Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5931

Pages:87

Published On:December 2025

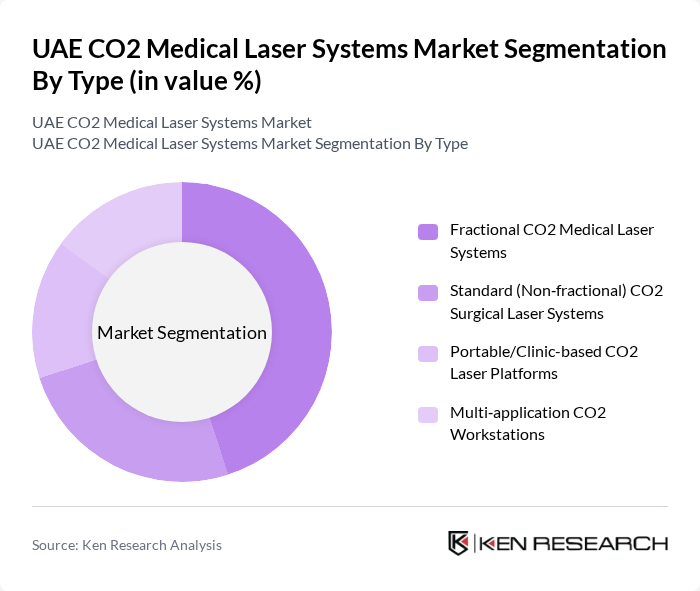

By Type:The market is segmented into various types of CO2 medical laser systems, each catering to specific medical and aesthetic applications. The leading sub-segment is the Fractional CO2 Medical Laser Systems, which are preferred for their effectiveness in skin resurfacing, acne scar reduction, and rejuvenation procedures with shorter recovery time and lower risk of complications compared with older ablative technologies. The demand for these systems is driven by the increasing popularity of non?invasive and minimally invasive cosmetic treatments, social media–driven aesthetic awareness, and growing emphasis on skin health and anti?aging solutions among consumers in the UAE.

By End-User:The end-user segment includes various healthcare facilities utilizing CO2 medical laser systems. Hospitals and Day Surgery Centers are the dominant users due to their capacity to invest in advanced medical technologies, the high volume of dermatology, gynecology, ENT, and dental procedures, and the increasing integration of lasers into outpatient surgery pathways to shorten length of stay and improve efficiency. The increasing trend of outpatient and day?care surgeries, the rise of specialized aesthetic and cosmetic centers, and patient preference for quick, low?downtime procedures further bolster the growth of this segment.

The UAE CO2 Medical Laser Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lumenis Be Ltd., Alma Lasers Ltd., Candela Medical, Cynosure LLC, Cutera Inc., Fotona d.o.o., Lutronic Corporation, BISON Medical Co., Ltd., LightScalpel LLC, Limmer Laser GmbH, Aakaar Medical Technologies Pvt. Ltd., Lynton Lasers Ltd., BTL Industries, InMode Ltd., Hologic Inc. (including Cynosure legacy portfolio) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE CO2 medical laser systems market appears promising, driven by ongoing advancements in technology and increasing consumer awareness of aesthetic treatments. As healthcare infrastructure expands, more facilities are likely to adopt these systems, enhancing treatment accessibility. Additionally, the integration of artificial intelligence in laser technologies is expected to revolutionize treatment personalization, improving patient outcomes and satisfaction. This evolving landscape presents a fertile ground for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Fractional CO2 Medical Laser Systems Standard (Non?fractional) CO2 Surgical Laser Systems Portable/Clinic-based CO2 Laser Platforms Multi?application CO2 Workstations |

| By End-User | Hospitals & Day Surgery Centers Dermatology & Aesthetic Clinics Plastic & Cosmetic Surgery Centers Gynecology, ENT & Dental Clinics |

| By Application | Dermatology & Aesthetic Indications (Skin Resurfacing, Scar & Wrinkle Reduction) Gynecology (Vaginal Rejuvenation, Cervical & Vulvar Lesions) ENT & Oral Surgery Other Surgical Applications (Urology, General Surgery, Oncology) |

| By Technology | Continuous Wave CO2 Lasers Pulsed CO2 Lasers Fractional CO2 Lasers Ultra?pulsed/Scanning CO2 Systems |

| By Region | Abu Dhabi Dubai Sharjah & Northern Emirates Others |

| By Distribution Channel | Direct Sales (Subsidiaries & Direct Offices) Authorized Local Distributors/Importers Online & E?procurement Portals Group Purchasing & Government Tenders |

| By Price Range | Premium (>USD 120,000 per System) Mid-range (USD 60,000–120,000 per System) Budget (Refurbished & Rental Systems) |

| By Cross Comparison of Key Players | Company Name Global Group Size (Tier?1 / Tier?2 / Regional) CO2 Medical Laser Revenue (Global & Middle East / UAE), Latest FY ?Year CO2 Segment Revenue CAGR Installed Base in UAE (Number of CO2 Systems) Market Share in UAE CO2 Segment (%) Product Portfolio Breadth (Dermatology, Gynecology, ENT, Dental, Surgical) Regulatory Approvals & Registrations (US FDA, CE Mark, UAE MoHAP/DOH/DHA) Average Selling Price Positioning (Premium / Mid?range / Value) Key Local Partnerships & Distribution Coverage (Cities/Emirates) After?sales Service Footprint (Local Service Centers, Response Time) R&D / Product Innovation Intensity (New CO2 Launches, Patents, Features) |

| By Detailed Profile of Major Companies | Lumenis Be Ltd. Alma Lasers Ltd. Candela Medical Cynosure LLC Cutera Inc. Fotona d.o.o. Lutronic Corporation BISON Medical Co., Ltd. LightScalpel LLC Limmer Laser GmbH Aakaar Medical Technologies Pvt. Ltd. Lynton Lasers Ltd. BTL Industries InMode Ltd. Hologic Inc. (including Cynosure legacy portfolio) |

| By Procurement Behavior of Key Ministries | Budget Allocation Trends Decision-Making Processes Preferred Suppliers Compliance Requirements |

| By Corporate Spend on Infrastructure & Energy | Investment Trends Budgeting Practices Long-term Contracts Cost Management Strategies |

| By Pain Point Analysis by End-User Category | Common Challenges Faced Service Gaps Technology Adoption Barriers Support and Maintenance Issues |

| By User Readiness for Adoption | Training Needs Technology Familiarity Infrastructure Readiness Financial Preparedness |

| By Post-Deployment ROI and Use Case Expansion | Measurement of Success Expansion Opportunities User Feedback Mechanisms Long-term Value Assessment |

| By Domestic Market Entry Strategy | Product Mix Pricing Band Packaging |

| By Export Entry Strategy | Target Countries Compliance Roadmap |

| By Phased Plan for Market Entry | Market Setup Market Entry Growth Acceleration Scale & Stabilize |

| By Key Activities and Milestones | Milestone Planning Activity Tracking |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dermatology Clinics | 100 | Dermatologists, Clinic Managers |

| Cosmetic Surgery Centers | 80 | Plastic Surgeons, Operations Directors |

| Hospitals with Laser Treatment Facilities | 100 | Medical Directors, Procurement Officers |

| Laser Equipment Distributors | 60 | Sales Managers, Product Specialists |

| Regulatory Bodies and Health Authorities | 50 | Policy Makers, Health Inspectors |

The UAE CO2 Medical Laser Systems Market is valued at approximately USD 20 million, reflecting a significant share within the broader UAE medical lasers market and the Middle East and Africa CO2 laser market.