Kuwait Baby Wipes Market Overview

- The Kuwait Baby Wipes Market is valued at USD 50 million, based on a five-year historical analysis and normalization from regional tissue and hygiene paper market data. This growth is primarily driven by increasing awareness of hygiene among parents, a rising birth rate, and a surge in demand for convenient, portable cleaning solutions. The market is further supported by the growing number of working women and higher disposable incomes, which encourage frequent purchases of baby care products. Additionally, the shift towards vegan and eco-friendly raw materials is influencing product innovation and expansion in the segment .

- Kuwait City remains the dominant market hub due to its high population density and urban lifestyle, which foster greater demand for baby care products. The affluent consumer base in Kuwait is increasingly inclined towards premium and organic baby wipes, with a notable preference for products that are free from parabens, sulfates, and other synthetic chemicals. This trend is reinforced by the city's advanced retail infrastructure and the availability of specialty baby care brands .

- In 2023, the Kuwaiti government enacted the “Kuwait Standard Specification for Baby Wipes, KWS 1865:2023” issued by the Public Authority for Industry. This regulation mandates that all baby wipes sold in Kuwait must be free from harmful chemicals such as parabens and phthalates, and must comply with strict safety and labeling standards. The regulation covers product composition, permissible ingredient thresholds, and eco-friendly packaging requirements, compelling manufacturers to innovate and ensure compliance with these standards to enhance consumer safety and environmental sustainability .

