Region:Middle East

Author(s):Shubham

Product Code:KRAA8522

Pages:94

Published On:November 2025

E-Commerce Market.png)

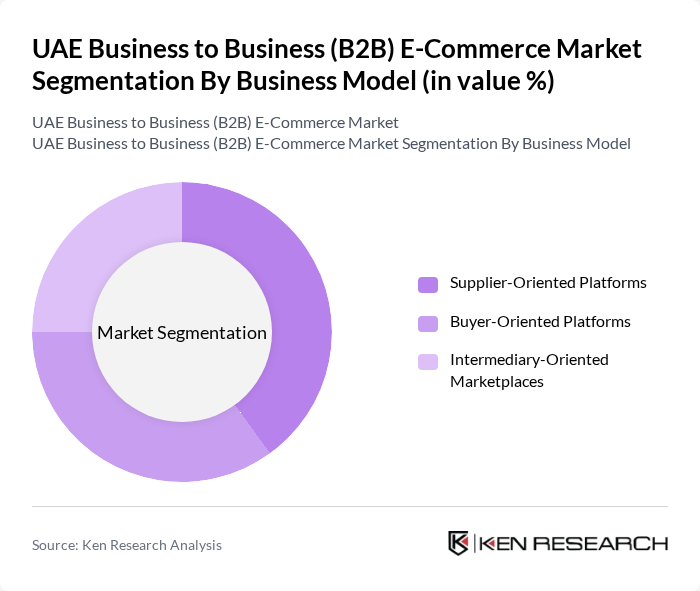

By Business Model:The B2B e-commerce market can be segmented into three primary business models: Supplier-Oriented Platforms, Buyer-Oriented Platforms, and Intermediary-Oriented Marketplaces. Supplier-oriented platforms are designed to facilitate manufacturers and suppliers in reaching their business customers directly. Buyer-oriented platforms focus on the needs of businesses looking to procure goods and services. Intermediary-oriented marketplaces serve as a bridge between buyers and sellers, providing a platform for transactions .

By Enterprise Size:The market is also segmented by enterprise size, which includes Small and Medium Enterprises (SMEs) and Large Enterprises. SMEs are increasingly adopting e-commerce solutions to enhance their market reach and operational efficiency. Large enterprises leverage B2B e-commerce for bulk purchasing and streamlined supply chain management, often integrating these platforms into their existing systems. The adoption rate among SMEs is particularly notable due to government incentives and digital onboarding programs .

The UAE Business to Business (B2B) E-Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tradeling, Amazon Business UAE, Noon Business, SupplyVan, Zadi Platform, Dubuy.com (DP World), Etisalat Marketplace, Al-Futtaim Logistics, Emirates Auction, Sharaf DG Business, Carrefour Business, Fadfada, Sary UAE, MaxAB UAE, Beehive contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE B2B e-commerce market appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence and machine learning is expected to enhance operational efficiencies and customer experiences. Additionally, the growing emphasis on sustainability will likely influence purchasing decisions, prompting businesses to adopt eco-friendly practices. As the market matures, companies that leverage these trends will be well-positioned to capture emerging opportunities and drive growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Business Model | Supplier-Oriented Platforms Buyer-Oriented Platforms Intermediary-Oriented Marketplaces |

| By Enterprise Size | Small and Medium Enterprises (SMEs) Large Enterprises |

| By Industry Vertical | Manufacturing Wholesale and Distribution Construction Healthcare Food and Beverage Others |

| By Application | Office Supplies Industrial Equipment Electronics Raw Materials Others |

| By Payment Method | Credit/Debit Cards Bank Transfers Digital Wallets Buy Now Pay Later (BNPL) Cash on Delivery Others |

| By Delivery Model | Direct Shipping Drop Shipping Click and Collect Subscription Services Others |

| By Geographic Distribution | Dubai Abu Dhabi Sharjah Other Emirates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector E-commerce Adoption | 60 | Operations Managers, IT Directors |

| Wholesale Distribution Channels | 50 | Supply Chain Managers, Sales Directors |

| Service Industry Digital Transactions | 40 | Business Development Managers, Finance Officers |

| Logistics and Supply Chain Solutions | 50 | Logistics Coordinators, Procurement Specialists |

| Technology Providers for B2B E-commerce | 40 | Product Managers, Technical Leads |

The UAE Business to Business (B2B) e-commerce market is valued at approximately USD 2.5 billion, driven by digital transformation, increased internet penetration, and demand for efficient supply chain solutions.