UAE Broadcast Equipment Market Overview

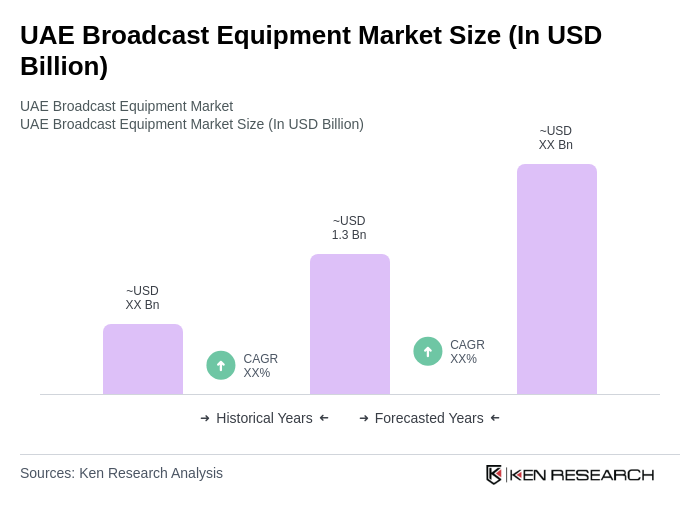

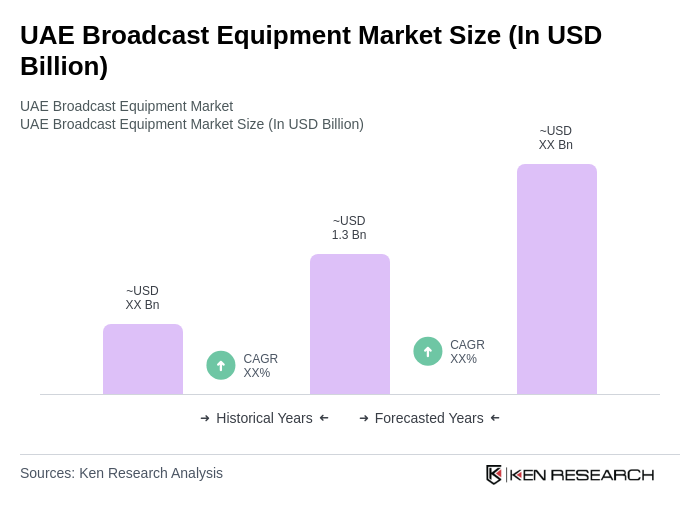

- The UAE Broadcast Equipment Market is valued at USD 1.3 billion, based on current market analysis. This growth is primarily driven by the increasing demand for high-definition content, advancements in broadcasting technology, and the rise of digital media platforms. The market has seen significant investments in infrastructure and technology, enhancing the capabilities of broadcasters and content creators. The UAE entertainment industry is projected to expand at a compound annual growth rate of 9.0%, with approximately 50% of users in the Middle East and North Africa streaming content daily via digital streaming platforms, indicating strong demand for broadcast equipment to support live sports, news, and entertainment distribution.

- Dubai and Abu Dhabi are the dominant cities in the UAE Broadcast Equipment Market due to their status as media hubs and centers for international events. The presence of major broadcasting companies such as Abu Dhabi Media, Shahid, and Dubai Media Inc., coupled with government support for media initiatives, has fostered a conducive environment for growth. Additionally, the increasing number of media channels and platforms in these cities has further solidified their market dominance. Recent investments by sports associations, including a USD 150 million rights deal for the UAE T20 event, demonstrate the region's commitment to broadcasting high-quality content and attracting premium broadcast equipment investments.

- The UAE government has implemented regulatory frameworks aimed at enhancing the quality of broadcast content and promoting digital broadcasting adoption. These regulations mandate that broadcasting entities comply with specific technical standards for equipment and transmission to ensure high-quality output. The regulatory environment supports the adoption of IP-based content distribution systems and modern transmission technologies, which has become an industry standard as broadcasters transition from traditional systems to digital platforms. This initiative is part of a broader strategy to elevate the UAE's position in the global media landscape and promote local content production.

