Region:Middle East

Author(s):Rebecca

Product Code:KRAD7514

Pages:89

Published On:December 2025

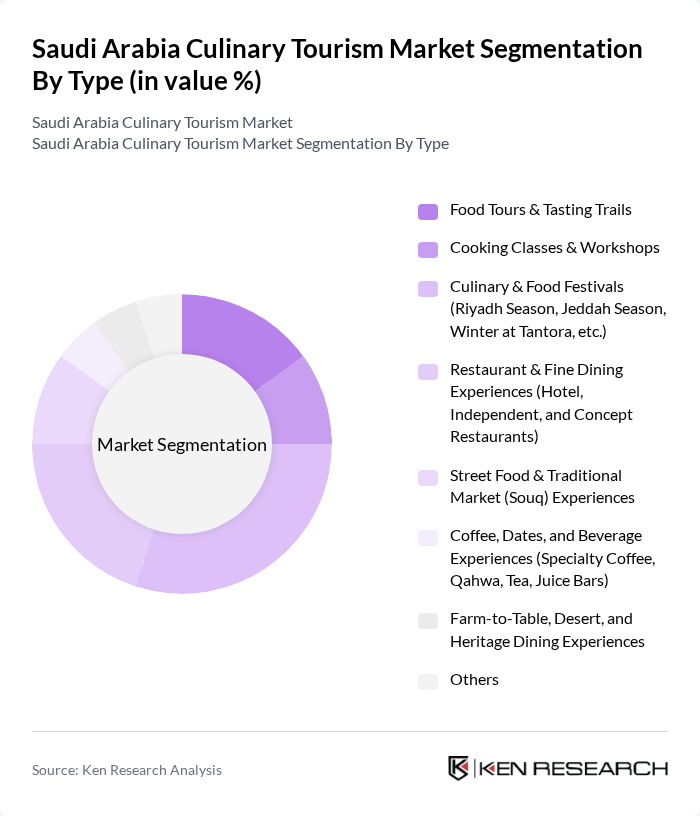

By Type:The culinary tourism market in Saudi Arabia can be segmented into various types, including Food Tours & Tasting Trails, Cooking Classes & Workshops, Culinary & Food Festivals, Restaurant & Fine Dining Experiences, Street Food & Traditional Market Experiences, Coffee, Dates, and Beverage Experiences, Farm-to-Table, Desert, and Heritage Dining Experiences, and Others. Among these, Culinary & Food Festivals are particularly popular, attracting large crowds and showcasing the country's diverse culinary heritage.

By Cuisine:The culinary tourism market can also be segmented by cuisine, including Traditional Saudi Cuisine, Broader Middle Eastern & Levantine Cuisine, International Cuisine, Fusion & Contemporary Saudi Cuisine, Specialty Diet & Wellness Cuisine, and Others. Traditional Saudi Cuisine is the most dominant segment, as it reflects the rich cultural heritage and is a major attraction for both domestic and international tourists.

The Saudi Arabia Culinary Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Tourism Authority (STA) – Culinary & Events Programs, Royal Commission for AlUla (RCU) – Winter at Tantora & AlUla Moments, General Entertainment Authority (GEA) – Riyadh Season & Jeddah Season Food Experiences, Diriyah Gate Development Authority (DGDA) – Bujairi Terrace Culinary District, Saudi Culinary Arts Commission, Saudi Arabian Airlines (SAUDIA) – SAUDIA Holidays & Culinary Packages, Almosafer & Discover Saudi (Seera Group), Dur Hospitality (Makarem Hotels & other brands), Al Khozama Management Company (e.g., Al Faisaliah, premium F&B concepts), Al Hokair Group for Tourism and Development, Alshaya Group – International Restaurant Franchises in KSA, Riyadh Season F&B Concessionaires & Food Hall Operators, Jeddah Season F&B & Waterfront Restaurant Operators, Boutique Group (Historic Palace Hotels & Dining), NEOM & The Red Sea Global – Destination & Resort Culinary Experiences contribute to innovation, geographic expansion, and service delivery in this space.

