Region:Middle East

Author(s):Rebecca

Product Code:KRAC1069

Pages:90

Published On:October 2025

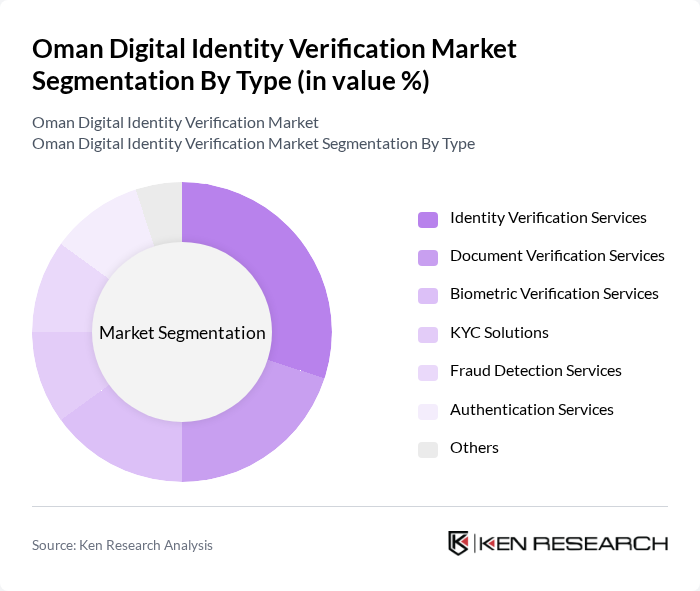

By Type:The market is segmented into various types of services that address different aspects of identity verification. The subsegments include Identity Verification Services, Document Verification Services, Biometric Verification Services, KYC Solutions, Fraud Detection Services, Authentication Services, and Others. Each subsegment plays a crucial role in addressing specific needs within the digital identity verification landscape .

The Identity Verification Services subsegment is currently dominating the market due to the increasing demand for secure online transactions and the need for businesses to comply with regulatory requirements. This service is essential for sectors such as finance, e-commerce, and healthcare, where identity verification is critical for customer onboarding and fraud prevention. The rise in digital services and heightened awareness of cybersecurity threats have further propelled the adoption of these services, making them a key focus for organizations seeking to enhance security .

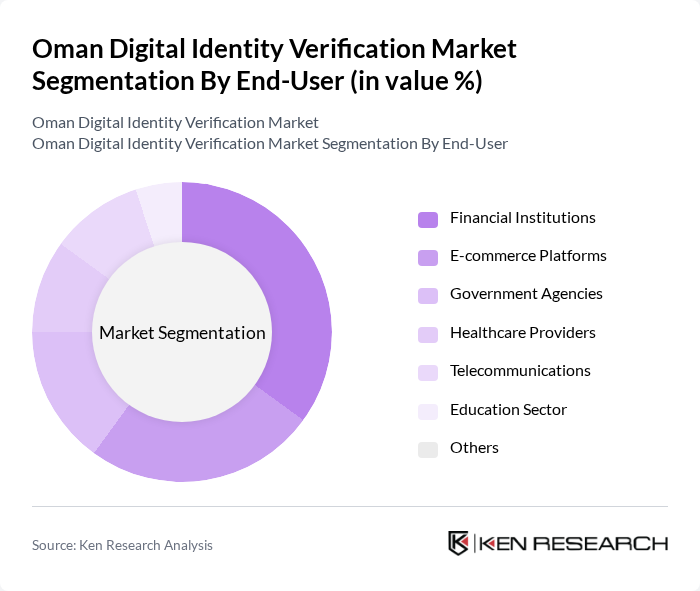

By End-User:The market is segmented by end-users, including Financial Institutions, E-commerce Platforms, Government Agencies, Healthcare Providers, Telecommunications, Education Sector, and Others. Each end-user segment has unique requirements and challenges that drive the demand for digital identity verification solutions .

The Financial Institutions segment is leading the market due to stringent regulatory requirements and the need for secure transactions. Banks and financial services are increasingly adopting digital identity verification solutions to mitigate risks associated with fraud and identity theft. The rise in online banking and digital payment solutions has further accelerated the demand for robust identity verification processes, making this segment a critical driver of market growth .

The Oman Digital Identity Verification Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thales Group, IDEMIA, Veriff, Onfido, Jumio, Trulioo, Yoti, Authenteq, Socure, Acuant, Signicat, Experian, LexisNexis Risk Solutions, Mitek Systems, and Tech5 contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Oman digital identity verification market appears promising, driven by technological advancements and increasing regulatory support. The integration of artificial intelligence and machine learning is expected to enhance verification processes, making them faster and more accurate. Additionally, as more businesses transition to digital platforms, the demand for seamless and secure identity verification solutions will likely rise, fostering innovation and collaboration among tech companies and service providers in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Identity Verification Services Document Verification Services Biometric Verification Services KYC Solutions Fraud Detection Services Authentication Services Others |

| By End-User | Financial Institutions E-commerce Platforms Government Agencies Healthcare Providers Telecommunications Education Sector Others |

| By Application | Online Transactions Customer Onboarding Fraud Prevention Regulatory Compliance Access Control Others |

| By Deployment Mode | Public Cloud Private Cloud Hybrid Cloud |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Al Sharqiyah Others |

| By Customer Type | Individual Customers Small and Medium Enterprises Large Enterprises |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time Fee Freemium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Digital Identity Solutions | 100 | IT Managers, Compliance Officers |

| Government Digital Services | 80 | Policy Makers, IT Directors |

| E-commerce Platforms | 60 | Operations Managers, Security Analysts |

| Healthcare Identity Verification | 50 | Healthcare Administrators, IT Security Officers |

| Telecommunications Identity Management | 70 | Product Managers, Network Security Experts |

The Oman Digital Identity Verification Market is valued at approximately USD 150 million, reflecting a significant demand for secure online transactions and compliance with regulatory standards across various sectors, including finance and e-commerce.