UAE Broadcast Equipment Market Segmentation

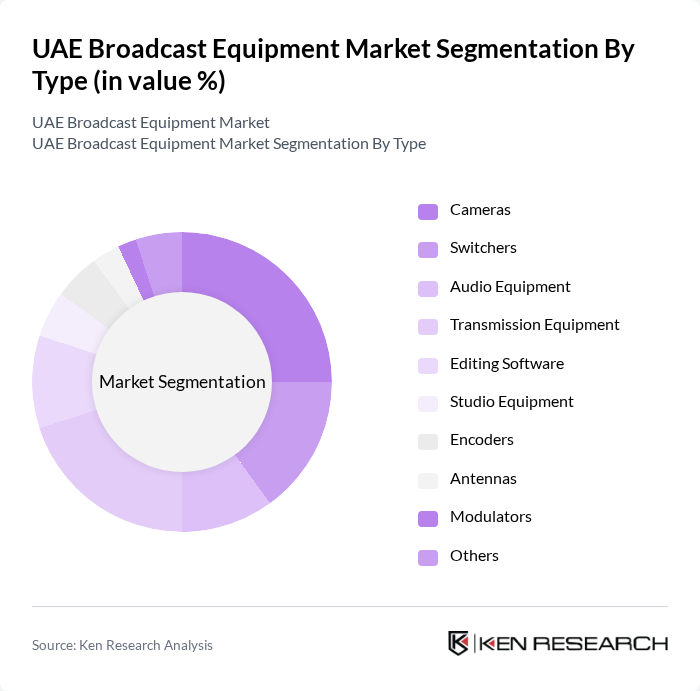

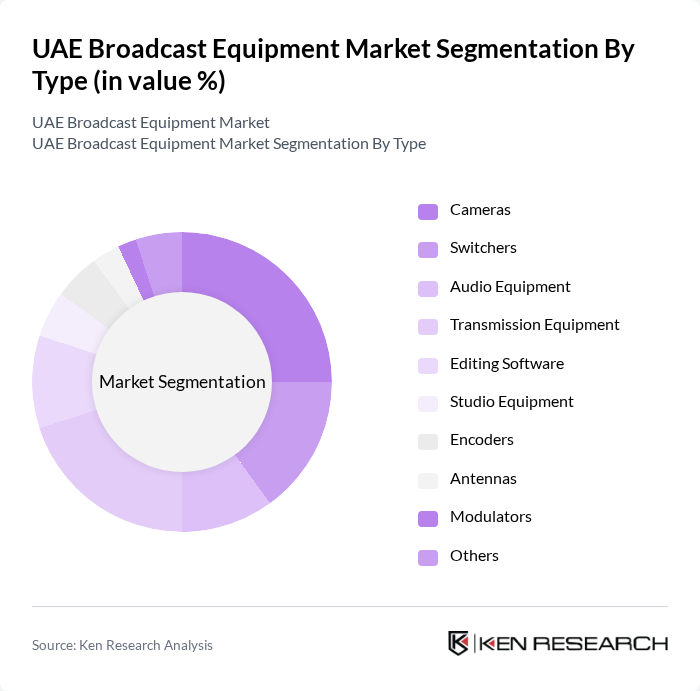

By Type:The market is segmented into various types of broadcast equipment, including Cameras, Switchers, Audio Equipment, Transmission Equipment, Editing Software, Studio Equipment, Encoders, Antennas, Modulators, and Others. Each of these segments plays a crucial role in the broadcasting process, catering to different needs and preferences of broadcasters and content creators. Encoders represent a significant segment globally, accounting for approximately 22.5% of market share, driven by rising demand for ultra-high-definition and 4K content transmission.

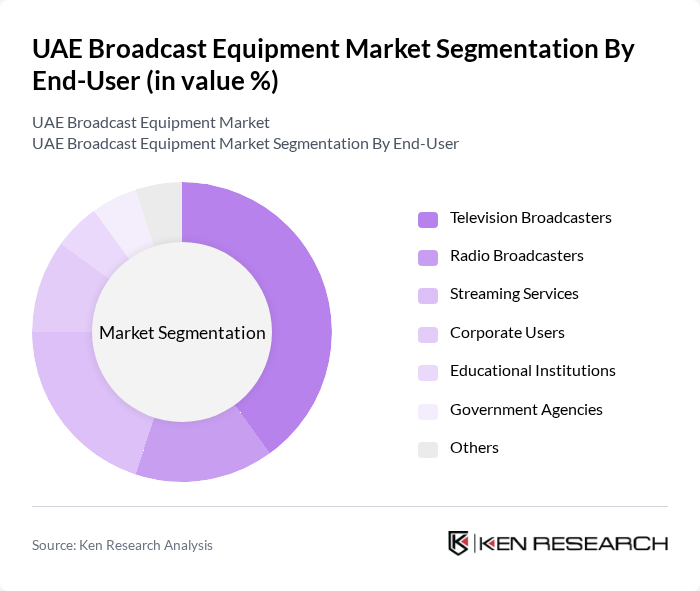

By End-User:The end-user segmentation includes Television Broadcasters, Radio Broadcasters, Streaming Services, Corporate Users, Educational Institutions, Government Agencies, and Others. Each end-user category has distinct requirements and preferences, influencing the types of broadcast equipment they utilize. Television broadcasters continue to dominate the market, though streaming services have emerged as a rapidly growing segment, driven by the expansion of over-the-top platforms and changing consumer preferences toward digital content consumption.

