Region:Middle East

Author(s):Rebecca

Product Code:KRAB4134

Pages:82

Published On:October 2025

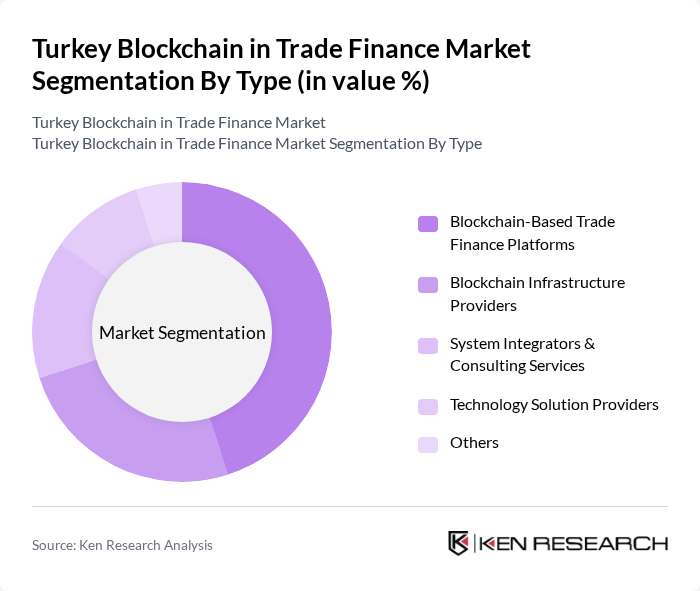

By Type:The market can be segmented into Blockchain-Based Trade Finance Platforms, Blockchain Infrastructure Providers, System Integrators & Consulting Services, Technology Solution Providers, and Others. Among these, Blockchain-Based Trade Finance Platforms lead the market due to their ability to streamline documentation, automate compliance, and reduce transaction times—capabilities that are increasingly critical for businesses engaged in international trade. The growing integration of blockchain with existing banking infrastructure and the adoption of smart contracts are further strengthening this segment’s position .

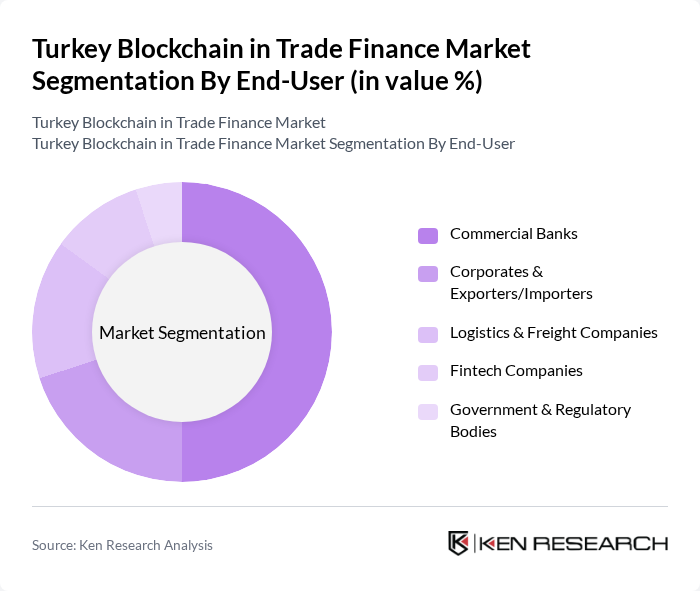

By End-User:The end-user segmentation includes Commercial Banks, Corporates & Exporters/Importers, Logistics & Freight Companies, Fintech Companies, Government & Regulatory Bodies, and Others. Commercial Banks are the dominant end-users, leveraging blockchain technology to enhance transaction security, reduce settlement times, and improve compliance with regulatory standards. This adoption is vital for maintaining competitiveness in the financial sector, particularly as Turkish banks expand their digital asset and blockchain service offerings .

The Turkey Blockchain in Trade Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Garanti BBVA, Türkiye ?? Bankas?, Ziraat Bankas?, Yap? Kredi, DenizBank, Akbank, Turkcell, KoçSistem, Sabanc?Dx, TEB (Türk Ekonomi Bankas?), Vak?fBank, Anadolubank, Alternatif Bank, Fibabanka, BKM (Bankalararas? Kart Merkezi) contribute to innovation, geographic expansion, and service delivery in this space.

The future of blockchain in Turkey's trade finance market appears promising, driven by technological advancements and increasing digitalization. As businesses seek to enhance operational efficiency, the adoption of blockchain solutions is expected to rise. The Turkish government is likely to introduce clearer regulations, fostering a more conducive environment for innovation. Additionally, partnerships between fintech companies and traditional banks will facilitate the development of integrated solutions, further propelling the market forward and addressing existing challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Blockchain-Based Trade Finance Platforms Blockchain Infrastructure Providers System Integrators & Consulting Services Technology Solution Providers Others |

| By End-User | Commercial Banks Corporates & Exporters/Importers Logistics & Freight Companies Fintech Companies Government & Regulatory Bodies Others |

| By Application | Letter of Credit (LC) Processing Supply Chain Finance Invoice & Receivables Financing Know Your Customer (KYC) & Compliance Cross-Border Payments & Settlements Asset Tokenization Others |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Grants Venture Capital & Private Equity Others |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Incentives for Startups Others |

| By Distribution Mode | Direct Sales Online Platforms Partnerships with Financial Institutions Channel Partners Others |

| By Pricing Strategy | Subscription-Based Pay-Per-Use Tiered Pricing Freemium/Trial Models Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Trade Finance | 100 | Trade Finance Managers, Risk Assessment Officers |

| Logistics and Supply Chain | 70 | Supply Chain Managers, Operations Directors |

| Fintech Solutions Providers | 50 | Product Managers, Business Development Executives |

| Regulatory Bodies and Government Agencies | 40 | Policy Makers, Regulatory Affairs Specialists |

| Industry Experts and Consultants | 60 | Consultants, Industry Analysts |

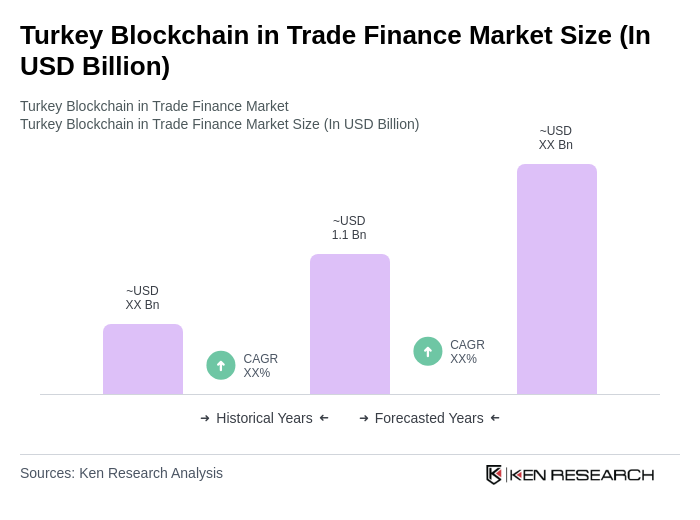

The Turkey Blockchain in Trade Finance Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the adoption of blockchain technology in financial services, enhancing transparency, efficiency, and security in trade transactions.