Region:Middle East

Author(s):Rebecca

Product Code:KRAA6920

Pages:84

Published On:September 2025

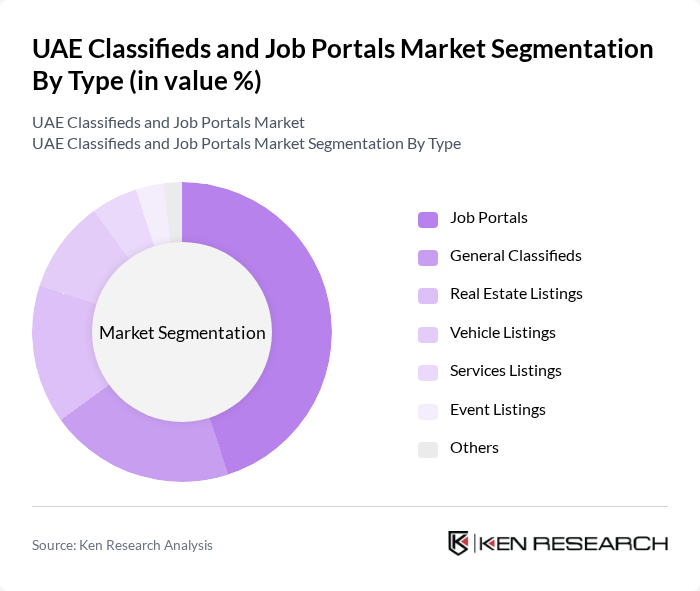

By Type:The market is segmented into various types, including Job Portals, General Classifieds, Real Estate Listings, Vehicle Listings, Services Listings, Event Listings, and Others. Among these, Job Portals are the most dominant segment, driven by the increasing number of job seekers and the growing demand for skilled labor in various sectors. The convenience of online applications and the ability to reach a wider audience have made job portals the preferred choice for both employers and job seekers.

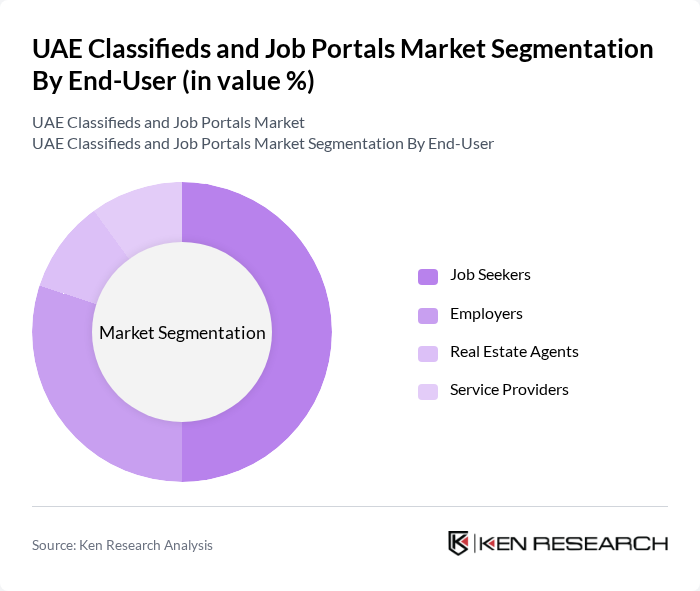

By End-User:The end-user segmentation includes Job Seekers, Employers, Real Estate Agents, and Service Providers. Job Seekers represent the largest segment, as the increasing number of expatriates and the demand for skilled labor in the UAE drive the need for job portals. Employers also play a significant role, as they seek efficient platforms to find qualified candidates, making this segment crucial for the overall market dynamics.

The UAE Classifieds and Job Portals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dubizzle, Bayt, GulfTalent, NaukriGulf, Indeed, LinkedIn, Monster Gulf, ExpatWoman, Property Finder, YallaMotor, Jobzella, Khaleej Times Jobs, Jobs in Dubai, JobStreet, Workana contribute to innovation, geographic expansion, and service delivery in this space.

The UAE classifieds and job portals market is poised for significant evolution, driven by technological advancements and changing workforce dynamics. As remote work becomes more prevalent, platforms will need to adapt to cater to a diverse range of job seekers. Additionally, the integration of AI and machine learning will enhance user experiences, making job matching more efficient. The focus on mobile accessibility will also continue to grow, ensuring that users can engage with platforms anytime, anywhere, thus expanding market reach.

| Segment | Sub-Segments |

|---|---|

| By Type | Job Portals General Classifieds Real Estate Listings Vehicle Listings Services Listings Event Listings Others |

| By End-User | Job Seekers Employers Real Estate Agents Service Providers |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Others |

| By Application | Job Recruitment Property Sales and Rentals Vehicle Sales Service Offerings |

| By Sales Channel | Online Platforms Mobile Applications Social Media |

| By Pricing Model | Subscription-Based Pay-Per-Listing Freemium |

| By Policy Support | Government Initiatives Incentives for Startups Tax Benefits |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Job Seekers in Technology Sector | 150 | Software Developers, IT Managers |

| Recruitment Agencies Insights | 100 | Recruitment Consultants, Agency Owners |

| HR Managers in Hospitality | 80 | HR Directors, Talent Acquisition Specialists |

| Expatriate Job Seekers | 120 | International Professionals, Skilled Workers |

| Employers in Retail Sector | 90 | Store Managers, Regional HR Managers |

The UAE Classifieds and Job Portals Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by digitalization, a rising expatriate population, and the increasing use of mobile applications for job searching and classifieds.