Region:Middle East

Author(s):Shubham

Product Code:KRAD6806

Pages:90

Published On:December 2025

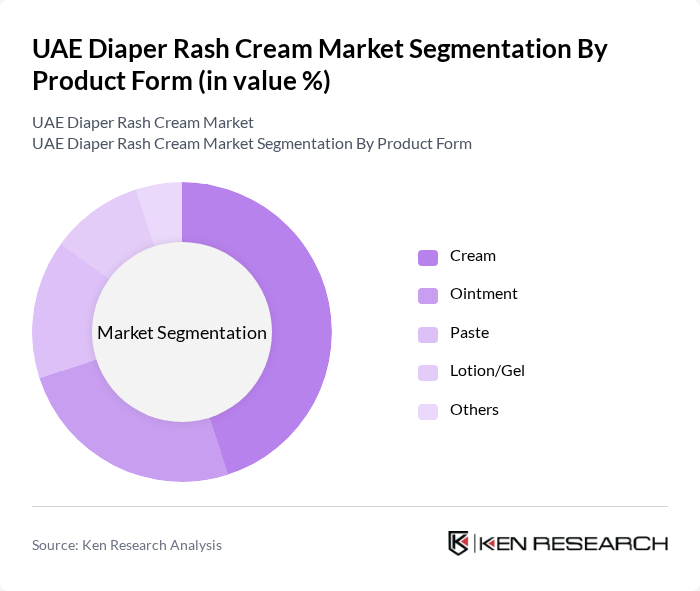

By Product Form:The product form segmentation includes various types of formulations available in the market. The subsegments are Cream, Ointment, Paste, Lotion/Gel, and Others. Among these, creams are the most popular due to their ease of application, spreadability, and quick absorption, making them a preferred choice for parents and widely offered by leading brands in the UAE. Ointments and pastes are also significant, particularly for moderate to severe cases of diaper rash, as they provide a thicker, more occlusive barrier and often contain higher levels of zinc oxide to protect the skin. The trend towards natural and organic formulations, including products with calendula, aloe vera, shea butter, and plant-based oils, is influencing the growth of lotions and gels, appealing to health-conscious consumers seeking lighter textures and cleaner ingredient labels.

By End-User:The end-user segmentation categorizes consumers based on age groups and usage. The subsegments include Infants (0–12 months), Toddlers (1–3 years), Older children & adults using diapers, and Others (institutional/clinical use). Infants represent the largest segment, consistent with global patterns where infants account for the majority of diaper rash cream consumption due to higher incidence of diaper dermatitis and frequent diaper changes. Toddlers also contribute significantly as parents seek to prevent diaper rash during this active stage and continue using protective creams alongside training pants and daytime diapers. The institutional segment is growing as hospitals, maternity clinics, and long-term care facilities in the UAE increasingly use these products for patient care, aligning with broader hospital protocols on skin integrity and prevention of moisture-associated skin damage.

The UAE Diaper Rash Cream Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson Middle East FZ-LLC (Desitin, Aveeno Baby), Bayer Middle East FZE (Bepanthen), Teva Pharmaceutical Industries Ltd. (Sudocrem), Laboratoires Expanscience – Mustela, Beiersdorf Middle East FZ-LLC (Eucerin, Nivea Baby), Galderma Middle East (Cetaphil Baby), Burt's Bees, Inc. (Burt’s Bees Baby), Weleda AG (Weleda Baby), Earth Mama Organics, Babyganics, Himalaya Wellness (Himalaya Baby Care), Sebapharma GmbH & Co. KG (Sebamed Baby), Pigeon Corporation, Fissan (Angelini Pharma), and local & regional private-label brands (e.g., Carrefour, Lulu, Boots) contribute to innovation, geographic expansion, and service delivery in this space.

The UAE diaper rash cream market is poised for continued growth, driven by evolving consumer preferences towards organic and hypoallergenic products. As parents become more discerning about ingredient safety, brands that prioritize natural formulations are likely to gain a competitive edge. Additionally, the increasing penetration of e-commerce is expected to facilitate greater access to a diverse range of products, enhancing consumer choice and convenience. This dynamic environment presents opportunities for innovation and strategic partnerships within the industry.

| Segment | Sub-Segments |

|---|---|

| By Product Form | Cream Ointment Paste Lotion/Gel Others |

| By End-User | Infants (0–12 months) Toddlers (1–3 years) Older children & adults using diapers Others (institutional/clinical use) |

| By Distribution Channel | Supermarkets/Hypermarkets Pharmacies & Drugstores Online Retail & Marketplaces Baby Specialty Stores Others (hospital & clinic pharmacies) |

| By Ingredient / Active Type | Zinc oxide–based Zinc oxide–free Organic / natural ingredient–based Others |

| By Packaging Type | Tubes Jars Pump bottles Sachets & travel packs Others |

| By Price Range | Economy Mid-range Premium Prestige/dermatologist brands |

| By Brand Positioning | Mass-market brands Natural/organic & clean-label brands Pharmacy/dermatologist-recommended brands Private-label & retailer brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 60 | Pediatricians, Dermatologists |

| Parents of Infants | 120 | New Mothers, Caregivers |

| Retail Managers | 50 | Store Managers, Category Buyers |

| Market Analysts | 40 | Industry Experts, Market Researchers |

| Product Development Teams | 70 | Brand Managers, R&D Specialists |

The UAE Diaper Rash Cream market is valued at approximately USD 18 million, reflecting a growing demand for specialized infant skincare products driven by increased healthcare expenditure and consumer awareness about skin health.