UAE Broadcast Equipment Market Competitive Landscape

The UAE Broadcast Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sony Corporation, Panasonic Corporation, Blackmagic Design, Avid Technology, Inc., Grass Valley, Harmonic Inc., NewTek, Inc., Telestream, LLC, Ross Video Ltd., Evertz Microsystems Ltd., Imagine Communications, Vizrt Group, Sennheiser Electronic GmbH, Riedel Communications, Datavideo Technologies Co., Ltd., AJA Video Systems Inc., EVS Broadcast Equipment SA, Cisco Systems Inc., Belden Inc. contribute to innovation, geographic expansion, and service delivery in this space.

UAE Broadcast Equipment Market Industry Analysis

Growth Drivers

- Increasing Demand for High-Definition Broadcasting:The UAE's media landscape is witnessing a surge in demand for high-definition (HD) broadcasting, driven by a growing consumer preference for superior visual quality. In future, the number of HD channels in the UAE is projected to reach 150, up from 120 in the previous period, reflecting a 25% increase. This trend is supported by the rising penetration of smart TVs, which is expected to exceed 90% of households, enhancing the need for advanced broadcast equipment to meet viewer expectations.

- Growth in Digital Content Consumption:Digital content consumption in the UAE is on the rise, with the average internet user spending over 8 hours daily on online platforms in future. This shift is leading to an increased demand for broadcast equipment that can support diverse content formats. The UAE's digital advertising market is projected to reach AED 3 billion, indicating a robust growth trajectory that necessitates advanced broadcasting solutions to cater to evolving consumer preferences and content delivery methods.

- Advancements in Broadcasting Technology:The UAE is at the forefront of adopting cutting-edge broadcasting technologies, including 4K and 8K resolution capabilities. In future, it is estimated that 40% of broadcasters will have transitioned to 4K broadcasting, up from 15% in the previous period. This technological advancement is driven by the need for enhanced viewer experiences and competitive differentiation, prompting investments in state-of-the-art broadcast equipment to facilitate high-quality content delivery across various platforms.

Market Challenges

- High Initial Investment Costs:The broadcast equipment market in the UAE faces significant challenges due to high initial investment costs. For instance, the average cost of setting up a new broadcasting station can exceed AED 12 million, which poses a barrier for new entrants. This financial hurdle limits market participation and innovation, as established players dominate the landscape, making it difficult for smaller companies to compete effectively in this capital-intensive industry.

- Rapid Technological Changes:The fast-paced evolution of broadcasting technology presents a challenge for companies in the UAE. With new technologies emerging every year, such as 5G and AI-driven content creation tools, broadcasters must continuously invest in upgrading their equipment. This constant need for adaptation can strain financial resources, as companies may face difficulties in keeping up with the latest advancements while maintaining operational efficiency and profitability.

UAE Broadcast Equipment Market Future Outlook

The future of the UAE broadcast equipment market is poised for significant transformation, driven by technological advancements and changing consumer behaviors. As the demand for high-quality content continues to rise, broadcasters will increasingly adopt cloud-based solutions and AI technologies to enhance production efficiency. Additionally, the integration of 5G technology is expected to revolutionize live broadcasting, enabling seamless content delivery and interactive viewer experiences. These trends will shape the competitive landscape, fostering innovation and collaboration among industry players.

Market Opportunities

- Growth in OTT Services:The rise of Over-the-Top (OTT) services presents a lucrative opportunity for broadcast equipment providers. With the number of OTT subscribers in the UAE projected to reach 4 million in future, broadcasters can leverage this trend to expand their service offerings and invest in equipment that supports diverse content delivery methods, enhancing viewer engagement and satisfaction.

- Increasing Government Support:The UAE government is actively promoting media initiatives, providing incentives for local content production. In future, government funding for media projects is expected to exceed AED 600 million, creating opportunities for partnerships between broadcasters and technology firms. This support can drive innovation and enhance the capabilities of local broadcasters, positioning them competitively in the regional market.