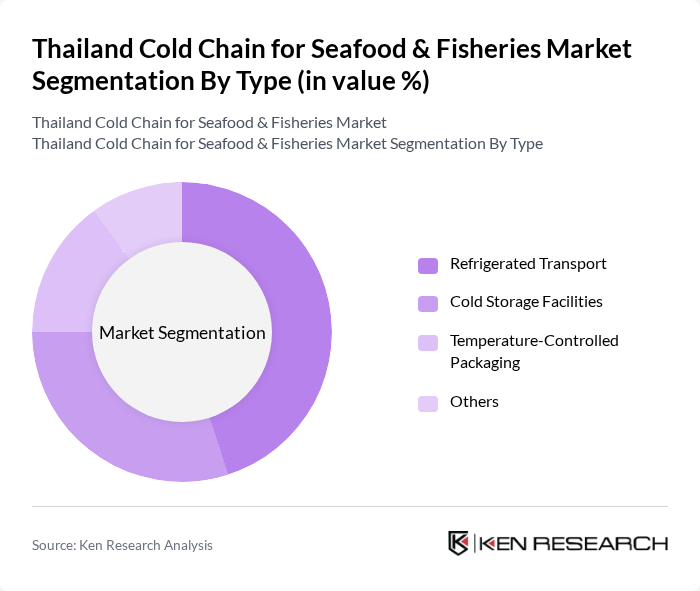

By Type:The cold chain market is segmented into various types, including Refrigerated Transport, Cold Storage Facilities, Temperature-Controlled Packaging, and Others. Each of these segments plays a crucial role in maintaining the quality and safety of seafood products throughout the supply chain. Among these, Refrigerated Transport is the leading sub-segment due to the increasing demand for efficient logistics solutions that ensure timely delivery of fresh seafood to markets.

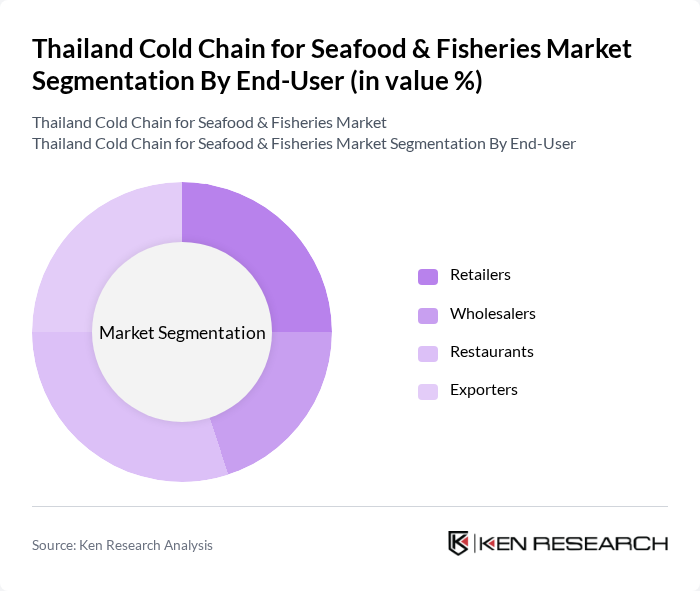

By End-User:The end-user segmentation includes Retailers, Wholesalers, Restaurants, and Exporters. Each of these segments has unique requirements for cold chain logistics, with Exporters being the dominant sub-segment. This is largely due to the growing international demand for Thai seafood products, necessitating robust cold chain solutions to meet export standards and maintain product integrity during transportation.

The Thailand Cold Chain for Seafood & Fisheries Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thai Union Group PCL, CP Foods, Sea Value Public Company Limited, Marine Gold Products Public Company Limited, Thai Fishery Producers Association, S&P Syndicate Public Company Limited, Bangkok Frozen Foods, Siam Canadian Group, Sriracha Seafood, Saha Farms, Ocean Fresh, Thai Seafood Co., Ltd., Poonphol Seafood, Charoen Pokphand Foods PCL, Thai Fishery Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of Thailand's cold chain for seafood and fisheries market appears promising, driven by increasing consumer awareness of food safety and sustainability. As e-commerce continues to grow, the demand for efficient cold chain solutions will rise, necessitating further investments in technology and infrastructure. Additionally, partnerships between seafood producers and logistics providers are expected to enhance distribution efficiency, ensuring that fresh seafood reaches consumers promptly while minimizing waste and environmental impact.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature-Controlled Packaging Others |

| By End-User | Retailers Wholesalers Restaurants Exporters |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Platforms Others |

| By Application | Fresh Seafood Processed Seafood Frozen Seafood Others |

| By Sales Channel | Online Sales Offline Sales B2B Sales Others |

| By Price Range | Premium Mid-Range Budget Others |

| By Packaging Type | Vacuum Packaging Modified Atmosphere Packaging Insulated Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Seafood Processing Facilities | 100 | Operations Managers, Quality Control Supervisors |

| Cold Storage Providers | 80 | Logistics Managers, Facility Operators |

| Seafood Exporters | 70 | Export Managers, Supply Chain Directors |

| Retail Seafood Outlets | 60 | Store Managers, Procurement Officers |

| Government Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

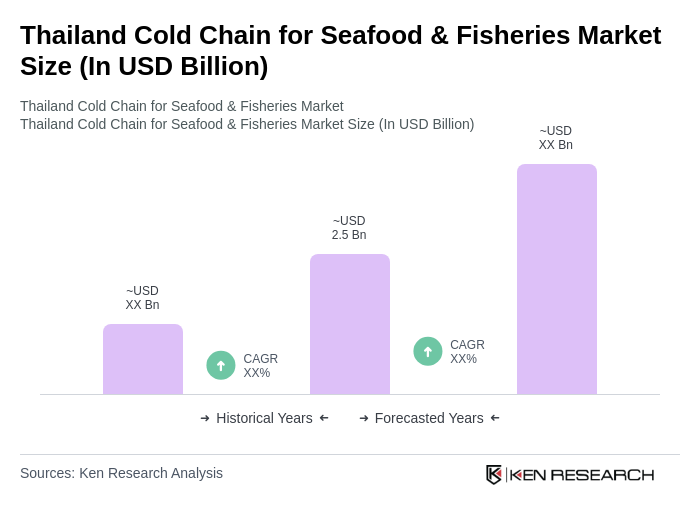

The Thailand Cold Chain for Seafood & Fisheries Market is valued at approximately USD 2.5 billion, reflecting a significant growth driven by rising demand for fresh seafood and the expansion of the seafood export market.