Region:Middle East

Author(s):Rebecca

Product Code:KRAB7961

Pages:83

Published On:October 2025

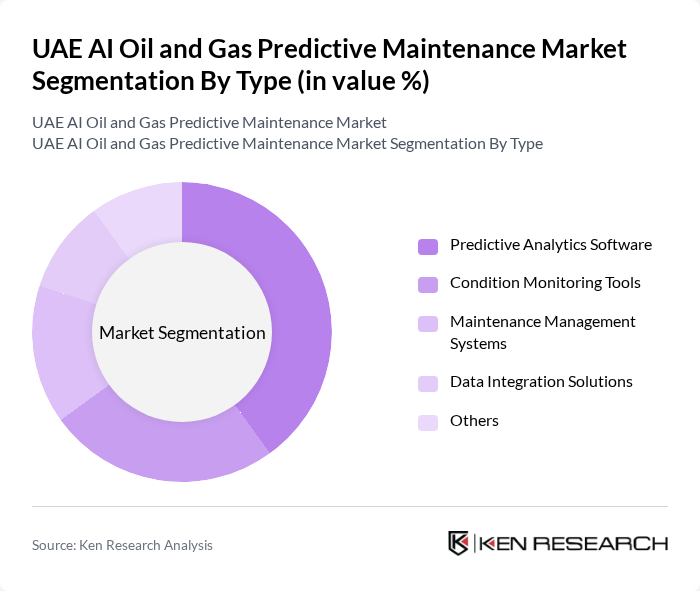

By Type:The market is segmented into various types, including Predictive Analytics Software, Condition Monitoring Tools, Maintenance Management Systems, Data Integration Solutions, and Others. Among these, Predictive Analytics Software is leading due to its ability to analyze vast amounts of data and provide actionable insights, which is crucial for preventing equipment failures and optimizing maintenance schedules.

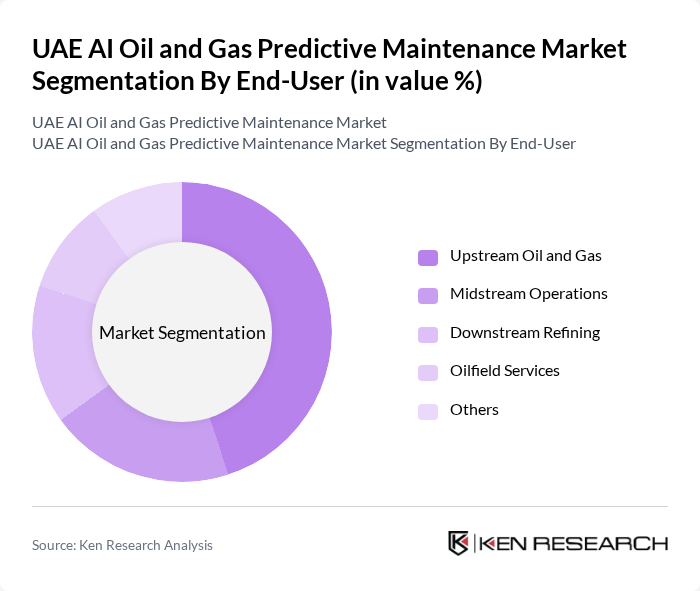

By End-User:The end-user segmentation includes Upstream Oil and Gas, Midstream Operations, Downstream Refining, Oilfield Services, and Others. The Upstream Oil and Gas segment is the most significant due to the high demand for predictive maintenance solutions to enhance exploration and production efficiency, reduce operational costs, and ensure safety in drilling operations.

The UAE AI Oil and Gas Predictive Maintenance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, IBM Corporation, Honeywell International Inc., GE Digital, Schneider Electric SE, Emerson Electric Co., Rockwell Automation, Inc., ABB Ltd., Yokogawa Electric Corporation, PTC Inc., Aspen Technology, Inc., AVEVA Group plc, OSIsoft, LLC, DNV GL, Kongsberg Gruppen ASA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE AI oil and gas predictive maintenance market appears promising, driven by technological advancements and a commitment to sustainability. As companies increasingly adopt machine learning and cloud-based solutions, operational efficiencies are expected to improve significantly. Furthermore, the integration of renewable energy sources into traditional oil and gas operations will likely create new avenues for predictive maintenance applications, enhancing overall system reliability and performance in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Predictive Analytics Software Condition Monitoring Tools Maintenance Management Systems Data Integration Solutions Others |

| By End-User | Upstream Oil and Gas Midstream Operations Downstream Refining Oilfield Services Others |

| By Application | Equipment Monitoring Asset Management Predictive Maintenance Scheduling Performance Optimization Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Service Type | Consulting Services Implementation Services Support and Maintenance Services |

| By Region | Abu Dhabi Dubai Sharjah Others |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Upstream Oil Production Maintenance | 100 | Maintenance Managers, Operations Directors |

| Midstream Pipeline Monitoring | 80 | Pipeline Engineers, Safety Officers |

| Downstream Refinery Operations | 90 | Refinery Managers, Process Engineers |

| AI Technology Providers | 70 | Product Managers, Technical Sales Representatives |

| Consultants in Predictive Maintenance | 60 | Industry Analysts, Technology Consultants |

The UAE AI Oil and Gas Predictive Maintenance Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of AI technologies and the need for operational efficiency in the oil and gas sector.