Region:Asia

Author(s):Dev

Product Code:KRAC0547

Pages:96

Published On:August 2025

By Type:The aquaculture feed market is segmented into various types, including fish feed, shrimp feed, mollusk feed, crab and other crustacean feed, larval/nursery and broodstock feeds, functional/medicated and probiotic feeds, and organic and specialty feeds. Among these, fish feed—especially for pangasius/catfish and carp—accounts for the largest share due to Vietnam’s high-volume pangasius sector, while shrimp feed is the second largest given the scale of whiteleg shrimp farming. The increasing demand for fish as a primary protein source and export-oriented farming pushes adoption of nutritionally balanced, pelletized and extruded feeds to improve growth and feed conversion.

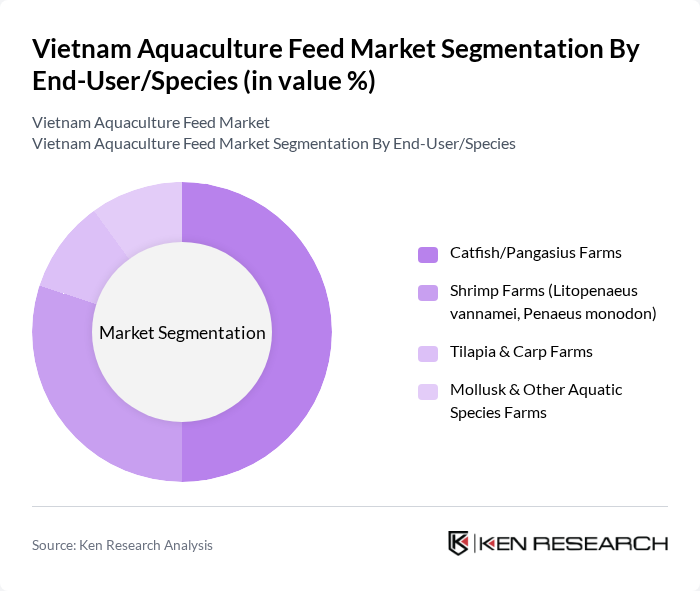

By End-User/Species:The end-user segment includes various types of farms such as catfish/pangasius farms, shrimp farms, tilapia and carp farms, and mollusk and other aquatic species farms. Catfish and pangasius farms are the leading end-users, consistent with industry reporting that catfish dominates end-user demand in Vietnam’s aquafeed market; shrimp farms are the next largest, followed by tilapia/carp and mollusks.

The Vietnam Aquaculture Feed Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill Vietnam, CP Vietnam Corporation (Charoen Pokphand Foods), Uni-President Vietnam, GreenFeed Vietnam Corporation, De Heus Vietnam, Skretting Vietnam (Nutreco), Proconco (Vietnam-France Joint Venture Feed, Proconco Vina), Vinh Hoan Corporation (VHC) – Feed & Farming, Biomin Vietnam (DSM-Firmenich), Hùng V??ng Corporation, Grobest Vietnam, Tongwei Vietnam, Qu?ng Ninh Fishery Feed JSC, Viet Thang Feed JSC (VTF), Th?ng Long Feed JSC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam aquaculture feed market appears promising, driven by increasing seafood demand and government initiatives aimed at sustainability. As the market evolves, producers are likely to adopt more innovative feed solutions, including plant-based ingredients and digital management technologies. The focus on enhancing nutritional profiles will also gain traction, aligning with global trends towards healthier aquaculture practices. Overall, the sector is poised for growth, supported by both domestic consumption and export opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Fish Feed (e.g., pangasius/catfish, tilapia, carp) Shrimp Feed (whiteleg and black tiger) Mollusk Feed Crab & Other Crustacean Feed Larval/Nursery & Broodstock Feeds Functional/Medicated & Probiotic Feeds Organic & Specialty Feeds |

| By End-User/Species | Catfish/Pangasius Farms Shrimp Farms (Litopenaeus vannamei, Penaeus monodon) Tilapia & Carp Farms Mollusk & Other Aquatic Species Farms |

| By Distribution Channel | Direct to Farmers Local Wholesalers/Dealers Exports Online & Retail Outlets |

| By Ingredient Type | Grains & Cereals Soybean Meal & Other Plant Proteins Fishmeal & Fish Oil Additives (amino acids, vitamins, acidifiers, probiotics) |

| By Product Form/Technology | Pellets Extruded Powdered & Crumbles Liquid/Coated |

| By Price Range | Premium Feeds Mid-Range Feeds Economy Feeds |

| By Region | Southern Vietnam (Mekong Delta) Northern Vietnam Central Vietnam Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aquaculture Feed Manufacturers | 60 | Production Managers, Sales Directors |

| Aquaculture Farm Operators | 120 | Farm Owners, Feed Managers |

| Feed Ingredient Suppliers | 70 | Procurement Managers, Supply Chain Coordinators |

| Industry Experts and Consultants | 50 | Aquaculture Specialists, Market Analysts |

| Regulatory Bodies and Associations | 40 | Policy Makers, Regulatory Officers |

The Vietnam Aquaculture Feed Market is valued at approximately USD 380 million, reflecting a significant growth driven by increased seafood consumption and a shift from farm-made to compound feeds, particularly for pangasius and shrimp farming.