Region:Middle East

Author(s):Shubham

Product Code:KRAD1899

Pages:83

Published On:December 2025

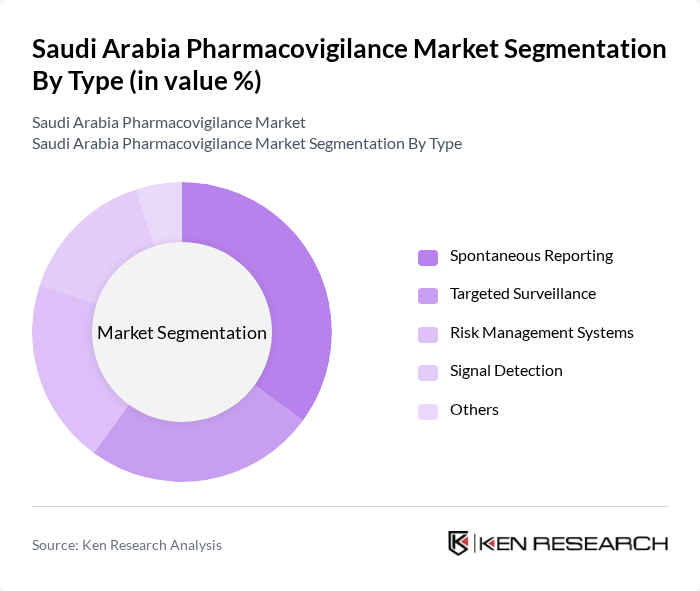

By Type:The pharmacovigilance market in Saudi Arabia is segmented into various types, including Spontaneous Reporting, Targeted Surveillance, Risk Management Systems, Signal Detection, and Others. Among these, Spontaneous Reporting is the most dominant segment, driven by the increasing awareness of adverse drug reactions and the need for real-time data collection. The growing emphasis on patient safety and regulatory compliance further enhances the demand for these services.

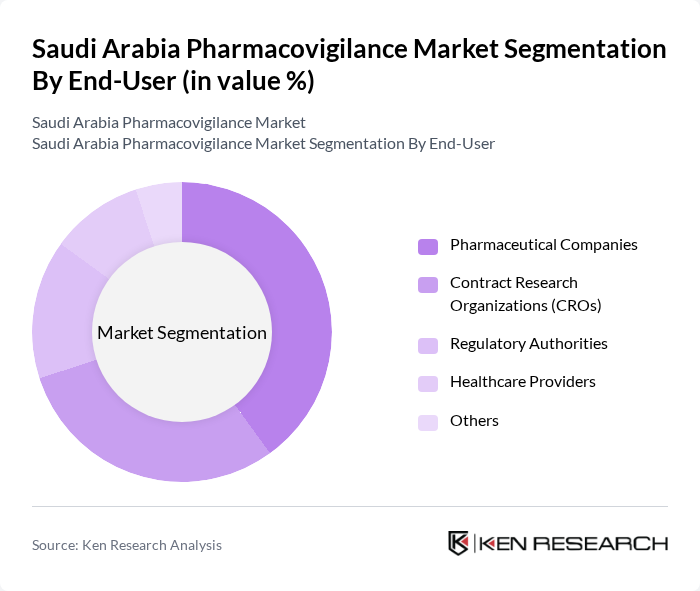

By End-User:The end-user segmentation of the pharmacovigilance market includes Pharmaceutical Companies, Contract Research Organizations (CROs), Regulatory Authorities, Healthcare Providers, and Others. Pharmaceutical Companies hold the largest share due to their need for comprehensive drug safety monitoring and compliance with regulatory requirements. The increasing number of clinical trials and drug approvals in the region further drives this segment's growth.

The Saudi Arabia Pharmacovigilance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Food and Drug Authority (SFDA), Novartis Pharmaceuticals, Pfizer Saudi Arabia, Roche Saudi Arabia, Sanofi-Aventis, Merck Sharp & Dohme (MSD), AstraZeneca, GlaxoSmithKline (GSK), Johnson & Johnson, Bayer Saudi Arabia, Takeda Pharmaceuticals, AbbVie, Amgen, Boehringer Ingelheim, and Eli Lilly and Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabian pharmacovigilance market appears promising, driven by ongoing investments in healthcare infrastructure and technological advancements. The government's Vision 2030 initiative, which includes a USD 600 billion investment in healthcare, is expected to enhance the capacity for pharmacovigilance systems. Additionally, the integration of real-world evidence solutions, projected to grow from USD 10 million in future to USD 25 million by future, will further support the evolution of drug safety monitoring and analytics.

| Segment | Sub-Segments |

|---|---|

| By Type | Spontaneous Reporting Targeted Surveillance Risk Management Systems Signal Detection Others |

| By End-User | Pharmaceutical Companies Contract Research Organizations (CROs) Regulatory Authorities Healthcare Providers Others |

| By Therapeutic Area | Oncology Cardiovascular Neurology Infectious Diseases Others |

| By Data Source | Clinical Trials Post-Marketing Surveillance Electronic Health Records Patient Registries Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Service Type | Consulting Services Data Management Services Risk Assessment Services Training and Education Services Others |

| By Technology | Cloud-Based Solutions On-Premise Solutions Mobile Applications Artificial Intelligence Tools Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Company Pharmacovigilance | 100 | Pharmacovigilance Managers, Regulatory Affairs Specialists |

| Healthcare Provider Reporting Practices | 80 | Physicians, Pharmacists, Nurses |

| Patient Experience with Adverse Events | 75 | Patients, Caregivers |

| Regulatory Compliance Insights | 60 | Regulatory Affairs Officers, Compliance Managers |

| Technology Adoption in Pharmacovigilance | 50 | IT Managers, Data Analysts in Pharma |

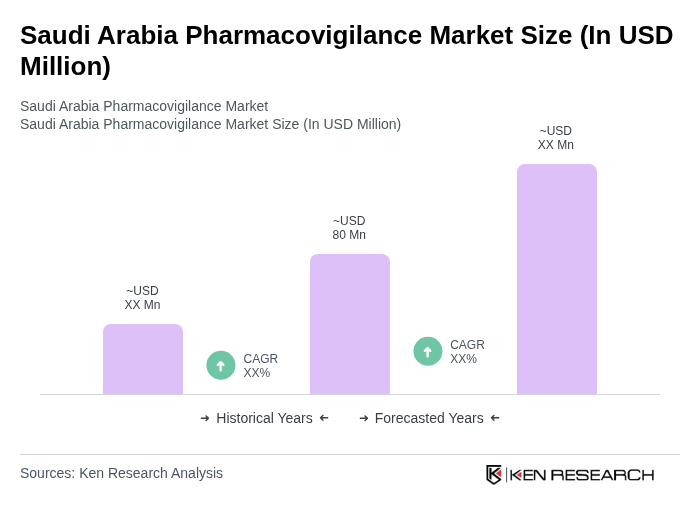

The Saudi Arabia Pharmacovigilance Market is currently valued at approximately USD 80 million. This valuation reflects the market's growth driven by an expanding pharmaceutical and biotech industry, increased awareness of adverse drug reactions, and enhanced regulatory frameworks.