Region:Middle East

Author(s):Shubham

Product Code:KRAB7302

Pages:91

Published On:October 2025

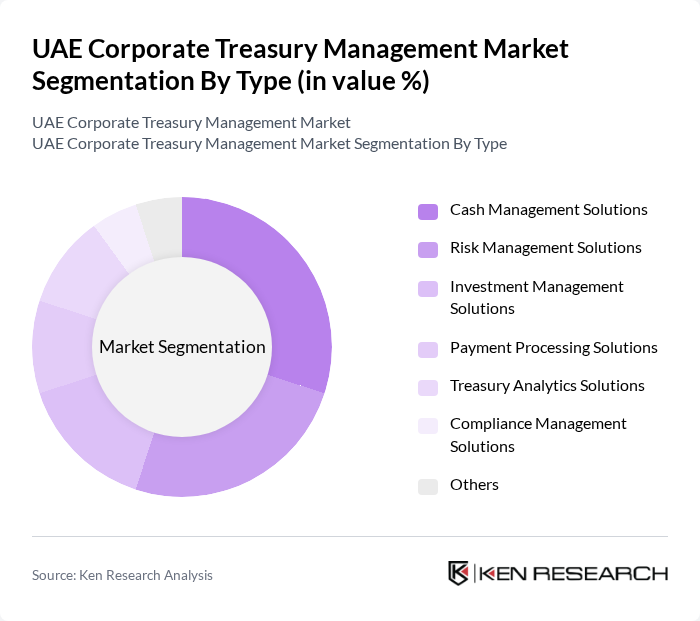

By Type:The market is segmented into various types of treasury management solutions, including Cash Management Solutions, Risk Management Solutions, Investment Management Solutions, Payment Processing Solutions, Treasury Analytics Solutions, Compliance Management Solutions, and Others. Each of these sub-segments plays a crucial role in addressing specific financial needs of organizations.

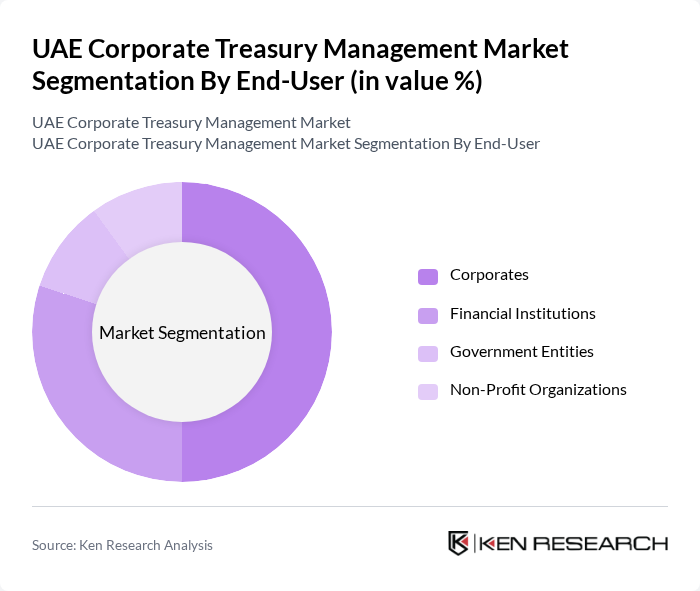

By End-User:The end-user segmentation includes Corporates, Financial Institutions, Government Entities, and Non-Profit Organizations. Each of these segments has unique treasury management needs, driving the demand for tailored solutions.

The UAE Corporate Treasury Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates NBD, Abu Dhabi Commercial Bank, First Abu Dhabi Bank, Dubai Islamic Bank, Mashreq Bank, National Bank of Fujairah, Sharjah Islamic Bank, RAK Bank, HSBC Middle East, Standard Chartered Bank, Citibank UAE, Deutsche Bank UAE, BNP Paribas UAE, J.P. Morgan UAE, Barclays UAE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE corporate treasury management market is poised for significant transformation, driven by technological advancements and evolving business needs. As companies increasingly adopt cloud-based solutions and integrate AI into their operations, the demand for real-time data analytics will rise. Furthermore, the focus on sustainability in corporate finance will shape treasury strategies, compelling organizations to align their financial practices with environmental goals, thereby enhancing their competitive edge in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Cash Management Solutions Risk Management Solutions Investment Management Solutions Payment Processing Solutions Treasury Analytics Solutions Compliance Management Solutions Others |

| By End-User | Corporates Financial Institutions Government Entities Non-Profit Organizations |

| By Industry | Manufacturing Retail Energy Telecommunications Healthcare Construction Others |

| By Service Model | On-Premise Solutions Cloud-Based Solutions Hybrid Solutions |

| By Deployment Type | Public Cloud Private Cloud Hybrid Cloud |

| By Geographic Presence | UAE GCC Region International Markets |

| By Pricing Model | Subscription-Based Pricing One-Time License Fee Pay-Per-Use Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Treasury Management in Oil & Gas | 100 | CFOs, Treasury Managers |

| Real Estate Sector Treasury Practices | 80 | Finance Directors, Risk Managers |

| Manufacturing Sector Cash Management | 70 | Financial Controllers, Treasury Analysts |

| Banking Services for Corporates | 90 | Relationship Managers, Product Heads |

| Regulatory Impact on Treasury Operations | 60 | Compliance Officers, Financial Advisors |

The UAE Corporate Treasury Management Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the increasing complexity of financial operations and the demand for efficient cash and risk management solutions among corporations.