Region:Middle East

Author(s):Geetanshi

Product Code:KRAB6800

Pages:93

Published On:October 2025

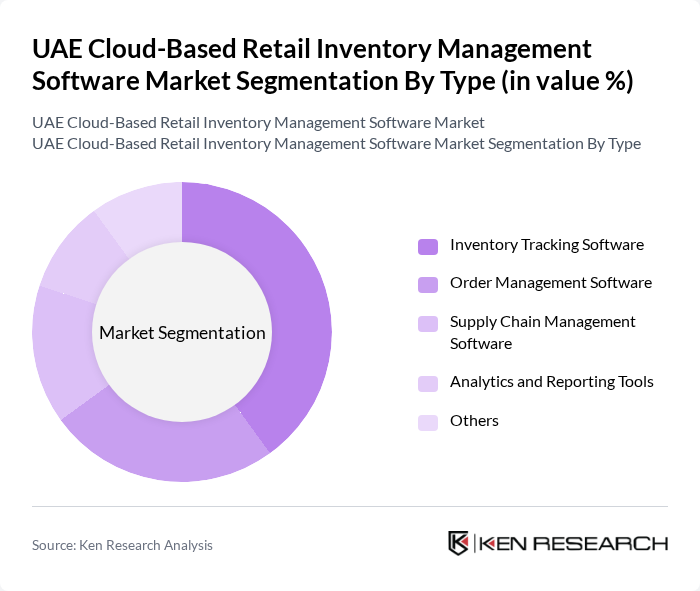

By Type:The market is segmented into various types of software solutions that cater to different aspects of retail inventory management. The subsegments include Inventory Tracking Software, Order Management Software, Supply Chain Management Software, Analytics and Reporting Tools, and Others. Among these, Inventory Tracking Software is the most prominent due to its critical role in ensuring accurate stock levels and minimizing losses.

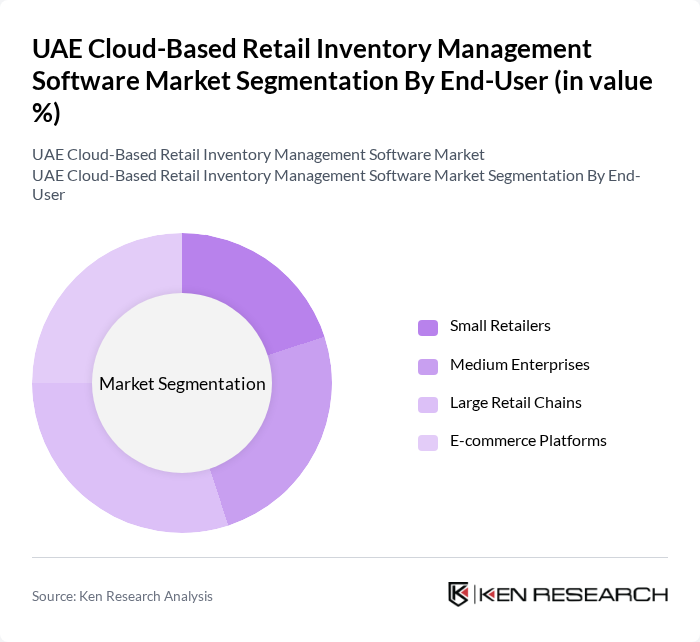

By End-User:The end-user segmentation includes Small Retailers, Medium Enterprises, Large Retail Chains, and E-commerce Platforms. The increasing trend of online shopping and the need for efficient inventory management in physical stores have made E-commerce Platforms the leading segment, as they require robust solutions to manage vast inventories and fulfill orders efficiently.

The UAE Cloud-Based Retail Inventory Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oracle Corporation, SAP SE, Microsoft Corporation, Infor, Brightpearl, TradeGecko, Zoho Inventory, Unleashed Software, Cin7, Fishbowl Inventory, Vend, Square, QuickBooks Commerce, RetailOps, Stitch Labs contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE cloud-based retail inventory management software market appears promising, driven by technological advancements and evolving consumer preferences. As retailers increasingly adopt omnichannel strategies, the demand for integrated inventory solutions will rise. Additionally, the focus on sustainability will push businesses to seek innovative inventory management practices that minimize waste. The UAE's commitment to digital transformation will further enhance the market landscape, fostering growth and innovation in inventory management solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Inventory Tracking Software Order Management Software Supply Chain Management Software Analytics and Reporting Tools Others |

| By End-User | Small Retailers Medium Enterprises Large Retail Chains E-commerce Platforms |

| By Sales Channel | Direct Sales Online Sales Resellers and Distributors |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Region | Abu Dhabi Dubai Sharjah Others |

| By Pricing Model | Subscription-Based One-Time License Fee Freemium |

| By Customer Size | Small Businesses Medium-Sized Businesses Large Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fashion Retail Inventory Management | 100 | Inventory Managers, Retail Operations Directors |

| Electronics Retail Supply Chain | 80 | Logistics Coordinators, IT Managers |

| Grocery Store Inventory Solutions | 90 | Store Managers, Supply Chain Analysts |

| Online Retail Inventory Systems | 75 | eCommerce Managers, Fulfillment Directors |

| Pharmaceutical Inventory Management | 70 | Pharmacy Managers, Compliance Officers |

The UAE Cloud-Based Retail Inventory Management Software Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by digital transformation, real-time inventory tracking, and efficient supply chain management solutions in the retail sector.