Region:Middle East

Author(s):Geetanshi

Product Code:KRAB8705

Pages:94

Published On:October 2025

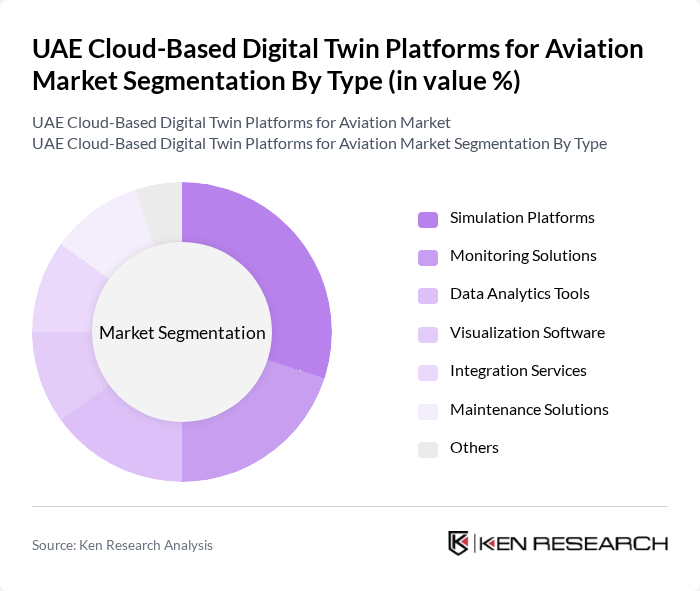

By Type:The market is segmented into various types, including Simulation Platforms, Monitoring Solutions, Data Analytics Tools, Visualization Software, Integration Services, Maintenance Solutions, and Others. Among these, Simulation Platforms are gaining traction due to their ability to create realistic models for training and operational planning, which is crucial for airlines and airports.

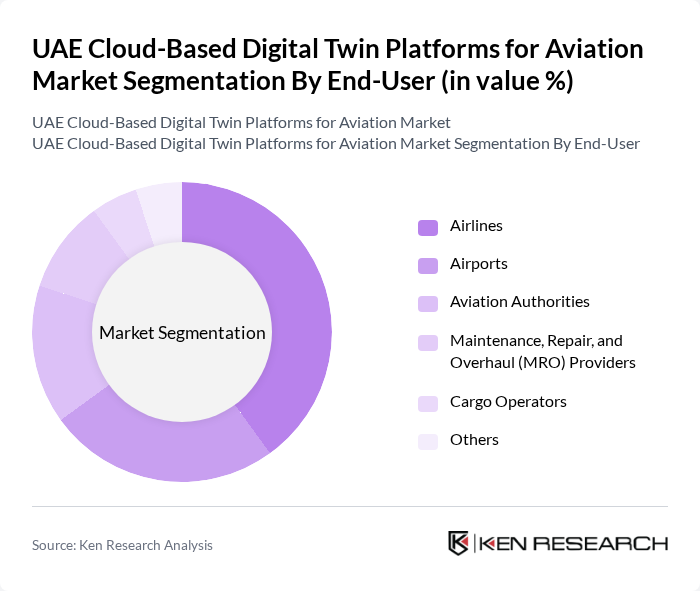

By End-User:The end-user segmentation includes Airlines, Airports, Aviation Authorities, Maintenance, Repair, and Overhaul (MRO) Providers, Cargo Operators, and Others. Airlines are the leading end-users, driven by the need for enhanced operational efficiency and safety through advanced digital twin technologies.

The UAE Cloud-Based Digital Twin Platforms for Aviation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Dassault Systèmes, Autodesk, Inc., ANSYS, Inc., IBM Corporation, Microsoft Corporation, PTC Inc., GE Digital, Bentley Systems, Incorporated, Altair Engineering, Inc., Honeywell International Inc., Oracle Corporation, SAP SE, Rockwell Automation, Inc., Tetra Tech, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of cloud-based digital twin platforms in the UAE aviation market appears promising, driven by technological advancements and government support. As the sector embraces digital transformation, the integration of augmented reality and enhanced data analytics will play a pivotal role in improving operational efficiency. Additionally, the focus on sustainability will encourage the development of eco-friendly aviation solutions, aligning with global trends. The UAE's commitment to becoming a leader in smart aviation will further accelerate the adoption of these innovative platforms.

| Segment | Sub-Segments |

|---|---|

| By Type | Simulation Platforms Monitoring Solutions Data Analytics Tools Visualization Software Integration Services Maintenance Solutions Others |

| By End-User | Airlines Airports Aviation Authorities Maintenance, Repair, and Overhaul (MRO) Providers Cargo Operators Others |

| By Application | Flight Operations Optimization Asset Management Safety and Compliance Monitoring Training and Simulation Predictive Maintenance Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud On-Premises Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Others |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises Startups Others |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee Freemium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Airline Operations Management | 100 | Operations Managers, IT Directors |

| Airport Authority Digital Initiatives | 80 | Airport Managers, Technology Officers |

| Maintenance and Repair Organizations | 70 | Maintenance Managers, Engineering Directors |

| Passenger Experience Enhancements | 60 | Customer Experience Managers, Marketing Directors |

| Regulatory Compliance and Integration | 50 | Compliance Officers, Regulatory Affairs Managers |

The UAE Cloud-Based Digital Twin Platforms for Aviation Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of advanced technologies like IoT and AI, which enhance operational efficiency and safety in the aviation sector.