Region:Middle East

Author(s):Rebecca

Product Code:KRAD4947

Pages:96

Published On:December 2025

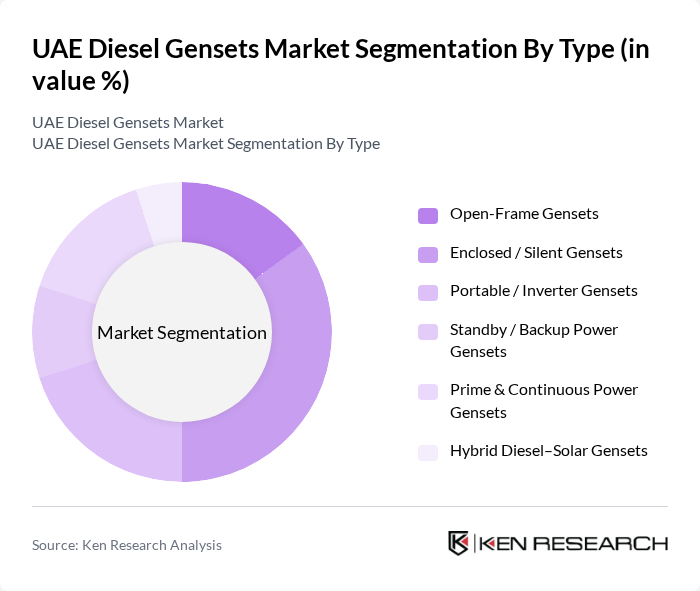

By Type:The market is segmented into various types of diesel gensets, including Open-Frame Gensets, Enclosed / Silent Gensets, Portable / Inverter Gensets, Standby / Backup Power Gensets, Prime & Continuous Power Gensets, and Hybrid Diesel–Solar Gensets. This segmentation is consistent with leading industry research that classifies diesel gensets by configuration and application, particularly for backup, prime, and hybrid uses. Among these, Enclosed / Silent Gensets are gaining traction due to their noise reduction capabilities and better enclosure design, making them suitable for urban environments, commercial buildings, healthcare facilities, and hospitality applications where noise and aesthetics are critical. The demand for Portable / Inverter Gensets is also on the rise, driven by the increasing need for mobile and small-capacity backup power solutions in residential, small business, events, and temporary construction sites, as well as the growing rental market for portable units.

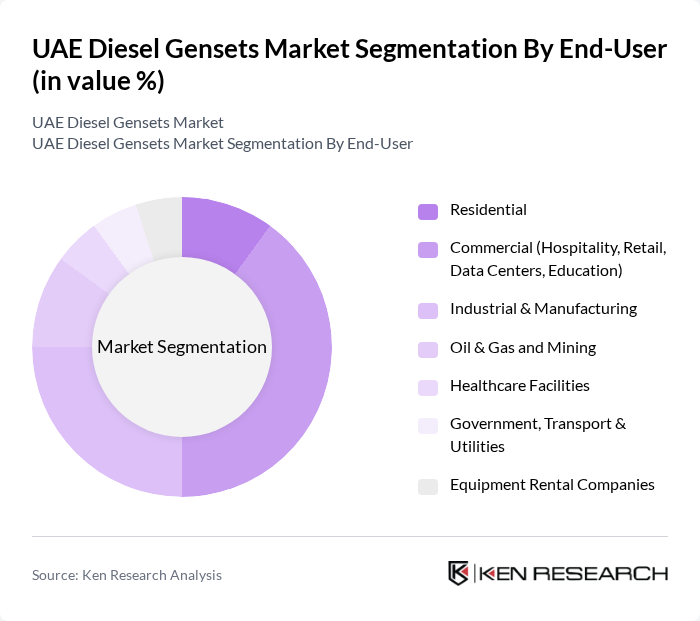

By End-User:The end-user segmentation includes Residential, Commercial (Hospitality, Retail, Data Centers, Education), Industrial & Manufacturing, Oil & Gas and Mining, Healthcare Facilities, Government, Transport & Utilities, and Equipment Rental Companies. This structure aligns with market analyses that highlight industrial, commercial, and infrastructure segments as the major demand centers for diesel gensets in the UAE. The Commercial sector is the leading end-user, driven by the need for uninterrupted power supply in hotels, retail outlets, offices, and especially data centers and telecom infrastructure, where uptime and power quality are critical. The Industrial & Manufacturing sector also shows significant demand due to ongoing industrial projects, free zones, and manufacturing activities, particularly in metals, construction materials, and logistics, which rely on gensets for both backup and prime power in case of grid instability or remote locations.

The UAE Diesel Gensets Market is characterized by a dynamic mix of regional and international players. Leading participants such as Caterpillar Inc. / Caterpillar Middle East, Cummins Inc. / Cummins Middle East FZE, Kohler Co. (Kohler Power Systems), Perkins Engines Company Limited, Rolls-Royce Power Systems (MTU Onsite Energy), Generac Power Systems, Inc., Atlas Copco AB, FG Wilson (Engineering) Ltd., HIMOINSA S.L., Aggreko plc, Mitsubishi Heavy Industries Engine & Turbocharger, Ltd., Doosan Portable Power, Wartsila Corporation, Saudi Diesel Equipment Co. (Regional Supplier), Jubaili Bros (Regional Genset Assembler & Distributor) contribute to innovation, geographic expansion, and service delivery in this space.

The UAE diesel gensets market is poised for significant transformation, driven by technological advancements and a shift towards sustainable energy solutions. As the government emphasizes renewable energy integration, diesel gensets will increasingly incorporate hybrid systems, enhancing efficiency and reducing emissions. Furthermore, the growing demand for smart gensets equipped with IoT capabilities will enable real-time monitoring and predictive maintenance, ensuring optimal performance and reliability in power generation across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Open-Frame Gensets Enclosed / Silent Gensets Portable / Inverter Gensets Standby / Backup Power Gensets Prime & Continuous Power Gensets Hybrid Diesel–Solar Gensets |

| By End-User | Residential Commercial (Hospitality, Retail, Data Centers, Education) Industrial & Manufacturing Oil & Gas and Mining Healthcare Facilities Government, Transport & Utilities Equipment Rental Companies |

| By Application | Standby / Emergency Backup Power Prime Power Continuous Power Peak Shaving / Load Management Construction Sites and Temporary Power Telecommunications & Data Centers |

| By Fuel Type | Conventional Diesel Bio-Diesel Blends Dual-Fuel (Diesel + Gas) |

| By Power Rating (kVA) | Up to 75 kVA – 375 kVA – 750 kVA – 1000 kVA Above 1000 kVA |

| By Distribution Channel | Direct Sales (OEMs & Regional Offices) Authorized Distributors & Dealers Rental Companies Online and E-Procurement Portals |

| By Region | Abu Dhabi Dubai Sharjah & Northern Emirates Others (Free Zones & Remote Sites) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Diesel Gensets | 100 | Project Managers, Site Engineers |

| Telecommunications Backup Power Solutions | 80 | Network Operations Managers, Technical Directors |

| Oil & Gas Industry Power Supply | 90 | Operations Managers, Safety Officers |

| Residential Genset Users | 70 | Homeowners, Facility Managers |

| Commercial Genset Applications | 85 | Facility Managers, Energy Procurement Officers |

The UAE Diesel Gensets Market is valued at approximately USD 1.18 billion, reflecting a robust demand for reliable power solutions across various sectors, including construction, oil and gas, and healthcare.