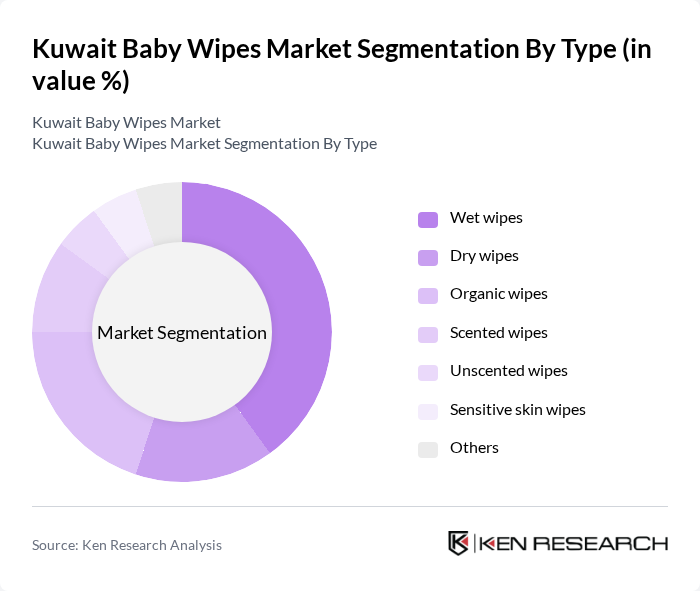

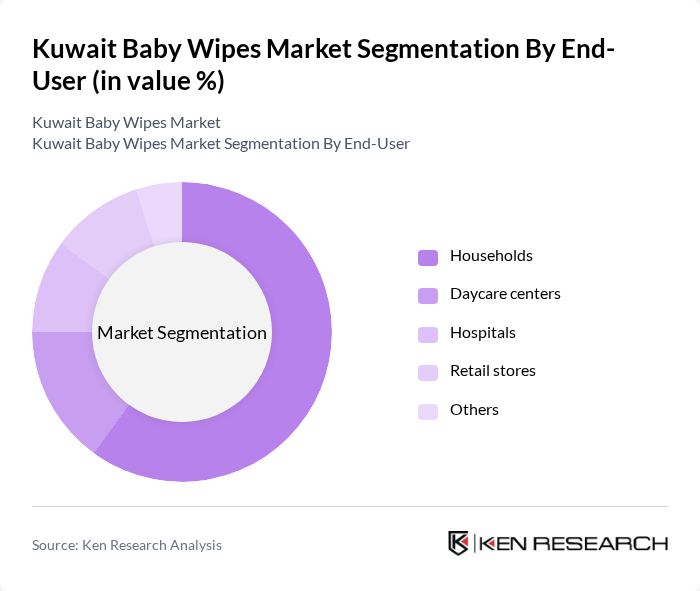

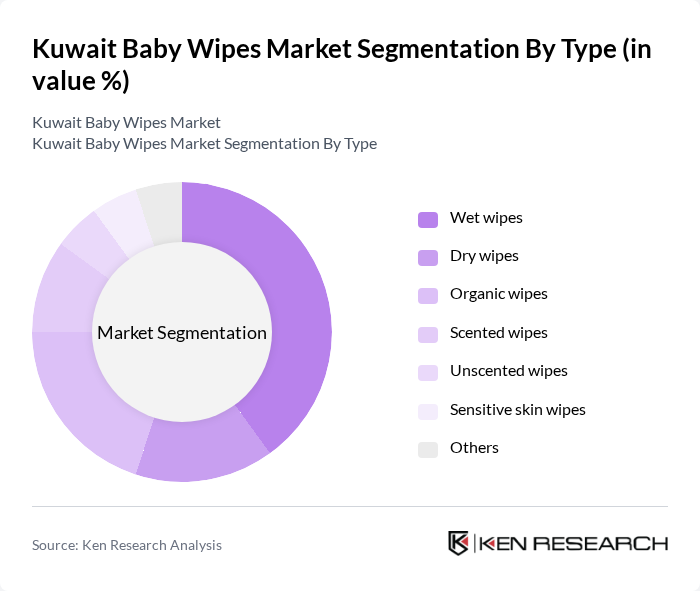

Kuwait Baby Wipes Market Segmentation

By Type:The market is segmented into Wet wipes, Dry wipes, Organic wipes, Scented wipes, Unscented wipes, Sensitive skin wipes, and Others. Wet wipes hold the largest share due to their convenience, high demand for disinfecting capabilities, and shorter shelf life, which drives frequent repurchase. Organic wipes are rapidly gaining traction as health-conscious and environmentally aware consumers shift towards natural, chemical-free products. Dry wipes are also popular for their high absorption rate and ease of disposal, while sensitive skin wipes are preferred by parents seeking hypoallergenic solutions .

By End-User:The end-user segmentation includes Households, Daycare centers, Hospitals, Retail stores, and Others. Households account for the majority share, driven by parents’ preference for daily use and convenience. Daycare centers and hospitals are significant contributors due to their bulk purchasing requirements for hygiene maintenance. Retail stores serve as key distribution points, offering a wide variety of brands and product types to meet diverse consumer needs .

Kuwait Baby Wipes Market Competitive Landscape

The Kuwait Baby Wipes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble (Pampers), Kimberly-Clark Corporation (Huggies), Unicharm Corporation (MamyPoko), Johnson & Johnson (Aveeno Baby, Neutrogena Baby), Nice-Pak Products, Inc., Seventh Generation, Earth Friendly Products (ECOS), Babyganics, Bambo Nature, Naty, Little Green, WaterWipes, Honest Company, Al Safa Trading Company (Local distributor), Al Mulla Group (Local distributor) contribute to innovation, geographic expansion, and service delivery in this space.

Kuwait Baby Wipes Market Industry Analysis

Growth Drivers

- Increasing Awareness of Hygiene Among Parents:The heightened focus on hygiene, particularly post-pandemic, has led to a significant increase in the demand for baby wipes in Kuwait. According to the World Bank, the country's health expenditure per capita reached approximately $1,500 in future, reflecting a growing commitment to health and hygiene. This trend is further supported by a 20% increase in the number of parents prioritizing hygiene products for their children, driving the baby wipes market's growth.

- Rising Disposable Income and Spending on Baby Care Products:Kuwait's GDP per capita is projected to be around $80,000 in future, indicating a robust economy and increased disposable income. This economic growth has led to a 25% rise in consumer spending on baby care products, including baby wipes. Parents are increasingly willing to invest in premium products that ensure their children's health and comfort, further propelling market expansion.

- Growth in the Number of Working Parents:The labor force participation rate for women in Kuwait has increased to 60% in future, contributing to a rise in dual-income households. This demographic shift has resulted in a 35% increase in demand for convenient baby care solutions, such as baby wipes. Working parents prioritize products that offer efficiency and ease of use, significantly boosting the baby wipes market in the region.

Market Challenges

- High Competition Among Local and International Brands:The Kuwait baby wipes market is characterized by intense competition, with over 60 brands vying for market share. This saturation has led to aggressive pricing strategies, impacting profit margins. According to industry reports, the top five brands account for only 45% of the market, indicating a fragmented landscape where new entrants struggle to establish a foothold amidst established players.

- Fluctuating Raw Material Prices:The volatility in the prices of raw materials, such as non-woven fabric and chemicals, poses a significant challenge for manufacturers. In future, the price of polypropylene, a key material, surged by 30% due to supply chain disruptions. This fluctuation can lead to increased production costs, forcing companies to either absorb the costs or pass them on to consumers, potentially affecting sales.

Kuwait Baby Wipes Market Future Outlook

The Kuwait baby wipes market is poised for continued growth, driven by evolving consumer preferences and increasing health consciousness. The demand for hypoallergenic and eco-friendly products is expected to rise, aligning with global sustainability trends. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of products, enhancing consumer choice. As the market adapts to these trends, innovative packaging solutions and subscription services may further reshape the landscape, catering to the needs of modern parents.

Market Opportunities

- Introduction of Organic and Biodegradable Baby Wipes:There is a growing consumer preference for organic and biodegradable products, with the market for eco-friendly baby wipes projected to increase by 50% in the next two years. This trend presents a significant opportunity for brands to innovate and capture environmentally conscious consumers, enhancing brand loyalty and market share.

- Expansion into Untapped Rural Markets:Rural areas in Kuwait represent a largely untapped market for baby wipes, with a potential customer base of over 250,000 households. Targeting these regions through tailored marketing strategies and distribution channels can significantly boost sales. Companies that invest in rural outreach can capitalize on the increasing awareness of hygiene among parents in these areas.