Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7918

Pages:89

Published On:October 2025

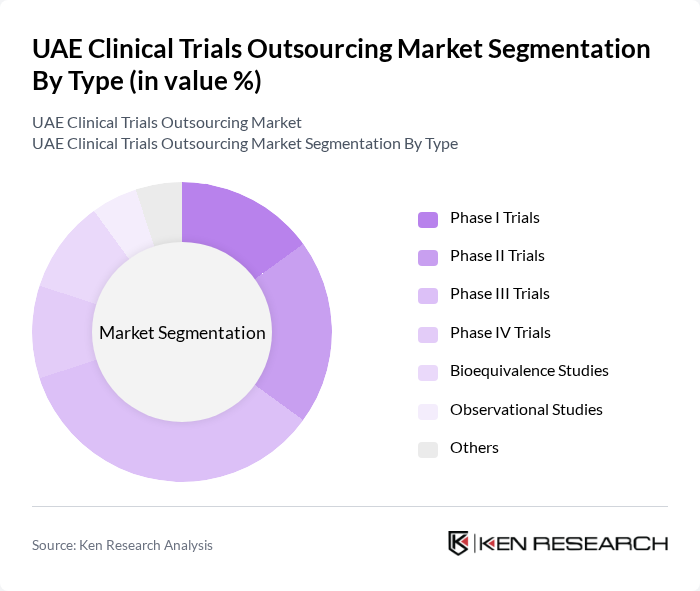

By Type:The market is segmented into various types of clinical trials, including Phase I, II, III, IV trials, bioequivalence studies, observational studies, and others. Each type serves a specific purpose in the drug development process, with Phase III trials being particularly significant due to their role in confirming the efficacy and safety of new treatments before they reach the market.

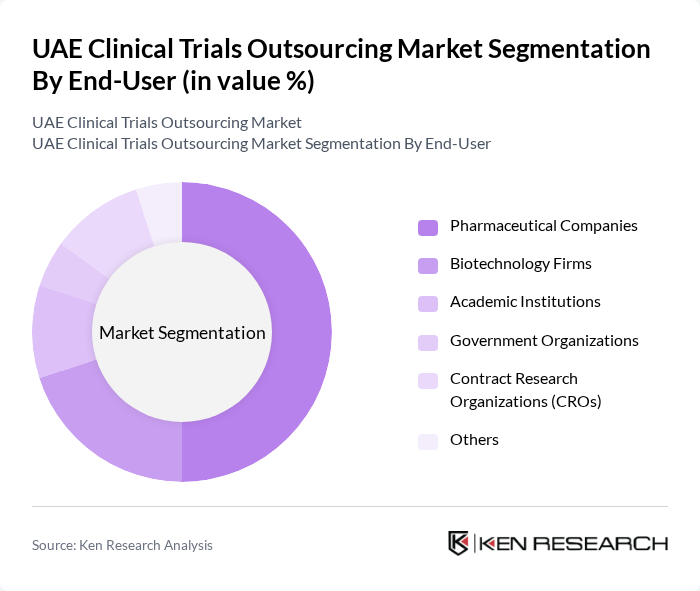

By End-User:The end-users of clinical trials outsourcing include pharmaceutical companies, biotechnology firms, academic institutions, government organizations, contract research organizations (CROs), and others. Pharmaceutical companies are the primary users, as they rely heavily on clinical trials to develop and bring new drugs to market.

The UAE Clinical Trials Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi Clinical Trials Center, Dubai Health Authority, Gulf Clinical Research, Clinigen Group, Parexel International Corporation, Covance Inc., ICON plc, Syneos Health, Medpace, Charles River Laboratories, PRA Health Sciences, WuXi AppTec, QuintilesIMS, KCR, Worldwide Clinical Trials contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE clinical trials outsourcing market appears promising, driven by advancements in technology and a growing emphasis on patient-centric approaches. The integration of digital health technologies is expected to streamline trial processes, enhancing efficiency and patient engagement. Additionally, the rise of real-world evidence will likely influence trial designs, making them more relevant to patient needs. As the market evolves, collaboration with global CROs will become increasingly vital for navigating regulatory landscapes and optimizing trial outcomes.

| Segment | Sub-Segments |

|---|---|

| By Type | Phase I Trials Phase II Trials Phase III Trials Phase IV Trials Bioequivalence Studies Observational Studies Others |

| By End-User | Pharmaceutical Companies Biotechnology Firms Academic Institutions Government Organizations Contract Research Organizations (CROs) Others |

| By Therapeutic Area | Oncology Cardiovascular Neurology Infectious Diseases Endocrinology Others |

| By Study Design | Randomized Controlled Trials Non-Randomized Trials Cross-Sectional Studies Longitudinal Studies Others |

| By Patient Population | Adult Patients Pediatric Patients Geriatric Patients Special Populations (e.g., pregnant women) Others |

| By Geographic Focus | Urban Areas Rural Areas Specific Emirates (e.g., Dubai, Abu Dhabi) Others |

| By Funding Source | Government Funding Private Investment Grants and Subsidies Corporate Sponsorship Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Companies | 100 | Clinical Research Managers, Regulatory Affairs Specialists |

| Contract Research Organizations (CROs) | 80 | Project Managers, Business Development Executives |

| Healthcare Institutions | 70 | Clinical Trial Coordinators, Medical Directors |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Patient Advocacy Groups | 60 | Advocacy Leaders, Patient Representatives |

The UAE Clinical Trials Outsourcing Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the demand for innovative therapies, chronic disease prevalence, and advancements in technology and regulatory frameworks.