Region:Middle East

Author(s):Dev

Product Code:KRAB7233

Pages:94

Published On:October 2025

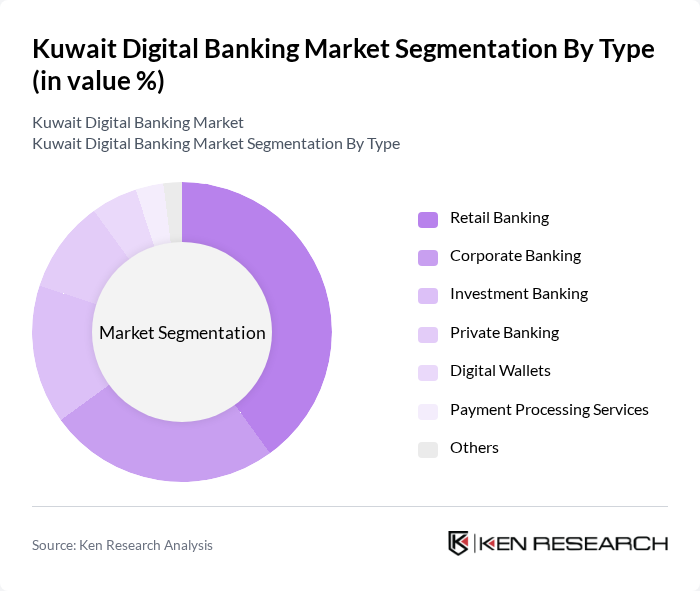

By Type:The market is segmented into various types, including Retail Banking, Corporate Banking, Investment Banking, Private Banking, Digital Wallets, Payment Processing Services, and Others. Among these, Retail Banking is the most dominant segment, driven by the increasing number of individual consumers opting for online banking solutions. The convenience and accessibility of digital platforms have made retail banking a preferred choice for many.

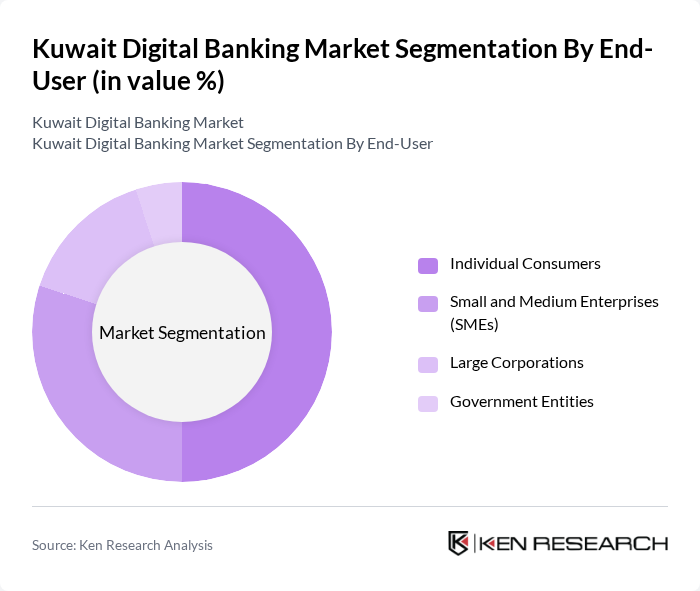

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individual Consumers represent the largest segment, as the growing trend of digital banking among the general population has led to increased adoption of online banking services. The convenience and user-friendly interfaces of digital platforms cater to the needs of individual users effectively.

The Kuwait Digital Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as National Bank of Kuwait, Gulf Bank, Boubyan Bank, Kuwait Finance House, Al Ahli Bank of Kuwait, Warba Bank, Burgan Bank, Kuwait International Bank, Ahli United Bank, Qatar National Bank, Arab Bank, Standard Chartered Bank, HSBC Bank Middle East, Citibank Kuwait, Bank of Bahrain and Kuwait contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait digital banking market appears promising, driven by technological advancements and evolving consumer preferences. As banks increasingly adopt artificial intelligence and machine learning, personalized banking services will become more prevalent, enhancing customer satisfaction. Additionally, the rise of neobanks and digital-only banks is expected to disrupt traditional banking models, fostering competition and innovation. Sustainability initiatives will also gain traction, aligning with global trends towards environmentally responsible banking practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Retail Banking Corporate Banking Investment Banking Private Banking Digital Wallets Payment Processing Services Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Service Channel | Mobile Banking Online Banking ATM Services Branch Banking |

| By Payment Method | Credit/Debit Cards Bank Transfers E-Wallets QR Code Payments |

| By Customer Segment | Millennials Gen Z Baby Boomers |

| By Geographic Presence | Urban Areas Rural Areas |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Customers | 150 | Individual Account Holders, Retail Banking Managers |

| Corporate Banking Clients | 100 | Corporate Account Managers, CFOs of SMEs |

| Fintech Users | 80 | Tech-savvy Consumers, Startup Founders |

| Regulatory Stakeholders | 50 | Policy Makers, Financial Regulators |

| Banking Technology Providers | 70 | Product Managers, IT Directors |

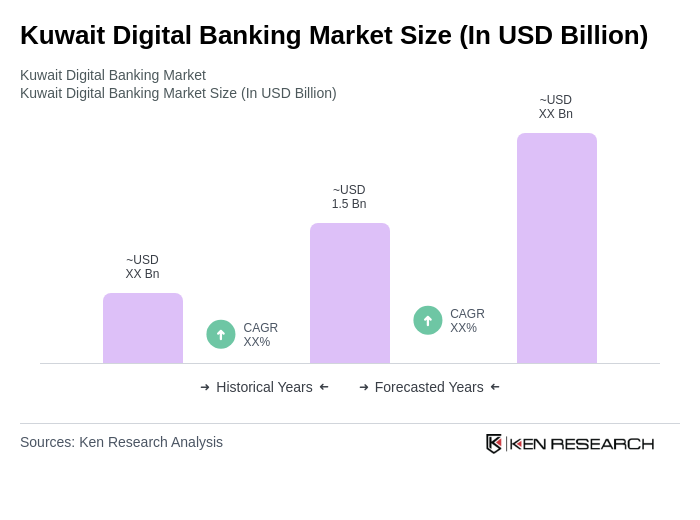

The Kuwait Digital Banking Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increased adoption of digital banking solutions and enhanced internet penetration among consumers.