Region:Global

Author(s):Dev

Product Code:KRAC4784

Pages:83

Published On:October 2025

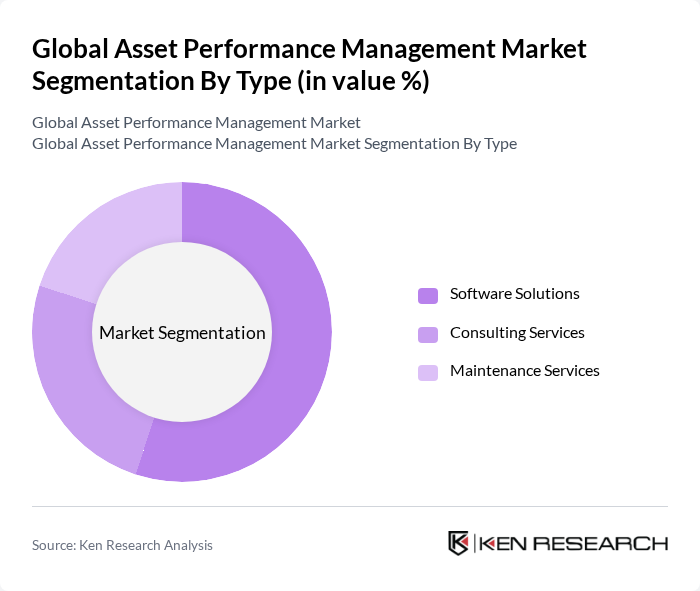

By Type:The market is segmented into Software Solutions, Consulting Services, and Maintenance Services. Software Solutions are increasingly preferred due to their ability to deliver real-time analytics, predictive insights, and seamless integration with enterprise systems, which are essential for optimizing asset performance and minimizing downtime. Consulting Services remain vital as organizations seek expert guidance for digital transformation and strategic asset management. Maintenance Services are critical for ensuring asset longevity, regulatory compliance, and operational reliability, especially in sectors with high-value infrastructure.

By End-User:The end-user segmentation includes Manufacturing, Energy and Utilities, Transportation and Logistics, Healthcare, Oil and Gas, Mining and Metals, Chemical and Pharmaceuticals, Government and Defense, IT and Telecom, and Food and Beverages. Manufacturing leads the market owing to the high demand for process optimization, predictive maintenance, and productivity improvements. Energy and Utilities represent a significant share, driven by the need for grid reliability, sustainability initiatives, and regulatory compliance. Transportation and Logistics, Healthcare, and Oil and Gas are also key adopters, leveraging asset performance management to reduce operational risks and enhance service delivery.

The Global Asset Performance Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Siemens AG, GE Digital, Schneider Electric SE, Honeywell International Inc., SAP SE, Oracle Corporation, ABB Ltd., Bentley Systems, Incorporated, Emerson Electric Co., Rockwell Automation, Inc., Yokogawa Electric Corporation, AVEVA Group plc, DNV GL, PTC Inc., Aspen Technology, Inc., Uptake Technologies Inc., Infor (Koch Industries), OSIsoft (now part of AVEVA), Hexagon AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the asset performance management market appears promising, driven by technological advancements and increasing regulatory pressures. As organizations prioritize digital transformation, the shift towards cloud-based solutions and enhanced analytics capabilities will likely accelerate. Furthermore, the growing emphasis on sustainability initiatives will push companies to adopt more efficient asset management practices, aligning with global environmental goals. This evolving landscape presents opportunities for innovation and collaboration among industry players, fostering a more resilient and efficient market.

| Segment | Sub-Segments |

|---|---|

| By Type | Software Solutions Consulting Services Maintenance Services |

| By End-User | Manufacturing Energy and Utilities Transportation and Logistics Healthcare Oil and Gas Mining and Metals Chemical and Pharmaceuticals Government and Defense IT and Telecom Food and Beverages |

| By Application | Asset Tracking Predictive Maintenance Performance Optimization Reliability and Condition Monitoring Sustainability & Emission Management |

| By Deployment Model | On-Premises Cloud-Based |

| By Industry | Energy and Utilities Oil and Gas Manufacturing Mining and Metals Healthcare and Life Sciences Chemical and Pharmaceuticals Government and Defense IT and Telecom Food and Beverages |

| By Region | North America Europe Asia-Pacific Middle East & Africa Latin America |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Asset Management | 120 | Operations Managers, Asset Managers |

| Energy Sector Performance Monitoring | 100 | Energy Analysts, Maintenance Supervisors |

| Transportation Fleet Management | 60 | Fleet Managers, Logistics Coordinators |

| Healthcare Asset Tracking | 50 | Healthcare Administrators, IT Managers |

| IT Infrastructure Performance | 70 | IT Directors, System Administrators |

The Global Asset Performance Management Market is valued at approximately USD 23.7 billion, driven by the increasing demand for operational efficiency, predictive maintenance, and the integration of IoT and cloud technologies in asset management.