Region:Europe

Author(s):Rebecca

Product Code:KRAB3494

Pages:96

Published On:October 2025

By Type:The segmentation by type includes Residential Listings, Commercial Listings, Rental Listings, New Developments, Smart Homes, Foreclosures, Auctions, and Others. Each subsegment reflects the diverse landscape and evolving consumer preferences in the Turkish real estate market. Residential Listings remain the largest category, driven by urban migration and increased demand for digital home search solutions. Commercial Listings and Rental Listings are also experiencing growth due to expanding business activity and shifting rental dynamics in metropolitan areas. The Smart Homes segment is gaining traction as AI-enabled home automation and security features become more accessible to Turkish consumers.

The Residential Listings subsegment dominates the market, supported by high demand for urban housing and the proliferation of online property platforms. The digitalization of real estate transactions and the adoption of AI-powered search and recommendation tools have made it easier for buyers to access a wide variety of residential options. AI technologies are increasingly used to match listings with buyer preferences, automate property valuations, and enhance the overall efficiency of property searches, making residential listings more attractive to potential buyers.

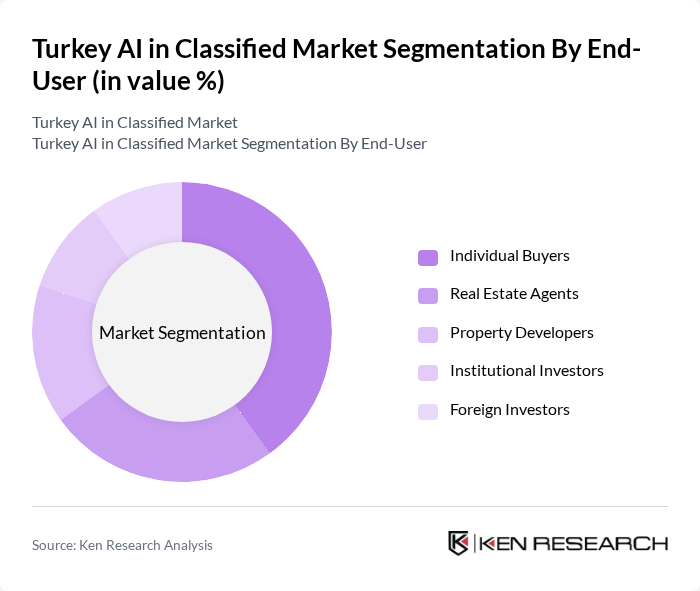

By End-User:The segmentation by end-user includes Individual Buyers, Real Estate Agents, Property Developers, Institutional Investors, and Foreign Investors. Individual Buyers form the largest segment, reflecting the growing number of first-time homebuyers and the shift toward digital property searches. Real Estate Agents and Property Developers increasingly leverage AI-driven platforms for lead generation, market analysis, and transaction management. Institutional and Foreign Investors are drawn by Turkey’s dynamic property market and the efficiency gains provided by AI-powered analytics and valuation tools.

Individual Buyers represent the largest market segment, driven by the increasing number of first-time homebuyers and the widespread adoption of digital property search platforms. The convenience and speed of AI-enhanced features enable buyers to make informed decisions and complete transactions efficiently. Rising property prices and competitive market conditions have further encouraged buyers to utilize AI tools for market insights, price comparisons, and personalized property recommendations.

The Turkey AI in Classified Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sahibinden.com, Hürriyet Emlak, Zingat.com, Emlakjet, Hepsiemlak, Arsa.com, Turyap, RE/MAX Türkiye, Coldwell Banker Türkiye, Century 21 Türkiye, Property Turkey, Emlak Konut GYO, GYODER (Gayrimenkul Yat?r?m Ortakl??? Derne?i), TSKB Gayrimenkul De?erleme A.?., Krea Gayrimenkul, Bazdid contribute to innovation, geographic expansion, and service delivery in this space.

The future of Turkey's AI in classified market appears promising, driven by technological advancements and increasing consumer reliance on digital platforms. As AI technologies evolve, we can expect enhanced personalization in property listings and improved customer service through chatbots. Additionally, the integration of virtual reality in property viewing is likely to transform user experiences, making transactions more efficient. These trends will shape the competitive landscape, encouraging innovation and collaboration among market players.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Listings Commercial Listings Rental Listings New Developments Smart Homes Foreclosures Auctions Others |

| By End-User | Individual Buyers Real Estate Agents Property Developers Institutional Investors Foreign Investors |

| By Sales Channel | Online Platforms Mobile Applications Social Media Offline Agencies |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Major Cities (Istanbul, Ankara, Izmir, Antalya) |

| By Price Range | Low-End Properties Mid-Range Properties High-End Properties |

| By User Demographics | First-Time Buyers Luxury Buyers Investors Expatriates |

| By Property Type | Apartments Villas Commercial Spaces Land Smart Buildings Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Real Estate Listings | 100 | Real Estate Agents, Property Managers |

| Automotive Classifieds | 80 | Car Dealership Owners, Sales Managers |

| Job Listings | 60 | HR Managers, Recruitment Consultants |

| Consumer Goods Marketplace | 50 | E-commerce Managers, Product Listing Specialists |

| Service Listings (e.g., home services) | 40 | Service Providers, Business Owners |

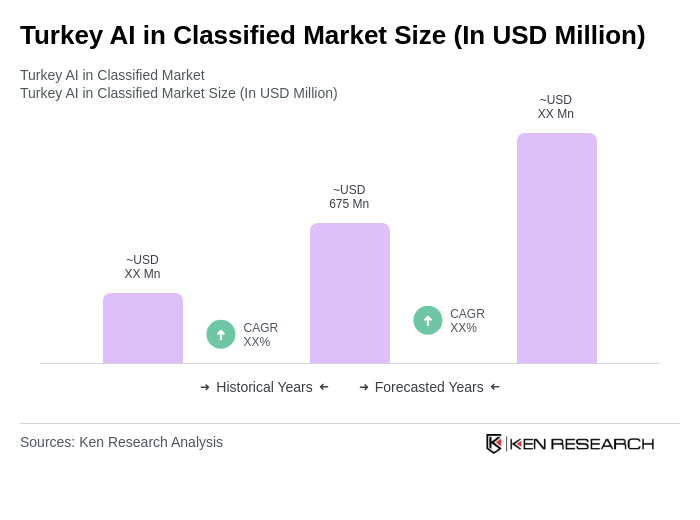

The Turkey AI in Classified Market is valued at approximately USD 675 million, reflecting significant growth driven by the adoption of digital platforms and advanced AI technologies in real estate transactions.