Region:Middle East

Author(s):Shubham

Product Code:KRAD5344

Pages:83

Published On:December 2025

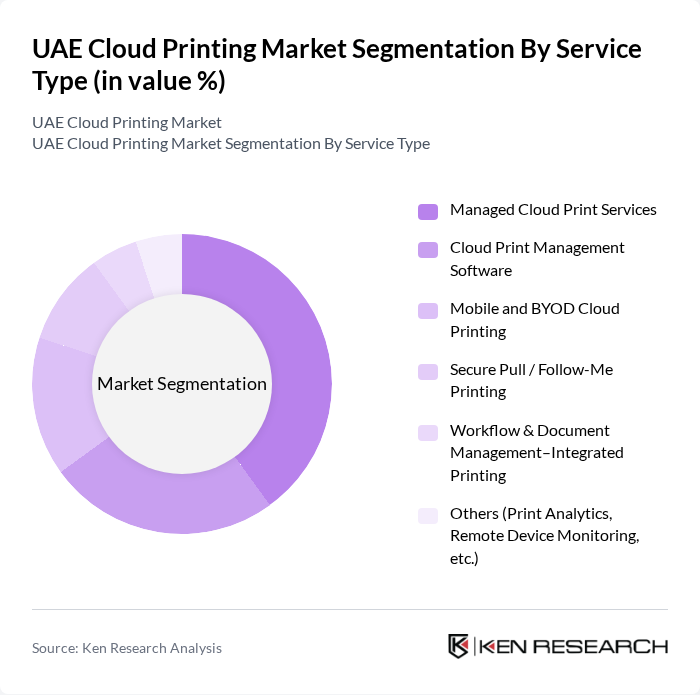

By Service Type:The service type segmentation includes various offerings that cater to different business needs. The subsegments are Managed Cloud Print Services, Cloud Print Management Software, Mobile and BYOD Cloud Printing, Secure Pull / Follow-Me Printing, Workflow & Document Management–Integrated Printing, and Others (Print Analytics, Remote Device Monitoring, etc.). This structure is consistent with global cloud print and cloud print management offerings used by leading vendors and research coverage. Among these, Managed Cloud Print Services is the leading subsegment, driven by the increasing demand for efficient print management solutions that reduce costs, support centralized control of distributed printer fleets, and improve uptime and security. Businesses are increasingly opting for managed services to streamline their printing processes, enable analytics-driven optimization, and enhance security through secure pull printing, authentication, and policy-based access.

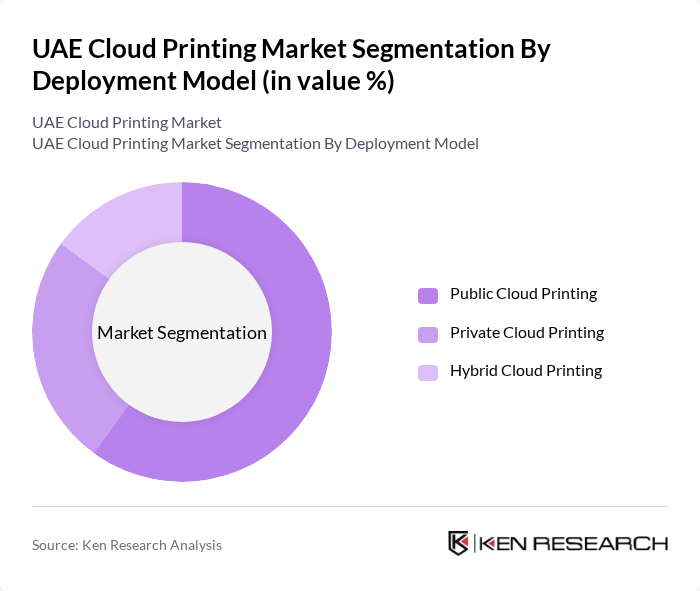

By Deployment Model:The deployment model segmentation includes Public Cloud Printing, Private Cloud Printing, and Hybrid Cloud Printing, which is in line with how global and regional cloud printing and cloud print management markets are structured. Public Cloud Printing is the most dominant model, favored by businesses for its scalability, faster deployment, and lower upfront infrastructure investment, mirroring the global trend where public cloud accounts for the largest share of cloud printing revenues. Companies are increasingly adopting public cloud solutions to leverage the benefits of reduced infrastructure costs, continuous feature updates, and enhanced accessibility, allowing employees and mobile users to print securely from different locations and devices.

The UAE Cloud Printing Market is characterized by a dynamic mix of regional and international players. Leading participants such as HP Inc. (HP Anyware, HP Managed Print Services), Canon Middle East FZ-LLC, Epson Middle East FZE, Xerox Emirates LLC (a Joint Venture with MHD), Ricoh Middle East & Africa FZ-LLC, Lexmark International Middle East, Brother International (Gulf) FZE, Konica Minolta Business Solutions Middle East, Kyocera Document Solutions Middle East & Africa, Dell Technologies (Cloud & Print Infrastructure Partners), Fujifilm Business Innovation Middle East, Sharp Middle East & Africa FZE, Oki Europe Limited – Middle East Office, PaperCut Software (Cloud Print Management Solutions), uniFLOW (NT-ware / Canon) Cloud Print & Scan Platform contribute to innovation, geographic expansion, and service delivery in this space.

The UAE cloud printing market is poised for significant growth, driven by technological advancements and evolving consumer preferences. As businesses increasingly prioritize efficiency and sustainability, the adoption of cloud printing solutions is expected to rise. The integration of AI and machine learning will enhance printing processes, while mobile printing applications will cater to the growing remote workforce. Additionally, partnerships with educational institutions and the expansion of e-commerce will create new avenues for growth, positioning cloud printing as a vital component of the UAE's digital transformation strategy.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Managed Cloud Print Services Cloud Print Management Software Mobile and BYOD Cloud Printing Secure Pull / Follow-Me Printing Workflow & Document Management–Integrated Printing Others (Print Analytics, Remote Device Monitoring, etc.) |

| By Deployment Model | Public Cloud Printing Private Cloud Printing Hybrid Cloud Printing |

| By Organization Size | Large Enterprises Medium Enterprises Small Enterprises |

| By End-User Industry | Banking, Financial Services & Insurance (BFSI) IT & Telecom Government & Public Sector Healthcare Education Retail & E?commerce Manufacturing & Industrial Others (Logistics, Hospitality, etc.) |

| By Application | Office / Enterprise Printing Branch & Remote Site Printing Mobile Workforce Printing Customer-Facing / Front-Office Printing Production & Transactional Printing |

| By Geographic Distribution | Dubai Abu Dhabi Sharjah Ajman Other Emirates (Ras Al Khaimah, Fujairah, Umm Al Quwain) |

| By Channel / Delivery Model | Direct OEM & Vendor-Managed Services Managed Service Providers (MSPs) & System Integrators Cloud Marketplaces & SaaS Platforms Resellers & Distributors |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Sector Cloud Printing | 120 | IT Managers, Procurement Officers |

| Education Sector Adoption | 90 | Administrative Heads, IT Coordinators |

| Healthcare Industry Usage | 80 | Facility Managers, IT Directors |

| Small and Medium Enterprises (SMEs) | 100 | Business Owners, Operations Managers |

| Government Sector Implementation | 70 | Procurement Officers, IT Specialists |

The UAE Cloud Printing Market is valued at approximately USD 0.15 billion, reflecting the region's share in the broader Middle East and Africa cloud print management market. This valuation is based on a five-year historical analysis of market trends.