Turkey Online Travel & Booking Platforms Market Overview

- The Turkey Online Travel & Booking Platforms Market is valued at USD 5.0 billion, based on a five-year historical analysis. Growth is primarily driven by the increasing adoption of digital technologies, rising disposable income, and a strong shift toward mobile-first booking solutions among consumers. The market is experiencing rapid digitalization, with mobile applications and user-friendly interfaces significantly enhancing customer experience and convenience. Additional drivers include the expansion of domestic tourism platforms, government-backed tourism campaigns, and the integration of AI and real-time booking technologies, which are attracting both domestic and international travelers .

- Istanbul, Ankara, and Antalya are the dominant cities in the Turkey Online Travel & Booking Platforms Market. Istanbul remains a major tourist hub, attracting millions of visitors annually. Ankara serves as the political and administrative center, facilitating business travel. Antalya, renowned for its beaches and resorts, draws a significant volume of leisure travelers. These cities are pivotal in driving both domestic and international market growth, supported by smart city innovations such as IoT-enabled infrastructure, real-time crowd monitoring, and digital city guides .

- In 2023, the Turkish government enhanced consumer protection in the online travel sector through the "Regulation on Distance Contracts" (Mesafeli Sözle?meler Yönetmeli?i), issued by the Ministry of Trade. This regulation mandates transparency in pricing and service fees, requiring online travel platforms to clearly disclose all costs and terms to consumers before booking. The regulation aims to strengthen consumer trust and promote fair competition among service providers by establishing clear operational standards and compliance requirements .

Turkey Online Travel & Booking Platforms Market Segmentation

By Type:The market is segmented into various types of online travel and booking platforms, each catering to specific consumer needs. The primary subsegments include hotel booking platforms, flight booking platforms, package tour platforms, car rental platforms, vacation rental platforms, bus and intercity transport booking platforms, travel insurance platforms, event and attraction ticketing platforms, and others. Hotel booking platforms remain the leading segment due to Turkey’s robust accommodation infrastructure and high inflow of both leisure and business tourists. The rise of alternative accommodations, such as vacation rentals and homestays, is also contributing to market diversification .

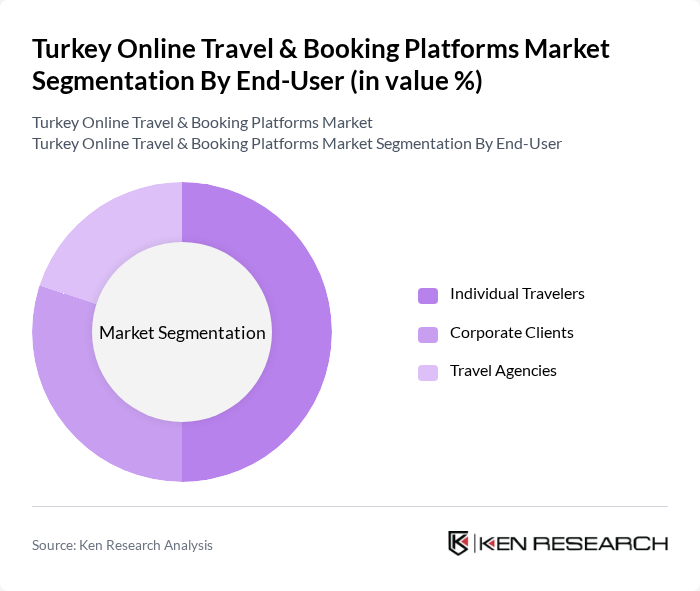

By End-User:The market is segmented based on end-users, including individual travelers, corporate clients, and travel agencies. Each segment exhibits distinct requirements and preferences, influencing the service offerings of online travel platforms. Individual travelers prioritize budget-friendly and flexible options, while corporate clients focus on efficiency, convenience, and integrated travel management solutions. Travel agencies increasingly leverage digital platforms to streamline operations and expand their service portfolios .

Turkey Online Travel & Booking Platforms Market Competitive Landscape

The Turkey Online Travel & Booking Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Booking.com, Expedia Group, Airbnb, Inc., TUI Group, TripAdvisor, Inc., Skyscanner Ltd., Odamax, Tatilsepeti, Enuygun, Biletall, Turna.com, Jolly Tur, Setur, Uzakrota, GeziBilen, Obilet.com, Etstur, Otelz.com, NeredenNereye.com, and TCDD Ta??mac?l?k A.?. contribute to innovation, geographic expansion, and service delivery in this space .

Turkey Online Travel & Booking Platforms Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:Turkey's internet penetration rate is approximately85%, with about72 millionusers accessing online services. This growth is driven by improved infrastructure and affordable data plans, which have made online travel platforms more accessible. The Turkish Statistical Institute reported that the number of households with internet access increased byover 2 millionin the most recent period, indicating a strong trend towards digital engagement in travel planning and bookings.

- Rise in Mobile Usage:Mobile internet users in Turkey are estimated atover 67 million, reflecting a significant increase from previous years. The widespread adoption of smartphones has facilitated the use of mobile travel applications, allowing consumers to book travel services conveniently. According to the Turkish Information and Communication Technologies Authority, mobile transactions in the travel sector grew byover 25%in the most recent period, highlighting the shift towards mobile-first solutions in the online travel market.

- Growth of Domestic Tourism:Domestic tourism in Turkey generatedover 52 million tripsin the most recent period, driven by increased disposable income and a growing interest in local destinations. The Ministry of Culture and Tourism reported a13%increase in domestic travel spending, reflecting a robust recovery post-pandemic. This trend is encouraging online travel platforms to tailor their offerings to meet the needs of local travelers, further boosting market growth.

Market Challenges

- Intense Competition:The Turkish online travel market is characterized by fierce competition, withover 150 active platformsvying for market share. Major players like Booking.com and local startups are continuously innovating to attract customers. According to industry reports, the average customer acquisition cost has risen byapproximately 18%in the most recent period, putting pressure on profit margins and forcing companies to invest heavily in marketing and technology to remain competitive.

- Regulatory Compliance Issues:The online travel sector in Turkey faces stringent regulatory requirements, including licensing and consumer protection laws. The Turkish government is expected to implement new data privacy regulations in future that will require travel platforms to enhance their data protection measures. Non-compliance could result in fines exceedingTRY 1 million, creating a significant burden for smaller operators who may lack the resources to adapt quickly to these changes.

Turkey Online Travel & Booking Platforms Market Future Outlook

The future of Turkey's online travel and booking platforms appears promising, driven by technological advancements and evolving consumer preferences. As the market adapts to increasing demand for personalized travel experiences, platforms are likely to leverage AI and big data analytics to enhance customer engagement. Additionally, the focus on sustainability will shape travel offerings, encouraging platforms to promote eco-friendly options. Overall, the market is poised for growth as it embraces innovation and responds to changing traveler expectations.

Market Opportunities

- Growth in International Tourism:Turkey's international tourist arrivals are estimated atover 49 millionin the most recent period, presenting a lucrative opportunity for online travel platforms. By catering to foreign travelers with tailored packages and localized services, platforms can significantly enhance their market presence and revenue streams.

- Development of Niche Travel Segments:The rise of niche travel segments, such as wellness tourism and adventure travel, offers online platforms a chance to diversify their offerings. With the wellness tourism market in Turkey showing double-digit growth in the most recent period, platforms can capitalize on this trend by creating specialized packages that cater to health-conscious travelers.