Region:Central and South America

Author(s):Shubham

Product Code:KRAC0828

Pages:85

Published On:August 2025

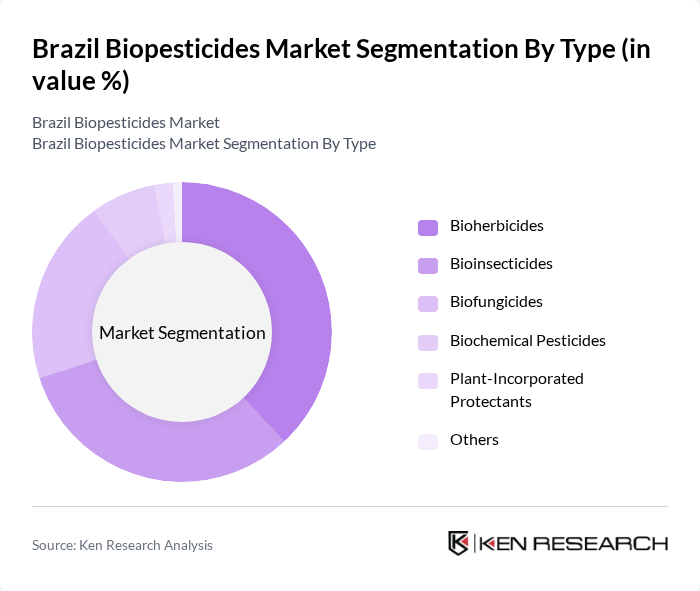

By Type:The biopesticides market can be segmented into various types, including Bioinsecticides, Bioherbicides, Biofungicides, Biochemical Pesticides, Plant-Incorporated Protectants, and Others. Among these, bioherbicides currently account for the largest market share, driven by their effectiveness in controlling problematic weeds and the increasing adoption of organic farming practices. Bioinsecticides are the fastest-growing segment, supported by their ability to target a wide range of pests and their alignment with integrated pest management (IPM) strategies. The use of Bacillus thuringiensis and Beauveria bassiana is prominent in Brazilian agriculture for pest control.

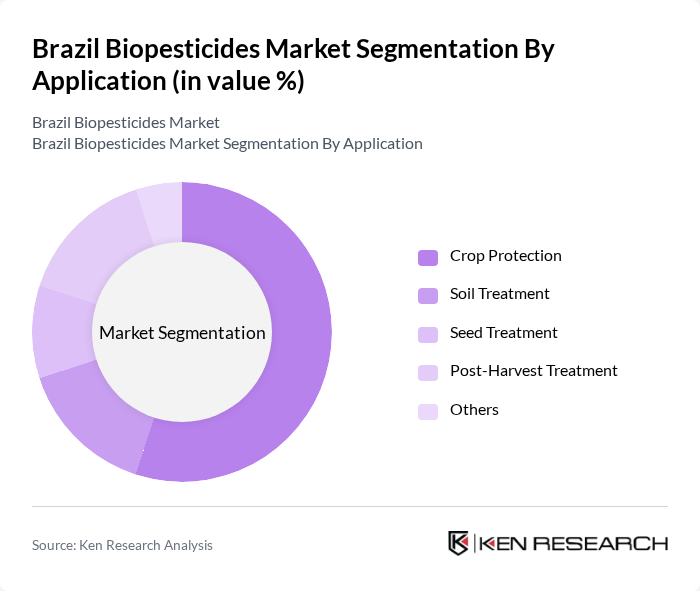

By Application:The applications of biopesticides are diverse, including Crop Protection, Soil Treatment, Seed Treatment, Post-Harvest Treatment, and Others. Crop protection remains the dominant application segment, driven by the need to safeguard crops from pests and diseases and the increasing focus on sustainable agriculture. The rising consumer demand for organic produce and the expansion of organic cultivation areas are propelling growth in crop protection applications.

The Brazil Biopesticides Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Bayer AG, Syngenta AG, FMC Corporation, Koppert Biological Systems, Certis Biologicals, BioControle Métodos de Controle de Pragas Ltda., Vittia S.A., Ballagro Agro Tecnologia Ltda., Agrivalle, Biotrop, Ourofino Agrociência, Sumitomo Chemical Company, Limited, UPL Limited, T. Stanes & Company Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Brazil biopesticides market appears promising, driven by increasing consumer demand for organic products and a shift towards sustainable agricultural practices. As farmers adopt integrated pest management (IPM) strategies, the reliance on biopesticides is expected to grow. Additionally, technological advancements in biopesticide formulations will enhance efficacy and reduce costs, making them more accessible. The Brazilian government’s support for organic farming will further stimulate market growth, creating a favorable environment for biopesticide adoption.

| Segment | Sub-Segments |

|---|---|

| By Type | Bioinsecticides Bioherbicides Biofungicides Biochemical Pesticides Plant-Incorporated Protectants Others |

| By Application | Crop Protection Soil Treatment Seed Treatment Post-Harvest Treatment Others |

| By End-User | Agriculture Horticulture Forestry Plantation Crops Others |

| By Distribution Channel | Direct Sales Retail Stores Online Sales Agricultural Cooperatives Others |

| By Region | North Region Northeast Region Central-West Region Southeast Region South Region Others |

| By Packaging Type | Bottles Pouches Bulk Packaging Sachets Others |

| By Price Range | Low Price Medium Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Crop Producers Using Biopesticides | 120 | Farm Owners, Agricultural Managers |

| Biopesticide Manufacturers | 60 | Product Development Managers, Sales Directors |

| Regulatory Authorities | 40 | Policy Makers, Compliance Officers |

| Research Institutions Focused on Biopesticides | 50 | Research Scientists, Academic Professors |

| Distributors of Agricultural Inputs | 70 | Supply Chain Managers, Sales Representatives |

The Brazil Biopesticides Market is valued at approximately USD 280 million, reflecting a growing trend towards sustainable agricultural practices and effective pest management solutions. This growth is supported by advancements in biopesticide technologies and increasing consumer demand for residue-free produce.