Region:Asia

Author(s):Rebecca

Product Code:KRAB4123

Pages:96

Published On:October 2025

By Type:The market is segmented into various types, including Remote Patient Monitoring, Virtual Consultations, Mobile Health Applications, Teletherapy Services, Health Information Exchange, Digital Health Platforms, Store-and-Forward Telemedicine, Telepharmacy, and Others. Among these, Remote Patient Monitoring and Virtual Consultations are the leading subsegments, driven by the increasing demand for continuous health monitoring and the convenience of virtual healthcare services.

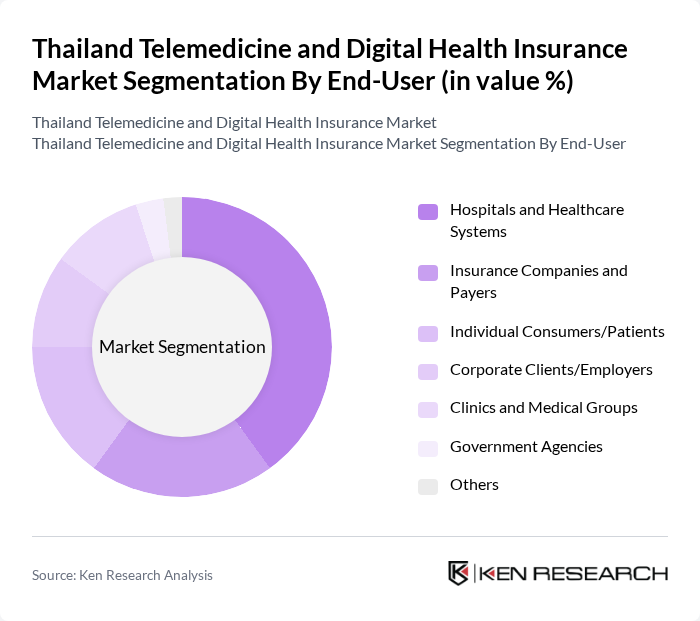

By End-User:The end-user segmentation includes Hospitals and Healthcare Systems, Insurance Companies and Payers, Individual Consumers/Patients, Corporate Clients/Employers, Clinics and Medical Groups, Government Agencies, and Others. Hospitals and Healthcare Systems are the dominant end-users, as they increasingly adopt telemedicine solutions to enhance patient care and streamline operations.

The Thailand Telemedicine and Digital Health Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bangkok Dusit Medical Services (BDMS), Bumrungrad International Hospital, Thonburi Healthcare Group (THG), Krungthai-AXA Life Insurance, AIA Thailand, Generali Thailand, Thai Health Insurance Public Company Limited, VHealth by Praram 9 Hospital, Doctor Anywhere (Thailand), Health at Home, Med247 Thailand, Telemedico Thailand, Muang Thai Life Assurance (MTL), Allianz Ayudhya Assurance, Pruksa Holding Public Company Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the telemedicine and digital health insurance market in Thailand appears promising, driven by technological advancements and increasing consumer acceptance. As the government continues to invest in digital health infrastructure, the integration of AI and machine learning into telehealth services is expected to enhance patient care. Furthermore, the shift towards preventive healthcare will likely encourage more individuals to utilize telemedicine, leading to a more proactive approach to health management and wellness.

| Segment | Sub-Segments |

|---|---|

| By Type | Remote Patient Monitoring Virtual Consultations Mobile Health Applications Teletherapy Services Health Information Exchange Digital Health Platforms Store-and-Forward Telemedicine Telepharmacy Others |

| By End-User | Hospitals and Healthcare Systems Insurance Companies and Payers Individual Consumers/Patients Corporate Clients/Employers Clinics and Medical Groups Government Agencies Others |

| By Service Model | B2B Telemedicine Services B2C Telemedicine Services C2C Telemedicine Services Others |

| By Insurance Type | Public Health Insurance (e.g., Universal Coverage Scheme, Social Security Scheme) Private Health Insurance Employer-Sponsored Insurance Microinsurance and Digital-Only Insurance Others |

| By Payment Model | Fee-for-Service Subscription-Based Pay-Per-Visit Bundled Payments/Capitation Others |

| By Technology Used | Video Conferencing Tools Mobile Applications Cloud-Based Platforms AI and Analytics Platforms Wearable Devices and IoT Others |

| By Geographic Coverage | Urban Areas Rural Areas Nationwide Services Cross-Border/International Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers Using Telemedicine | 90 | Doctors, Clinic Managers, Telehealth Coordinators |

| Insurance Companies Offering Digital Health Plans | 60 | Product Managers, Underwriters, Marketing Directors |

| Patients Utilizing Telehealth Services | 120 | Patients, Caregivers, Health Advocates |

| Technology Providers in Telemedicine | 50 | Product Developers, IT Managers, Business Analysts |

| Regulatory Bodies and Health Policy Makers | 40 | Policy Analysts, Health Economists, Regulatory Officers |

The Thailand Telemedicine and Digital Health Insurance Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the adoption of digital health technologies and the increasing demand for accessible medical services, particularly in remote areas.