Region:Middle East

Author(s):Shubham

Product Code:KRAA4969

Pages:90

Published On:September 2025

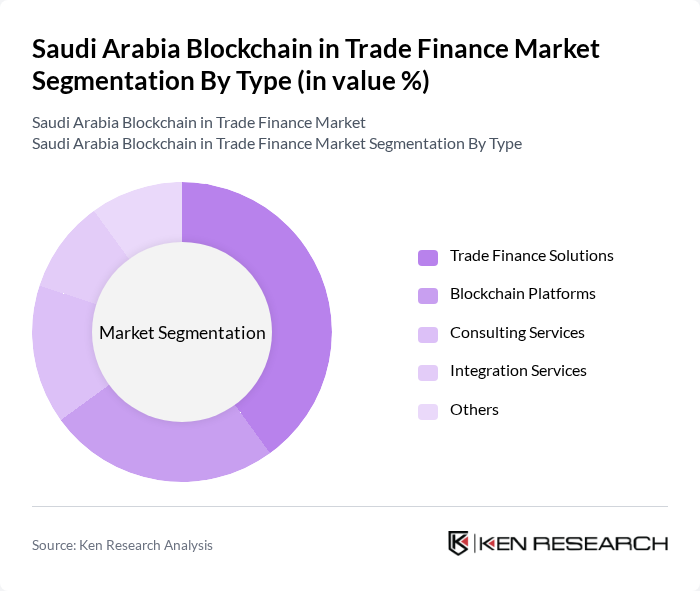

By Type:The market is segmented into various types, including Trade Finance Solutions, Blockchain Platforms, Consulting Services, Integration Services, and Others. Among these, Trade Finance Solutions are leading due to their direct impact on improving transaction efficiency and reducing costs for businesses. The increasing need for secure and transparent financial transactions is driving the demand for these solutions, making them a preferred choice for many organizations.

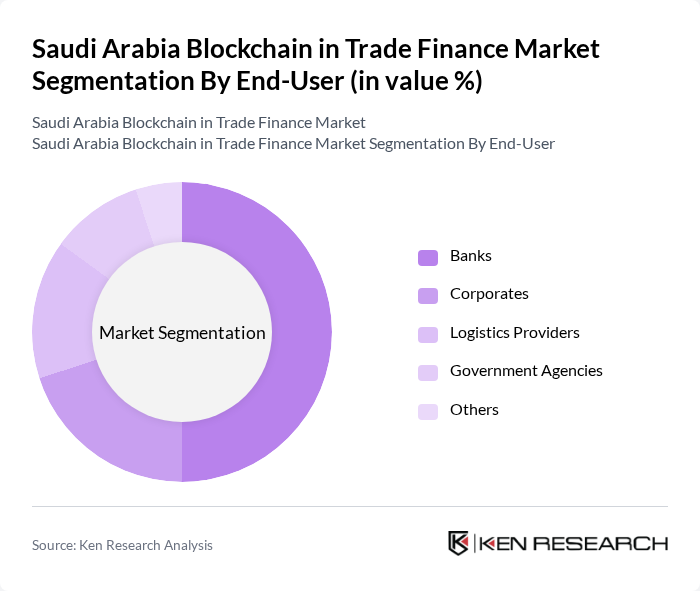

By End-User:The end-user segmentation includes Banks, Corporates, Logistics Providers, Government Agencies, and Others. Banks are the dominant segment, leveraging blockchain technology to enhance transaction security and efficiency. The increasing focus on digital transformation in the banking sector is driving the adoption of blockchain solutions, making banks the primary users of these technologies in trade finance.

The Saudi Arabia Blockchain in Trade Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Arabian Monetary Authority (SAMA), National Commercial Bank (NCB), Al Rajhi Bank, Riyad Bank, Arab National Bank (ANB), STC Pay, Blockchain Solutions Company, IBM Saudi Arabia, SAP Saudi Arabia, Microsoft Saudi Arabia, Accenture Saudi Arabia, PwC Saudi Arabia, Deloitte Saudi Arabia, KPMG Saudi Arabia, Binance Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of blockchain in Saudi Arabia's trade finance market appears promising, driven by ongoing government support and increasing awareness among stakeholders. As the demand for transparency and efficiency grows, more financial institutions are likely to explore blockchain solutions. In future, partnerships between banks and technology firms are expected to increase, fostering innovation. Additionally, the rise of decentralized finance (DeFi) applications may further enhance the landscape, providing new avenues for trade finance solutions and improving overall market dynamics.

| Segment | Sub-Segments |

|---|---|

| By Type | Trade Finance Solutions Blockchain Platforms Consulting Services Integration Services Others |

| By End-User | Banks Corporates Logistics Providers Government Agencies Others |

| By Application | Cross-Border Payments Supply Chain Financing Invoice Financing Risk Management Others |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Grants Others |

| By Policy Support | Subsidies for Blockchain Initiatives Tax Incentives for Blockchain Startups Regulatory Support for Innovation Others |

| By Distribution Mode | Direct Sales Online Platforms Partnerships with Financial Institutions Others |

| By Pricing Strategy | Subscription-Based Pricing Pay-Per-Use Pricing Tiered Pricing Models Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Trade Finance | 100 | Trade Finance Managers, Risk Assessment Officers |

| Logistics and Supply Chain | 80 | Supply Chain Managers, Operations Directors |

| Technology Providers for Blockchain | 60 | Product Managers, Business Development Executives |

| Regulatory Bodies and Government Agencies | 50 | Policy Makers, Economic Advisors |

| Industry Associations and Trade Groups | 40 | Executive Directors, Research Analysts |

The Saudi Arabia Blockchain in Trade Finance Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of blockchain technology to enhance transparency, reduce fraud, and streamline trade finance processes.