Region:North America

Author(s):Shubham

Product Code:KRAA1750

Pages:87

Published On:August 2025

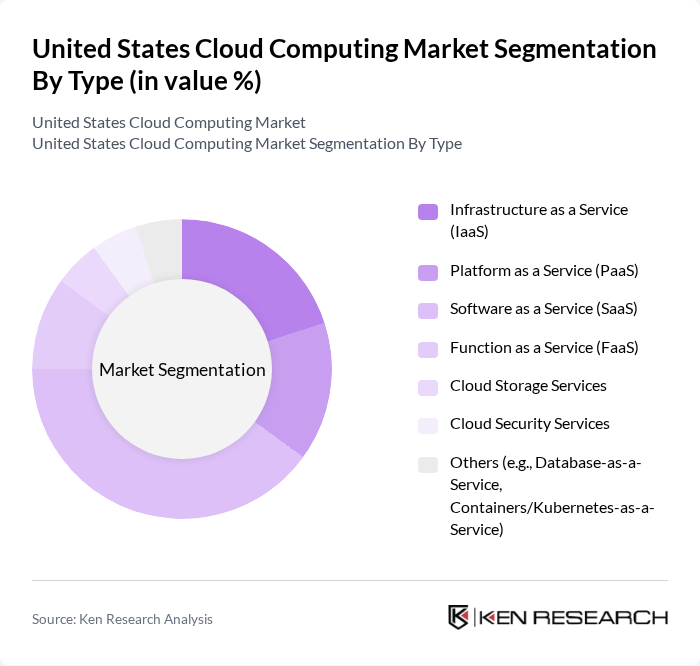

By Type:The cloud computing market can be segmented into various types, including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS), Function as a Service (FaaS), Cloud Storage Services, Cloud Security Services, and Others (e.g., Database-as-a-Service, Containers/Kubernetes-as-a-Service). Among these, SaaS has emerged as the dominant segment due to its widespread adoption across businesses of all sizes, driven by the need for cost-effective software solutions and ease of access. The flexibility and scalability offered by SaaS applications have made them particularly appealing to organizations looking to enhance productivity without significant upfront investments .

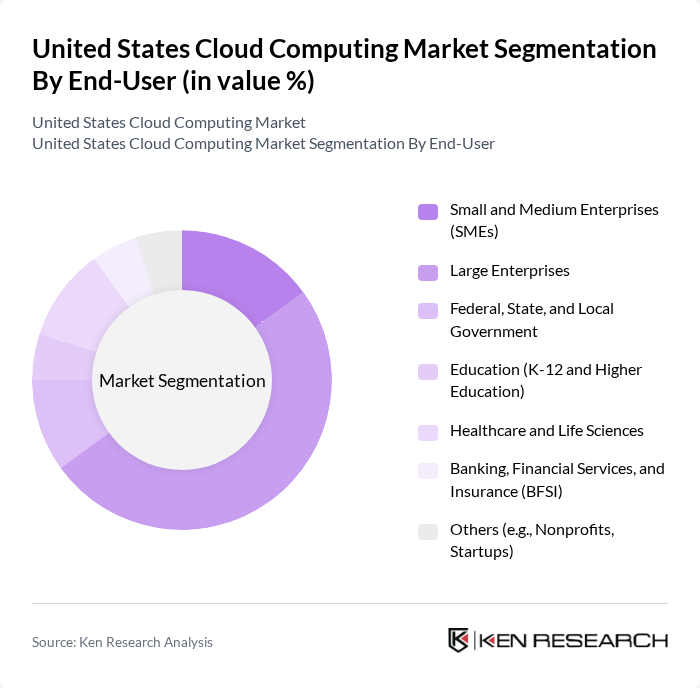

By End-User:The end-user segmentation of the cloud computing market includes Small and Medium Enterprises (SMEs), Large Enterprises, Federal, State, and Local Government, Education (K-12 and Higher Education), Healthcare and Life Sciences, Banking, Financial Services, and Insurance (BFSI), and Others (e.g., Nonprofits, Startups). Large Enterprises are the leading segment, primarily due to their substantial IT budgets and the need for advanced cloud solutions to manage complex operations. The trend towards digital transformation and the increasing reliance on data analytics have further propelled large organizations to adopt cloud services extensively .

The United States Cloud Computing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Web Services, Inc. (AWS), Microsoft Corporation (Azure), Google Cloud (Alphabet Inc.), IBM Cloud, Oracle Cloud Infrastructure (OCI), Salesforce, Inc., VMware by Broadcom, Rackspace Technology, Inc., DigitalOcean Holdings, Inc., Snowflake Inc., ServiceNow, Inc., Cisco Systems, Inc. (Webex, AppDynamics, Observability), Datadog, Inc., Twilio Inc. (Twilio Segment), MongoDB, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the U.S. cloud computing market appears promising, driven by technological advancements and evolving business needs. As organizations increasingly adopt multi-cloud strategies, the demand for integrated solutions will rise. Furthermore, the focus on sustainability in cloud operations is expected to shape investment decisions, with companies prioritizing eco-friendly practices. The integration of IoT with cloud services will also enhance operational efficiencies, creating new avenues for growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Function as a Service (FaaS) Cloud Storage Services Cloud Security Services Others (e.g., Database-as-a-Service, Containers/Kubernetes-as-a-Service) |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Federal, State, and Local Government Education (K-12 and Higher Education) Healthcare and Life Sciences Banking, Financial Services, and Insurance (BFSI) Others (e.g., Nonprofits, Startups) |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Multi-Cloud Edge Cloud |

| By Industry Vertical | IT and Telecommunications Retail and E-commerce Manufacturing Media and Entertainment Transportation and Logistics Energy and Utilities Public Sector and Defense Others |

| By Service Model | Managed Services Professional Services Consulting Services Support and Maintenance Services FinOps and Cost Optimization Services |

| By Geographic Presence | Northeast Midwest South West Others (U.S. territories) |

| By Pricing Model | Subscription-Based Pay-As-You-Go (Consumption-Based) Tiered Pricing Reserved/Committed Use Pricing Others (e.g., Spot/Preemptible Instances) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Cloud Adoption | 120 | IT Managers, Chief Information Officers |

| Financial Services Cloud Solutions | 100 | Risk Management Officers, IT Security Managers |

| Retail Cloud Infrastructure | 110 | Operations Directors, E-commerce Managers |

| Manufacturing Cloud Integration | 90 | Supply Chain Managers, IT Directors |

| Education Sector Cloud Services | 80 | IT Administrators, Educational Technology Coordinators |

The United States Cloud Computing Market is valued at approximately USD 220 billion, reflecting a robust growth trajectory driven by the increasing adoption of cloud services across various sectors, particularly Software as a Service (SaaS).