UAE Clinical Genomics Market Overview

- The UAE Clinical Genomics Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by advancements in genomic technologies, increasing prevalence of genetic disorders, and rising awareness regarding personalized medicine. The integration of genomics into healthcare has led to improved diagnostic capabilities and treatment options, further propelling market expansion.

- Dubai and Abu Dhabi are the dominant cities in the UAE Clinical Genomics Market due to their advanced healthcare infrastructure, significant investments in research and development, and a growing population with increasing healthcare needs. These cities are also home to leading healthcare institutions and research centers that foster innovation and collaboration in the field of genomics.

- In 2023, the UAE government implemented the National Strategy for Genomics, which aims to enhance genomic research and its application in healthcare. This initiative includes funding for genomic research projects and the establishment of a national genomic database to facilitate personalized medicine and improve public health outcomes.

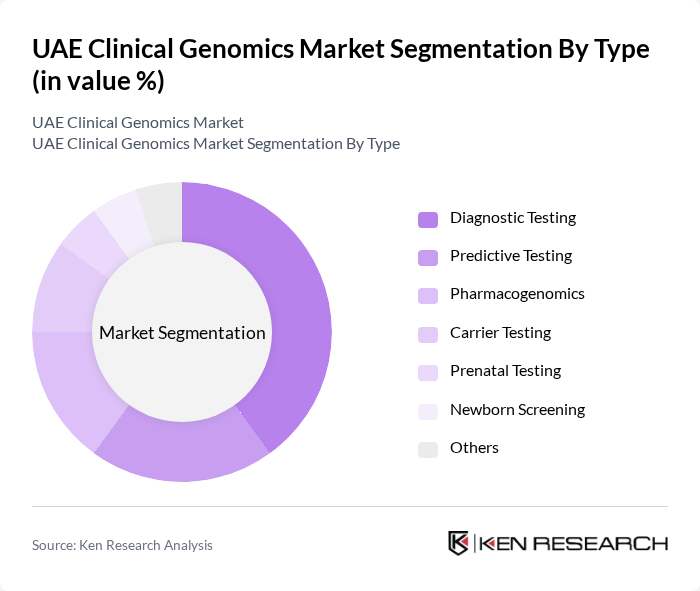

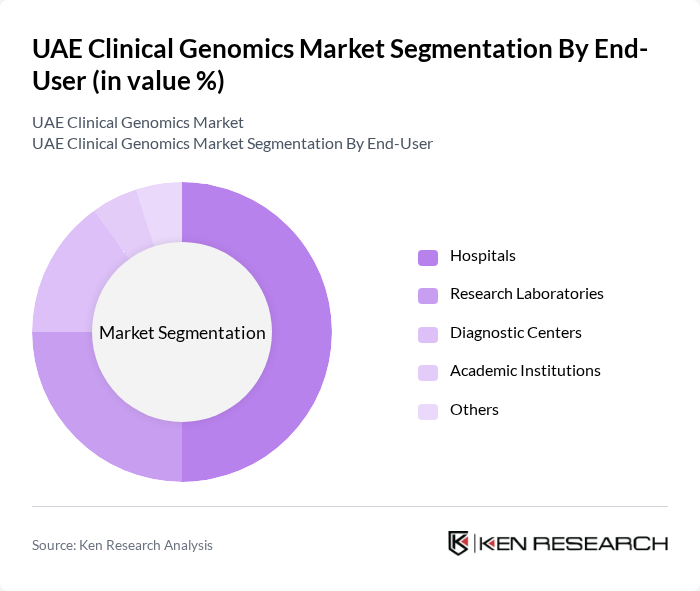

UAE Clinical Genomics Market Segmentation

By Type:The market is segmented into various types, including Diagnostic Testing, Predictive Testing, Pharmacogenomics, Carrier Testing, Prenatal Testing, Newborn Screening, and Others. Among these, Diagnostic Testing is the leading sub-segment due to its critical role in identifying genetic disorders and guiding treatment decisions. The increasing demand for early diagnosis and personalized treatment options has significantly contributed to the growth of this segment.

