Region:Asia

Author(s):Shubham

Product Code:KRAB4418

Pages:94

Published On:October 2025

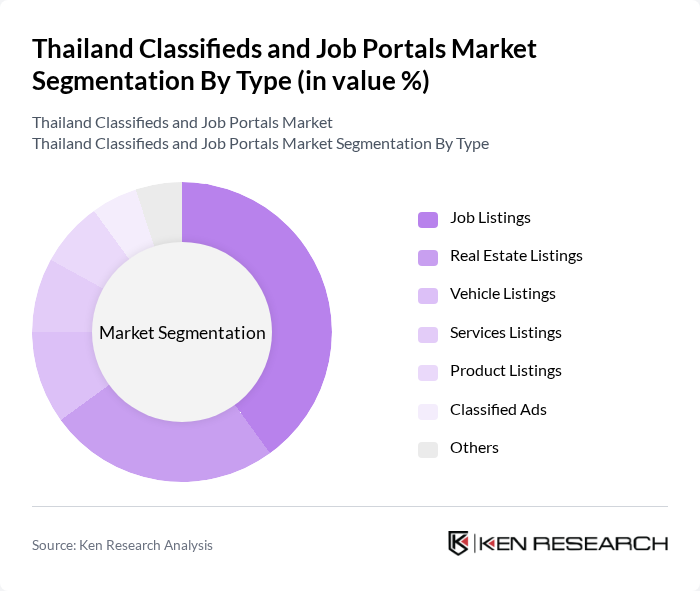

By Type:The market is segmented into various types, including Job Listings, Real Estate Listings, Vehicle Listings, Services Listings, Product Listings, Classified Ads, and Others. Among these, Job Listings are the most dominant segment, driven by the increasing number of job seekers and the growing trend of online recruitment. The convenience of applying for jobs online and the ability to reach a wider audience have made job listings a preferred choice for both employers and job seekers.

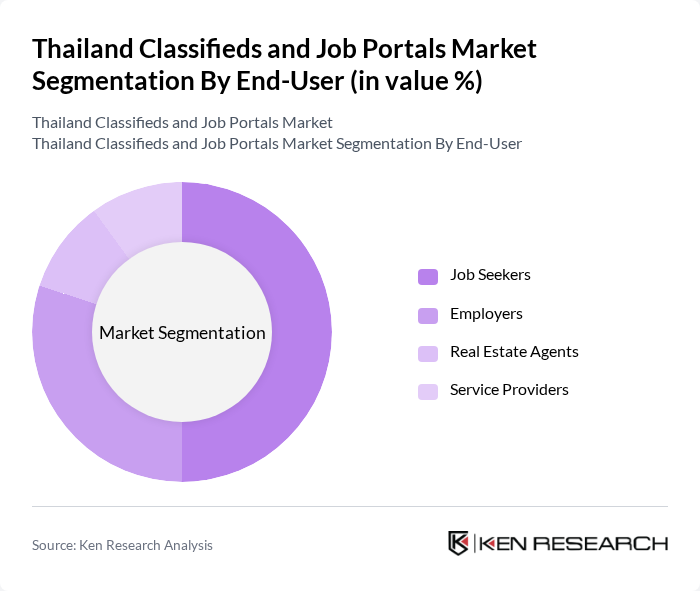

By End-User:This segmentation includes Job Seekers, Employers, Real Estate Agents, and Service Providers. Job Seekers represent the largest segment, as the increasing unemployment rate and the need for skilled labor drive more individuals to seek job opportunities online. Employers also play a significant role, as they utilize these platforms to find suitable candidates efficiently.

The Thailand Classifieds and Job Portals Market is characterized by a dynamic mix of regional and international players. Leading participants such as JobThai, JobsDB, ThaiJob, Indeed Thailand, LinkedIn Thailand, WorkVenture, JobTopGun, Fastwork, ThaiJob.com, JobBKK, WeMoveForward, JobStreet Thailand, FreelanceBay, JobsInThailand, JobSeeker Thailand contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand classifieds and job portals market is poised for continued evolution, driven by technological advancements and changing consumer behaviors. The integration of AI and machine learning will enhance user experiences, enabling personalized job recommendations and streamlined application processes. Additionally, the increasing reliance on mobile platforms will further shape the market, as businesses adapt to meet the needs of a mobile-first audience. These trends indicate a dynamic future for the industry, with opportunities for innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Job Listings Real Estate Listings Vehicle Listings Services Listings Product Listings Classified Ads Others |

| By End-User | Job Seekers Employers Real Estate Agents Service Providers |

| By Sales Channel | Online Portals Mobile Applications Social Media Platforms |

| By Region | Central Thailand Northern Thailand Southern Thailand Northeastern Thailand |

| By Pricing Model | Free Listings Paid Listings Subscription Models |

| By User Demographics | Age Groups Income Levels Education Levels |

| By Service Type | Full-time Jobs Part-time Jobs Freelance Opportunities Internships |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Job Seekers in IT Sector | 150 | Software Developers, IT Project Managers |

| Employers in Retail Industry | 100 | HR Managers, Store Managers |

| Freelancers and Gig Workers | 80 | Graphic Designers, Content Writers |

| Recruitment Agencies | 70 | Recruitment Consultants, Agency Owners |

| Job Portal Operators | 60 | Product Managers, Marketing Directors |

The Thailand Classifieds and Job Portals Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased internet penetration, mobile device usage, and a shift towards online job searching and classifieds.