Region:Middle East

Author(s):Rebecca

Product Code:KRAD2079

Pages:93

Published On:January 2026

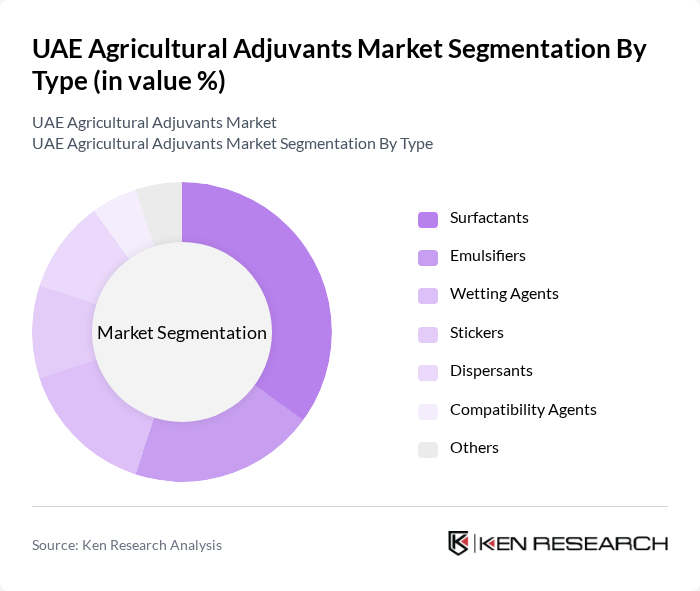

By Type:The market is segmented into various types of agricultural adjuvants, including surfactants, emulsifiers, wetting agents, stickers, dispersants, compatibility agents, and others. Surfactants are particularly dominant due to their ability to enhance the effectiveness of pesticides and fertilizers, making them essential in agricultural practices. The increasing focus on improving crop yield and efficiency in resource use drives the demand for these products.

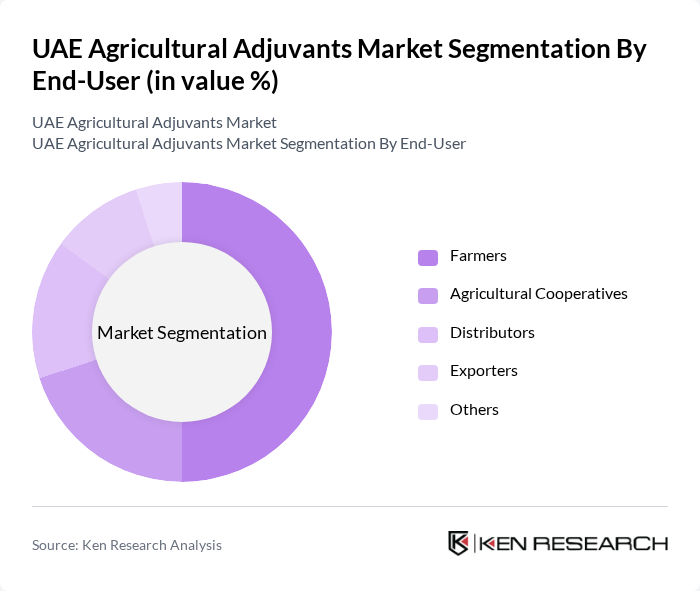

By End-User:The end-user segmentation includes farmers, agricultural cooperatives, distributors, exporters, and others. Farmers represent the largest segment, driven by the need for effective crop management solutions. The increasing number of smallholder farmers adopting modern agricultural practices contributes significantly to the growth of this segment.

The UAE Agricultural Adjuvants Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Syngenta AG, Dow AgroSciences, FMC Corporation, Adjuvants Plus, Nufarm Limited, Croda International Plc, Solvay S.A., Wilbur-Ellis Company, Helena Agri-Enterprises, LLC, Precision Laboratories, LLC, Bayer AG, UPL Limited, Cheminova A/S, and Arysta LifeScience Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE agricultural adjuvants market appears promising, driven by a strong focus on sustainability and technological innovation. The increasing adoption of eco-friendly adjuvants aligns with the UAE's commitment to environmental sustainability, while advancements in precision agriculture and digital tools are set to enhance the efficiency of adjuvant applications. Furthermore, substantial government investments in agricultural research and development will likely accelerate innovation, creating a dynamic landscape for adjuvant manufacturers and users alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Surfactants Emulsifiers Wetting Agents Stickers Dispersants Compatibility Agents Others |

| By End-User | Farmers Agricultural Cooperatives Distributors Exporters Others |

| By Crop Type | Fruits and Vegetables Cereals and Grains Oilseeds Turf and Ornamental Others |

| By Formulation Type | Liquid Granular Powder Others |

| By Distribution Channel | Direct Sales Online Retail Distributors and Wholesalers Others |

| By Application Method | Foliar Application Soil Application Seed Treatment Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Adjuvant Usage | 100 | Agronomists, Crop Managers |

| Fruit and Vegetable Adjuvant Applications | 80 | Farm Owners, Agricultural Technicians |

| Adjuvant Distribution Channels | 60 | Distributors, Retail Managers |

| Research and Development in Adjuvants | 50 | R&D Managers, Product Development Specialists |

| Regulatory Compliance and Adjuvants | 40 | Compliance Officers, Policy Makers |

The UAE Agricultural Adjuvants Market is valued at approximately USD 35 million, driven by the increasing adoption of controlled-environment agriculture and the demand for improved spray performance in arid climates.