Region:Middle East

Author(s):Geetanshi

Product Code:KRAB6657

Pages:93

Published On:October 2025

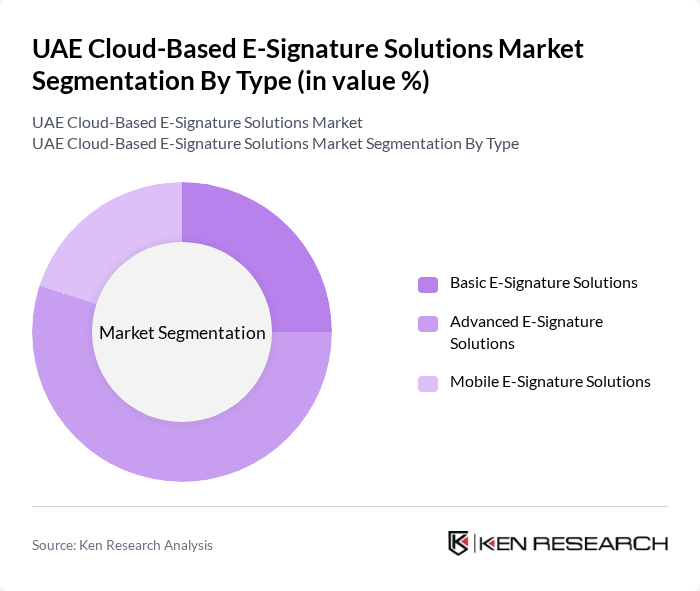

By Type:The market is segmented into Basic E-Signature Solutions, Advanced E-Signature Solutions, and Mobile E-Signature Solutions. Among these, Advanced E-Signature Solutions are leading the market due to their enhanced security features and compliance with international standards. Businesses are increasingly opting for advanced solutions to ensure the integrity and authenticity of their documents, which is crucial in sectors like finance and healthcare.

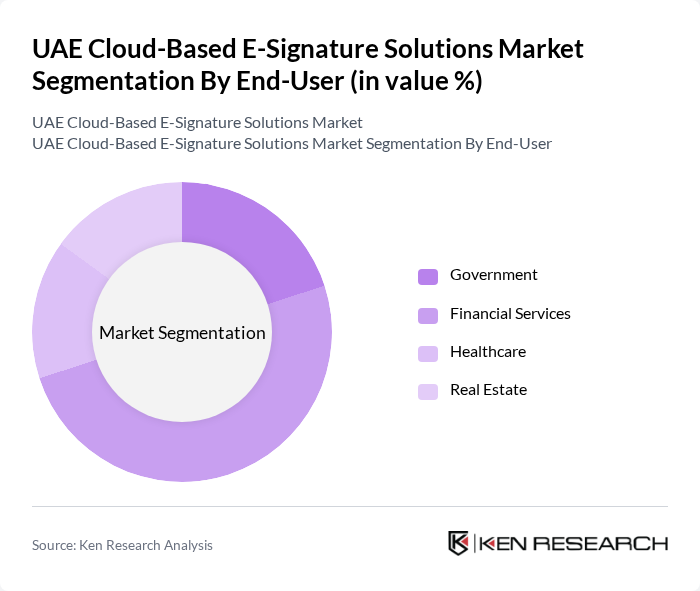

By End-User:The end-user segmentation includes Government, Financial Services, Healthcare, and Real Estate. The Financial Services sector is the most significant contributor to the market, driven by the need for secure and efficient transaction processes. Financial institutions are increasingly adopting e-signature solutions to streamline operations, reduce paperwork, and enhance customer experience, making this segment a leader in the market.

The UAE Cloud-Based E-Signature Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as DocuSign, Adobe Sign, SignNow, HelloSign, SignEasy, PandaDoc, eSignLive, RightSignature, OneSpan Sign, SignRequest, Zoho Sign, Sertifi, KeepSolid Sign, Signaturit, Yousign contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE cloud-based e-signature market appears promising, driven by ongoing digital transformation and increasing regulatory support. As businesses continue to embrace remote work and digital solutions, the demand for secure and efficient e-signature services is expected to rise. Innovations in technology, such as AI and blockchain, will further enhance the capabilities of e-signature platforms, ensuring compliance and security while improving user experience and operational efficiency across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Basic E-Signature Solutions Advanced E-Signature Solutions Mobile E-Signature Solutions |

| By End-User | Government Financial Services Healthcare Real Estate |

| By Industry Vertical | Legal Education Retail Manufacturing |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Sales Channel | Direct Sales Online Sales Reseller Partnerships |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| By Others | Custom Solutions Niche Market Offerings |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Sector Adoption | 150 | IT Managers, Compliance Officers |

| SME Utilization of E-Signatures | 100 | Business Owners, Operations Managers |

| Legal Sector Insights | 80 | Lawyers, Paralegals |

| Government Agency Implementation | 70 | Government Officials, IT Directors |

| Healthcare Sector E-Signature Use | 60 | Healthcare Administrators, Compliance Managers |

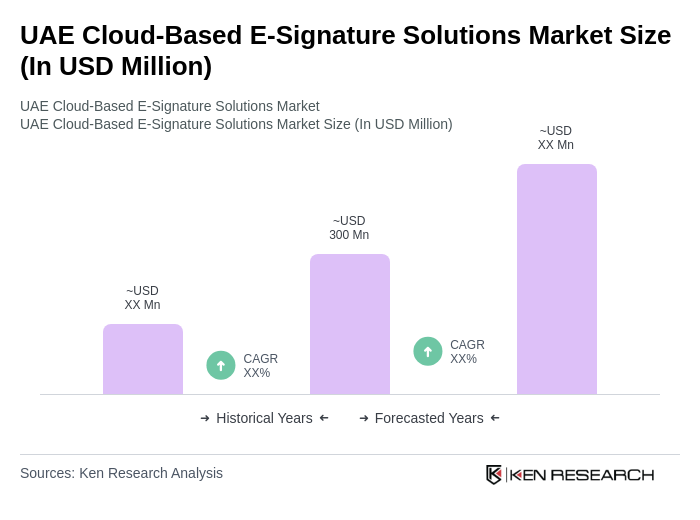

The UAE Cloud-Based E-Signature Solutions Market is valued at approximately USD 300 million, reflecting significant growth driven by digital transformation initiatives and the increasing demand for secure document management solutions across various sectors.