Region:Middle East

Author(s):Shubham

Product Code:KRAB8462

Pages:95

Published On:October 2025

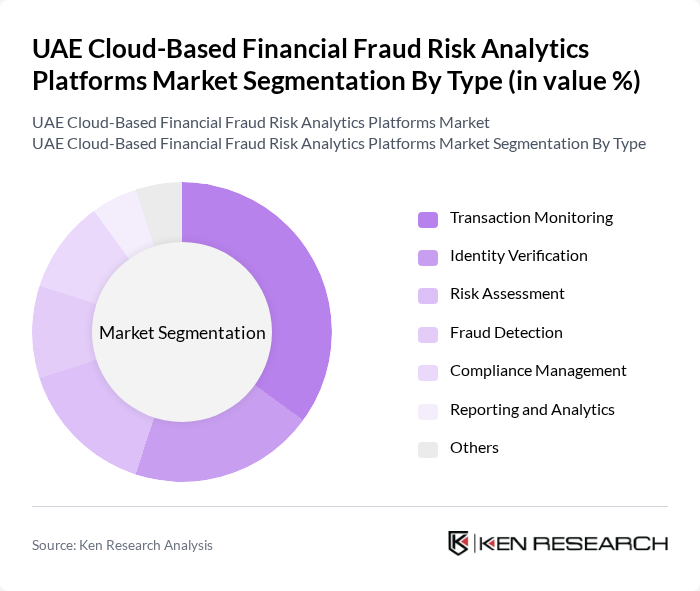

By Type:The market is segmented into various types, including Transaction Monitoring, Identity Verification, Risk Assessment, Fraud Detection, Compliance Management, Reporting and Analytics, and Others. Among these, Transaction Monitoring is the leading sub-segment due to the increasing need for real-time tracking of financial transactions to prevent fraud. The rise in online transactions and digital banking has heightened the demand for effective monitoring solutions, making it a critical component in the fight against financial fraud.

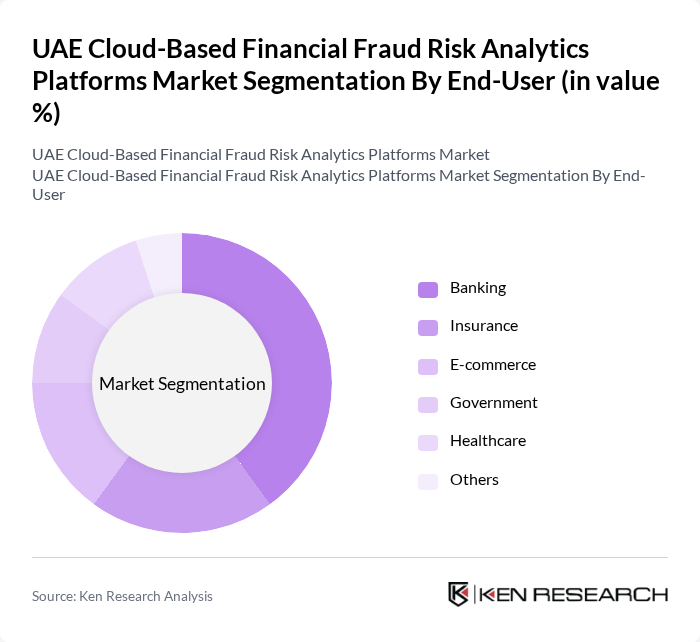

By End-User:The end-user segmentation includes Banking, Insurance, E-commerce, Government, Healthcare, and Others. The Banking sector is the dominant end-user, driven by the increasing need for secure transaction processing and fraud prevention measures. As banks continue to digitize their services, the demand for cloud-based financial fraud risk analytics platforms has surged, making it essential for maintaining customer trust and regulatory compliance.

The UAE Cloud-Based Financial Fraud Risk Analytics Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as FICO, SAS Institute Inc., ACI Worldwide, NICE Actimize, Oracle Corporation, IBM Corporation, Palantir Technologies, Experian, LexisNexis Risk Solutions, SAP SE, Verafin, Fiserv, Kount, Riskified, Zoot Enterprises contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE cloud-based financial fraud risk analytics market appears promising, driven by technological advancements and increasing regulatory pressures. As financial institutions prioritize real-time analytics and AI integration, the demand for innovative solutions is expected to rise. Additionally, the growing emphasis on cybersecurity will likely lead to enhanced investments in fraud detection technologies. Collaborative efforts between fintech companies and traditional banks will further accelerate the development of tailored solutions, ensuring a robust response to evolving fraud threats in the financial sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Transaction Monitoring Identity Verification Risk Assessment Fraud Detection Compliance Management Reporting and Analytics Others |

| By End-User | Banking Insurance E-commerce Government Healthcare Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Others |

| By Pricing Model | Subscription-Based Pay-Per-Use License Fee Others |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises Others |

| By Service Type | Managed Services Professional Services Consulting Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Fraud Analytics | 100 | Risk Managers, Fraud Prevention Officers |

| Insurance Industry Risk Management | 80 | Compliance Managers, Data Analysts |

| Investment Firms Fraud Detection | 70 | Portfolio Managers, IT Security Specialists |

| Fintech Startups Analytics Solutions | 60 | Founders, Product Managers |

| Regulatory Compliance in Financial Services | 90 | Legal Advisors, Regulatory Affairs Managers |

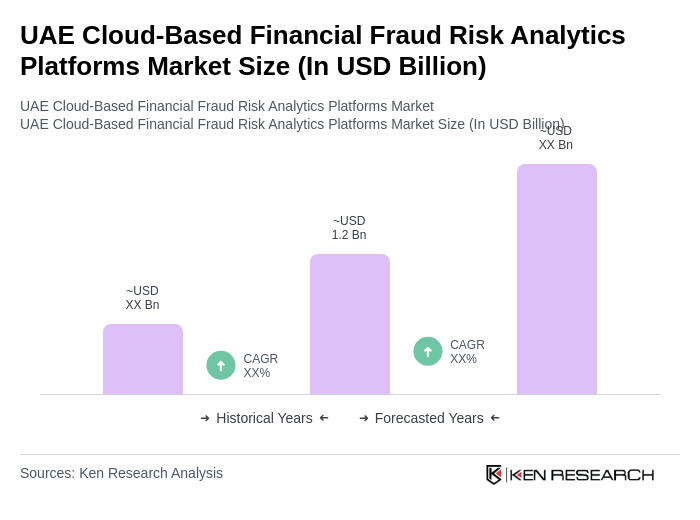

The UAE Cloud-Based Financial Fraud Risk Analytics Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of digital banking and e-commerce, alongside the need for advanced fraud detection mechanisms.