Region:Middle East

Author(s):Shubham

Product Code:KRAC2860

Pages:92

Published On:October 2025

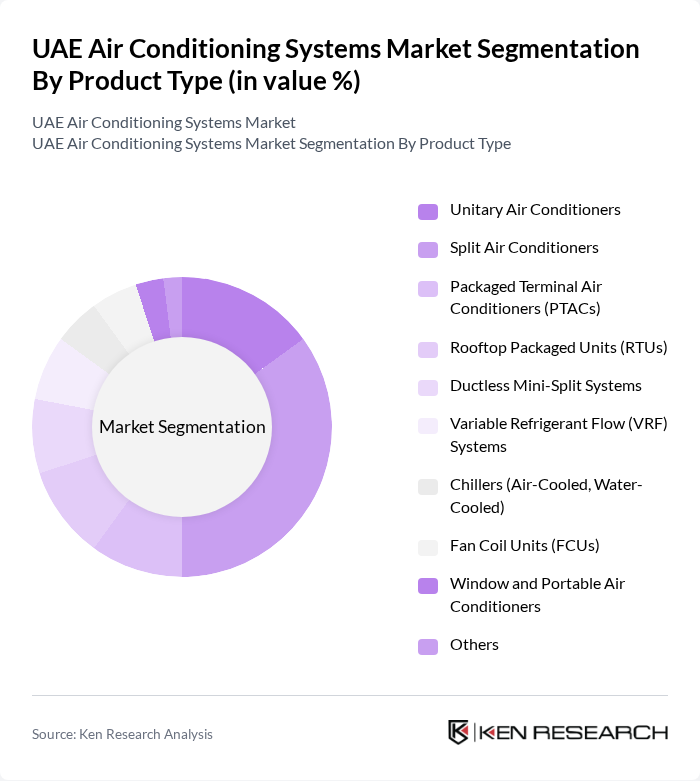

By Product Type:The product type segmentation includes various air conditioning systems tailored for different applications and consumer needs. The subsegments are Unitary Air Conditioners, Split Air Conditioners, Packaged Terminal Air Conditioners (PTACs), Rooftop Packaged Units (RTUs), Ductless Mini-Split Systems, Variable Refrigerant Flow (VRF) Systems, Chillers (Air-Cooled, Water-Cooled), Fan Coil Units (FCUs), Window and Portable Air Conditioners, and Others. Among these, Split Air Conditioners are leading the market due to their versatility, energy efficiency, and ease of installation, making them a preferred choice for both residential and commercial applications. The growing adoption of inverter-based split ACs and smart split systems is further strengthening this segment's position .

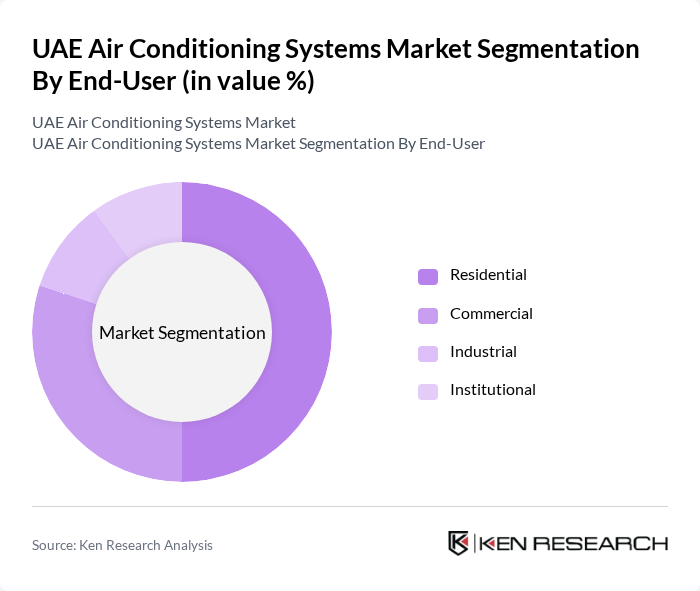

By End-User:The end-user segmentation encompasses various sectors utilizing air conditioning systems, including Residential, Commercial, Industrial, and Institutional. The Residential segment is the largest, driven by the growing population and the increasing number of housing projects. The demand for comfortable living environments in extreme weather conditions has led to a significant rise in residential air conditioning installations, making it a key driver of market growth. The commercial sector, including retail, hospitality, and office spaces, also contributes substantially due to ongoing infrastructure and tourism development .

The UAE Air Conditioning Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carrier Global Corporation, Daikin Industries, Ltd., Trane Technologies plc, LG Electronics Inc., Mitsubishi Electric Corporation, Gree Electric Appliances, Inc., Fujitsu General Limited, Samsung Electronics Co., Ltd., Panasonic Corporation, Hitachi, Ltd., Lennox International Inc., Rheem Manufacturing Company, York International Corporation (Johnson Controls), Haier Smart Home Co., Ltd., Midea Group Co., Ltd., Zamil Air Conditioners (Zamil Industrial Investment Co.), SKM Air Conditioning LLC, Trosten Industries Company LLC, Al-Futtaim Engineering & Technologies (Al-Futtaim Group), Danfoss FZCO contribute to innovation, geographic expansion, and service delivery in this space .

The UAE air conditioning systems market is poised for significant transformation driven by technological advancements and sustainability initiatives. The integration of smart technologies and IoT-enabled systems is expected to enhance energy efficiency and user experience. Additionally, the government's focus on reducing carbon emissions and promoting renewable energy sources will likely shape future product offerings. As urbanization continues, the demand for innovative cooling solutions will grow, creating a dynamic market landscape that prioritizes efficiency and environmental responsibility.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Unitary Air Conditioners Split Air Conditioners Packaged Terminal Air Conditioners (PTACs) Rooftop Packaged Units (RTUs) Ductless Mini-Split Systems Variable Refrigerant Flow (VRF) Systems Chillers (Air-Cooled, Water-Cooled) Fan Coil Units (FCUs) Window and Portable Air Conditioners Others |

| By End-User | Residential Commercial Industrial Institutional |

| By Application | Residential Cooling Commercial Cooling Industrial Cooling Institutional Cooling |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Distributors and Wholesalers |

| By Price Range | Budget Mid-Range Premium |

| By Brand | Local Brands International Brands Emerging Brands |

| By Energy Efficiency Rating | Low Efficiency Medium Efficiency High Efficiency Ultra High Efficiency |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Air Conditioning Systems | 100 | Homeowners, Property Managers |

| Commercial HVAC Solutions | 80 | Facility Managers, Building Owners |

| Industrial Cooling Systems | 60 | Operations Managers, Plant Engineers |

| Energy-Efficient Systems Adoption | 50 | Sustainability Officers, Energy Managers |

| Maintenance and Service Providers | 70 | Service Technicians, Business Owners |

The UAE Air Conditioning Systems Market is valued at approximately USD 1.1 billion, driven by factors such as extreme climate conditions, rapid urbanization, and a growing demand for energy-efficient cooling solutions.