By End-User:The end-user segmentation includes Hospitals, Research Laboratories, Diagnostic Centers, Academic Institutions, and Others. Hospitals are the leading end-user segment, driven by the increasing adoption of genomic testing for patient management and treatment planning. The growing emphasis on precision medicine in hospital settings has led to a surge in demand for genomic services.

UAE Clinical Genomics Market Competitive Landscape

The UAE Clinical Genomics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Illumina, Inc., Thermo Fisher Scientific Inc., Roche Diagnostics, Agilent Technologies, Inc., QIAGEN N.V., BGI Genomics, Myriad Genetics, Inc., Genomatix Software GmbH, PerkinElmer, Inc., Eurofins Scientific, Fulgent Genetics, Inc., Invitae Corporation, 23andMe, Inc., Color Genomics, Inc., GRAIL, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

UAE Clinical Genomics Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Genetic Disorders:The UAE has reported a significant rise in genetic disorders, with approximately 1 in 4 Emiratis affected by some form of genetic condition. According to the UAE Ministry of Health, around 20% of newborns are screened for genetic disorders, highlighting the urgent need for advanced genomic solutions. This growing prevalence is driving demand for genomic testing and personalized treatment options, thereby propelling market growth in the clinical genomics sector.

- Advancements in Genomic Technologies:The UAE is witnessing rapid advancements in genomic technologies, with investments exceeding AED 1.5 billion in research and development. The introduction of next-generation sequencing (NGS) has revolutionized genetic testing, allowing for faster and more accurate diagnoses. The Dubai Health Authority has initiated programs to integrate these technologies into healthcare systems, enhancing the capabilities of genomic analysis and fostering innovation in clinical genomics.

- Rising Demand for Personalized Medicine:The personalized medicine market in the UAE is projected to reach AED 3 billion in future, driven by an increasing focus on tailored healthcare solutions. Patients are increasingly seeking treatments that are customized to their genetic profiles, leading to a surge in genomic testing services. This trend is supported by healthcare providers who are adopting genomic data to improve patient outcomes, thus fueling the growth of the clinical genomics market.

Market Challenges

- High Costs of Genomic Testing:The cost of genomic testing in the UAE can range from AED 6,000 to AED 18,000, which poses a significant barrier to widespread adoption. Many patients and healthcare providers are deterred by these high costs, limiting access to essential genomic services. This financial challenge is compounded by limited insurance coverage for genetic testing, making it difficult for patients to afford necessary diagnostics and treatments.

- Limited Awareness Among Healthcare Providers:Despite advancements in genomic technologies, many healthcare providers in the UAE lack adequate training and awareness regarding genomic testing. A survey by the UAE Medical Association indicated that over 65% of healthcare professionals feel unprepared to interpret genomic data. This knowledge gap hinders the integration of genomic testing into routine clinical practice, limiting its potential benefits for patient care and public health.

UAE Clinical Genomics Market Future Outlook

The future of the UAE clinical genomics market appears promising, driven by ongoing technological advancements and increasing public awareness of genetic health. As the government continues to invest in healthcare infrastructure, the integration of genomic data into clinical practice is expected to enhance patient outcomes significantly. Furthermore, collaborations between private and public sectors will likely foster innovation, leading to the development of more affordable genomic solutions and expanding access to personalized medicine across the region.

Market Opportunities

- Expansion of Telehealth Services:The rise of telehealth services in the UAE presents a unique opportunity for the clinical genomics market. With an estimated 35% increase in telehealth consultations in future, healthcare providers can offer genomic testing remotely, improving access for patients in remote areas. This trend is expected to enhance patient engagement and streamline the delivery of genomic services.

- Collaborations with Research Institutions:Collaborations between genomic companies and research institutions are on the rise, with over 20 partnerships established in the last year alone. These collaborations facilitate knowledge sharing and resource pooling, driving innovation in genomic research. By leveraging academic expertise, the clinical genomics market can accelerate the development of new testing methodologies and treatments, ultimately benefiting patient care.