Region:Middle East

Author(s):Rebecca

Product Code:KRAB9554

Pages:89

Published On:October 2025

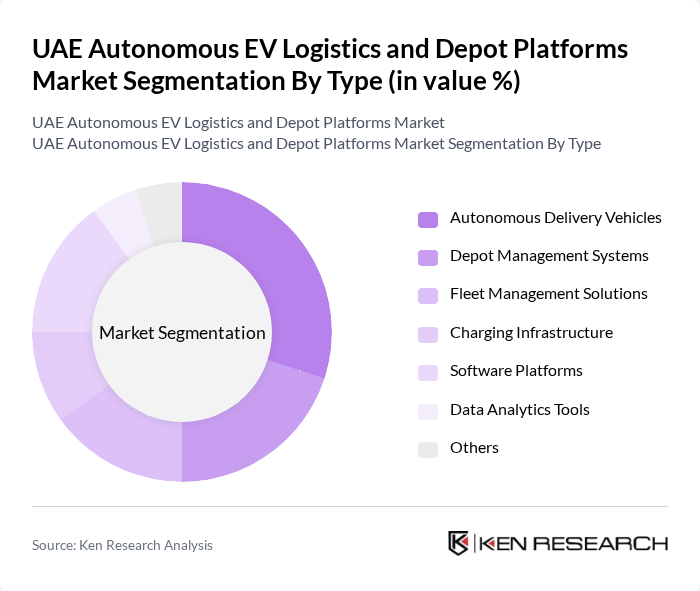

By Type:The market is segmented into various types, including Autonomous Delivery Vehicles, Depot Management Systems, Fleet Management Solutions, Charging Infrastructure, Software Platforms, Data Analytics Tools, and Others. Each of these subsegments plays a crucial role in enhancing the efficiency and effectiveness of logistics operations.

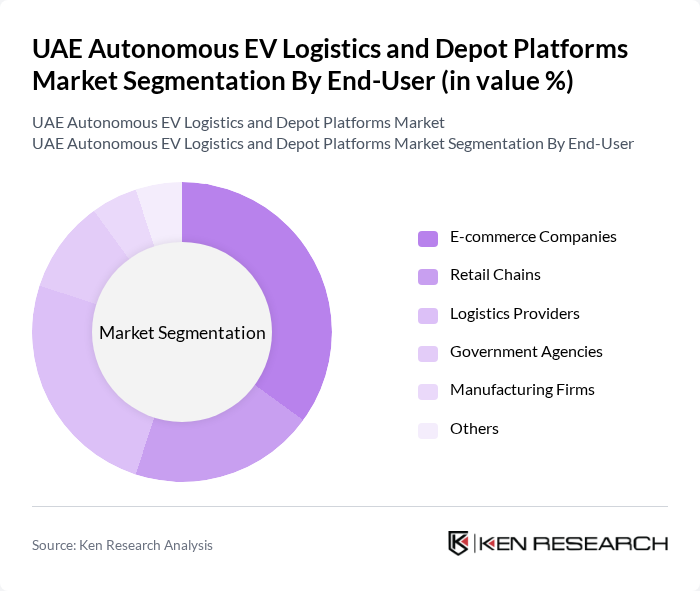

By End-User:The end-user segmentation includes E-commerce Companies, Retail Chains, Logistics Providers, Government Agencies, Manufacturing Firms, and Others. Each segment has unique requirements and contributes differently to the overall market dynamics.

The UAE Autonomous EV Logistics and Depot Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as DP World, Emirates Logistics, Aramex, Fetchr, Careem, Talabat, Etihad Rail, Abu Dhabi Ports, Dubai South, Al-Futtaim Group, Al Naboodah Group, Al Ghurair Group, Gulf Navigation Holding, National Transport and Logistics Company, Emirates Transport contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE Autonomous EV Logistics and Depot Platforms market appears promising, driven by technological advancements and supportive government policies. In future, the integration of smart technologies and data analytics is expected to enhance operational efficiencies, while the expansion of EV infrastructure will facilitate broader adoption. As public acceptance of autonomous vehicles grows, logistics companies are likely to invest more in innovative solutions, positioning themselves competitively in a rapidly evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Autonomous Delivery Vehicles Depot Management Systems Fleet Management Solutions Charging Infrastructure Software Platforms Data Analytics Tools Others |

| By End-User | E-commerce Companies Retail Chains Logistics Providers Government Agencies Manufacturing Firms Others |

| By Application | Last-Mile Delivery Urban Logistics Freight Transportation Depot Operations Inventory Management Others |

| By Distribution Mode | Direct Sales Online Platforms Partnerships with Logistics Firms Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| By Customer Segment | Large Enterprises SMEs Startups Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for R&D Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Autonomous EV Fleet Management | 100 | Fleet Managers, Operations Directors |

| Depot Automation Solutions | 80 | Depot Managers, Technology Officers |

| Logistics Software Integration | 70 | IT Managers, Software Developers |

| Regulatory Compliance in Autonomous Logistics | 60 | Compliance Officers, Legal Advisors |

| Consumer Acceptance of Autonomous Deliveries | 90 | Market Researchers, Customer Experience Managers |

The UAE Autonomous EV Logistics and Depot Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by technological advancements, demand for efficient logistics solutions, and government initiatives promoting sustainable transportation.