Region:Middle East

Author(s):Geetanshi

Product Code:KRAB8141

Pages:88

Published On:October 2025

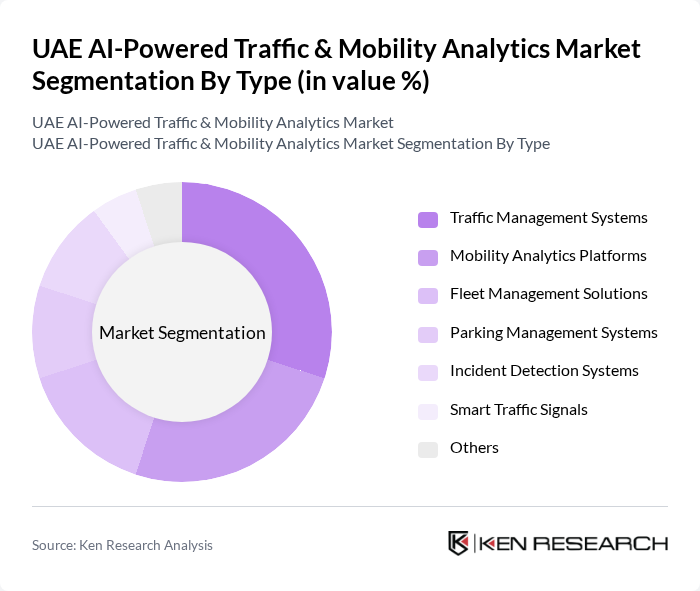

By Type:The market is segmented into various types, including Traffic Management Systems, Mobility Analytics Platforms, Fleet Management Solutions, Parking Management Systems, Incident Detection Systems, Smart Traffic Signals, and Others. Each of these sub-segments plays a crucial role in enhancing traffic efficiency and mobility analytics.

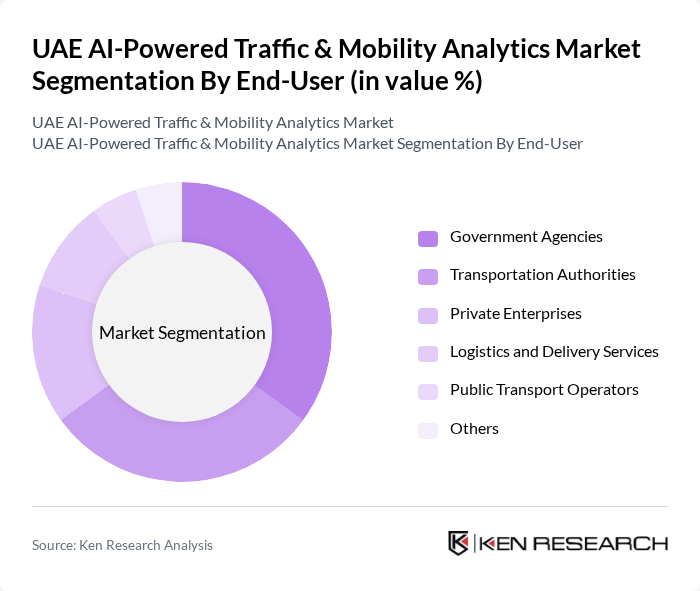

By End-User:The end-user segmentation includes Government Agencies, Transportation Authorities, Private Enterprises, Logistics and Delivery Services, Public Transport Operators, and Others. Each segment utilizes AI-powered solutions to enhance operational efficiency and improve service delivery.

The UAE AI-Powered Traffic & Mobility Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Mobility, IBM Corporation, Cisco Systems, Inc., Kapsch TrafficCom AG, TomTom International BV, HERE Technologies, Cubic Corporation, Q-Free ASA, Iteris, Inc., Inrix, Inc., Trafficware, Waze (Google), Geotab Inc., Systra, Alstom SA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE AI-powered traffic and mobility analytics market appears promising, driven by technological advancements and government support. In the future, the integration of AI with IoT will enhance traffic management efficiency, while the rise of smart city initiatives will further propel market growth. As urban areas continue to expand, the demand for innovative solutions will increase, leading to a more connected and efficient transportation ecosystem that prioritizes sustainability and user experience.

| Segment | Sub-Segments |

|---|---|

| By Type | Traffic Management Systems Mobility Analytics Platforms Fleet Management Solutions Parking Management Systems Incident Detection Systems Smart Traffic Signals Others |

| By End-User | Government Agencies Transportation Authorities Private Enterprises Logistics and Delivery Services Public Transport Operators Others |

| By Application | Traffic Flow Optimization Congestion Management Safety and Security Monitoring Environmental Impact Assessment Urban Planning and Development Others |

| By Deployment Mode | Cloud-Based Solutions On-Premises Solutions Hybrid Solutions |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Traffic Management Solutions | 100 | City Planners, Traffic Engineers |

| AI-Driven Mobility Services | 80 | Mobility Service Providers, Technology Developers |

| Public Transportation Analytics | 70 | Transit Authority Officials, Operations Managers |

| Logistics and Fleet Management | 90 | Logistics Managers, Fleet Operators |

| Smart City Initiatives | 60 | Urban Development Experts, Policy Makers |

The UAE AI-Powered Traffic & Mobility Analytics Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by smart city initiatives, advancements in AI technology, and the need for efficient traffic management solutions.