Region:Middle East

Author(s):Rebecca

Product Code:KRAB6846

Pages:86

Published On:October 2025

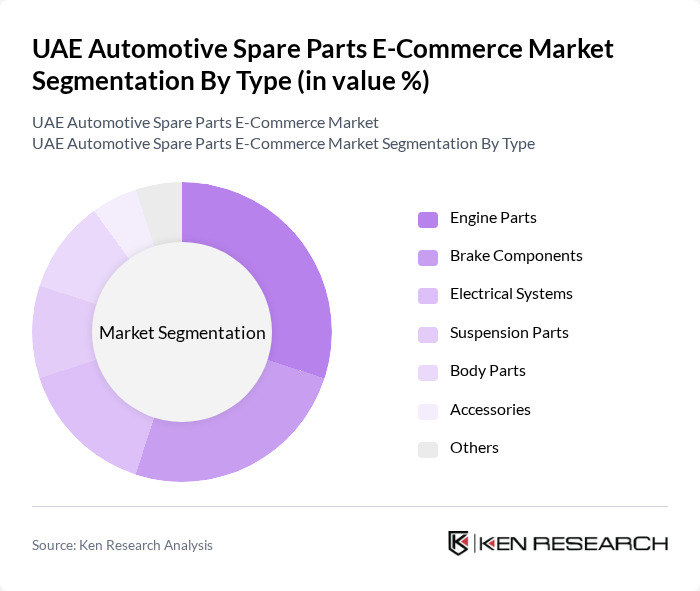

By Type:The market is segmented into various types of automotive spare parts, including engine parts, brake components, electrical systems, suspension parts, body parts, accessories, and others. Among these, engine parts and brake components are particularly significant due to their essential roles in vehicle performance and safety. The increasing number of vehicles on the road has led to a higher demand for these critical components, driving growth in this segment.

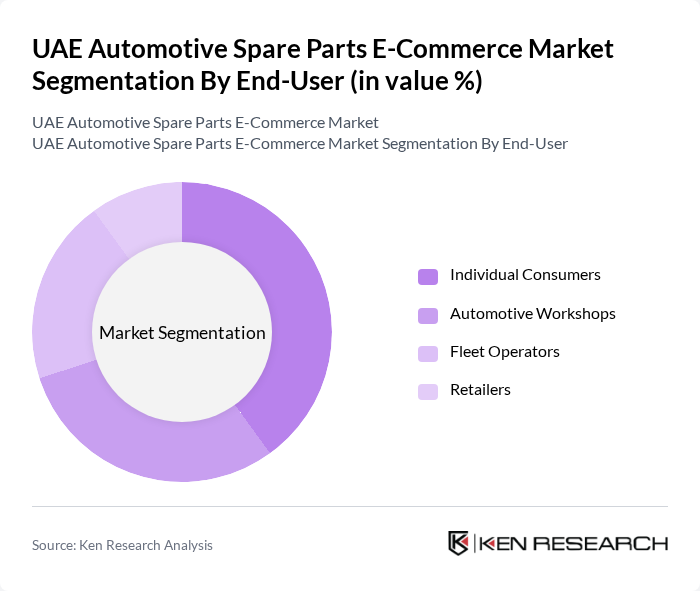

By End-User:The end-user segmentation includes individual consumers, automotive workshops, fleet operators, and retailers. Individual consumers represent a significant portion of the market, driven by the increasing trend of DIY repairs and maintenance. Automotive workshops also play a crucial role, as they require a steady supply of spare parts to service vehicles efficiently. The growth of fleet operators further contributes to the demand for spare parts, as they maintain large numbers of vehicles.

The UAE Automotive Spare Parts E-Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Futtaim Group, Al Nabooda Automobiles, Arabian Automobiles, Al Tayer Group, Emirates Motor Company, Al Mulla Group, Al Jazeera Automotive, Al Mufeed Group, AutoPro, Parts Center, Spare Parts UAE, AutoZone, CarParts.com, Souq.com, Noon.com contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE automotive spare parts e-commerce market appears promising, driven by technological advancements and changing consumer preferences. As more consumers embrace online shopping, businesses will need to enhance their digital platforms to provide seamless experiences. Additionally, the integration of AI and machine learning will enable personalized shopping experiences, further boosting sales. Companies that adapt to these trends and invest in innovative solutions will likely thrive in this evolving landscape, ensuring sustained growth and competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Type | Engine Parts Brake Components Electrical Systems Suspension Parts Body Parts Accessories Others |

| By End-User | Individual Consumers Automotive Workshops Fleet Operators Retailers |

| By Sales Channel | Direct Online Sales Marketplaces B2B Platforms Social Media Commerce |

| By Distribution Mode | Home Delivery Click and Collect Third-Party Logistics |

| By Price Range | Budget Mid-Range Premium |

| By Brand | OEM Parts Aftermarket Parts Generic Brands |

| By Region | Abu Dhabi Dubai Sharjah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| OEM Spare Parts Retailers | 100 | Store Managers, Sales Executives |

| Aftermarket Parts Distributors | 80 | Distribution Managers, Procurement Specialists |

| E-commerce Platforms for Automotive Parts | 90 | eCommerce Directors, Marketing Managers |

| Logistics Providers for Spare Parts | 70 | Logistics Managers, Operations Directors |

| End-Users of Automotive Spare Parts | 120 | Car Owners, Fleet Managers |

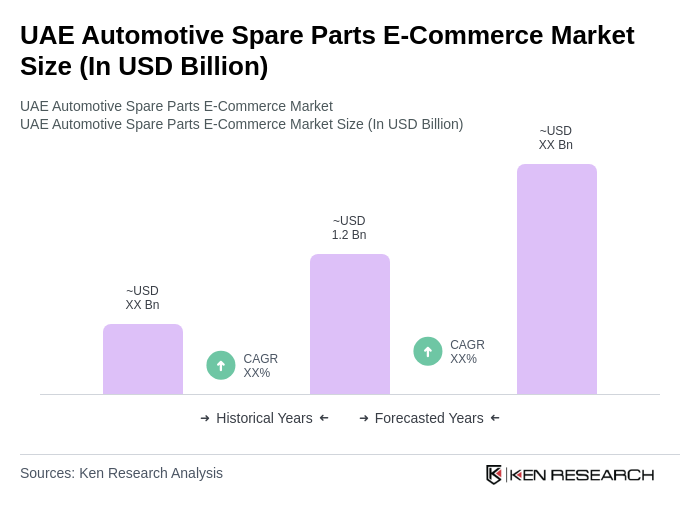

The UAE Automotive Spare Parts E-Commerce Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased online shopping, rising vehicle ownership, and demand for cost-effective spare parts solutions.