The future of culinary tourism in Saudi Arabia appears promising, driven by increasing global interest and government support. As the nation continues to invest in tourism infrastructure and promote its rich culinary heritage, the sector is expected to attract a growing number of international visitors in future. Additionally, the integration of technology in culinary experiences and a focus on sustainability will likely enhance the appeal of Saudi Arabia as a culinary destination, fostering innovation and growth in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Food Tours & Tasting Trails Cooking Classes & Workshops Culinary & Food Festivals (Riyadh Season, Jeddah Season, Winter at Tantora, etc.) Restaurant & Fine Dining Experiences (Hotel, Independent, and Concept Restaurants) Street Food & Traditional Market (Souq) Experiences Coffee, Dates, and Beverage Experiences (Specialty Coffee, Qahwa, Tea, Juice Bars) Farm?to?Table, Desert, and Heritage Dining Experiences Others |

| By Cuisine | Traditional Saudi Cuisine (Najdi, Hijazi, Asiri, Eastern, Northern, etc.) Broader Middle Eastern & Levantine Cuisine International Cuisine (Western, Asian, African, Latin American, etc.) Fusion & Contemporary Saudi Cuisine Specialty Diet & Wellness Cuisine (Vegan, Organic, Health?focused) Others |

| By Target Audience | Domestic Tourists International Leisure Tourists Religious Tourists & Pilgrims (Mecca & Medina) Business Travelers & MICE Visitors Expat Residents High?Net?Worth & Luxury Travelers Culinary Enthusiasts & Food Bloggers/Influencers Others |

| By Region | Riyadh & Riyadh Province Jeddah & Makkah Province (incl. Mecca) Eastern Province (Dammam, Dhahran, Al?Khobar, Al?Ahsa) Medina Region (incl. Medina City) Al?Ula & Northwestern Region (Tabuk, NEOM, Red Sea) Southern Region (Asir, Jazan, Al?Baha, Najran) Others |

| By Seasonality | Religious Seasons (Ramadan, Hajj, Umrah Peak) National & Festival Seasons (Riyadh Season, Jeddah Season, Winter at Tantora, Saudi National Day, etc.) Peak Leisure Tourism Season Off?Peak Season Others |

| By Booking Channel | Online Travel Agencies & Experience Platforms (Booking, TripAdvisor, Viator, GetYourGuide, etc.) Direct Bookings via Operator or Restaurant (Web, App, Call) Hotel & Tour Operator Packages Social Media & Influencer?Led Bookings Local Travel Agencies & DMCs Others |

| By Experience Type | Guided Group Tours & Experiences Private & Customized Experiences Self?Guided & Digital?App?Based Experiences Event?Based & Pop?Up Culinary Experiences Long?Stay Culinary Programs (Retreats, Courses, Residencies) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Culinary Tour Participants | 150 | International Tourists, Food Enthusiasts |

| Local Restaurant Owners | 120 | Restaurant Owners, Culinary Entrepreneurs |

| Culinary Event Organizers | 90 | Event Organizers, Marketing Managers |

| Travel Agency Representatives | 80 | Travel Agents, Tour Operators |

| Food Bloggers and Influencers | 60 | Food Bloggers, Social Media Influencers |

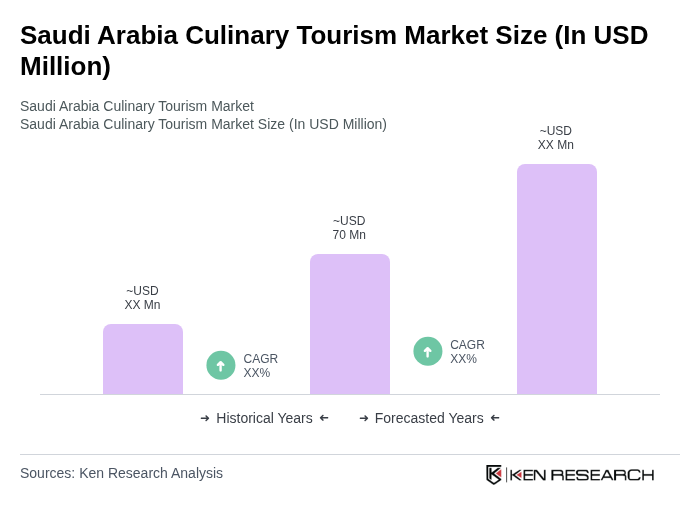

The Saudi Arabia Culinary Tourism Market is valued at approximately USD 70 million, reflecting a growing interest in authentic culinary experiences and food festivals, supported by government initiatives under Vision 2030 to promote tourism.