Region:Middle East

Author(s):Shubham

Product Code:KRAD6610

Pages:87

Published On:December 2025

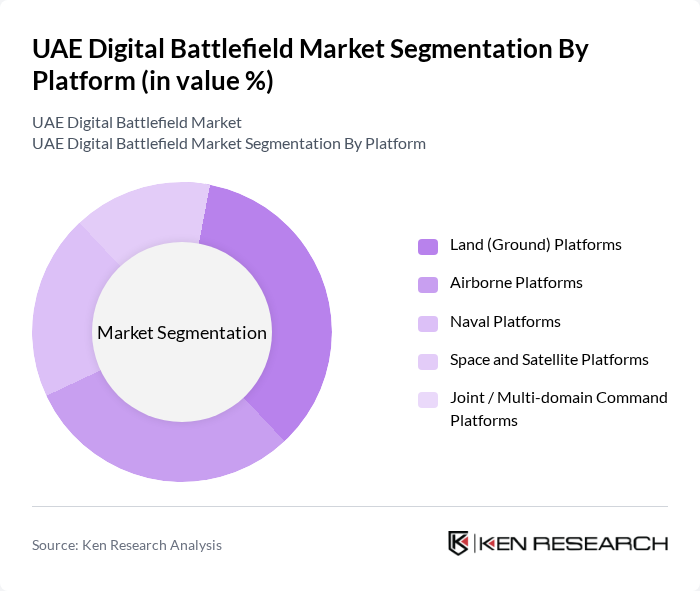

By Platform:The segmentation by platform includes various categories such as Land (Ground) Platforms, Airborne Platforms, Naval Platforms, Space and Satellite Platforms, and Joint / Multi-domain Command Platforms. Each of these platforms plays a crucial role in the overall digital battlefield strategy, with specific applications tailored to enhance operational efficiency and effectiveness.

By Solution:The solution segmentation encompasses Hardware, Software, and Services. Each of these solutions is integral to the digital battlefield, providing the necessary tools and support for effective military operations. The demand for innovative solutions is driven by the need for enhanced capabilities in data processing, communication, and operational management.

The UAE Digital Battlefield Market is characterized by a dynamic mix of regional and international players. Leading participants such as EDGE Group PJSC, HALCON (EDGE Group), ADASI (Autonomous Systems, EDGE Group), Emirates Advanced Research and Technology Holding (EARTH, EDGE Group), Abu Dhabi Ship Building PJSC (ADSB), Tawazun Council, Calidus LLC, GAL (Global Aerospace Logistics), Thuraya Telecommunications Company / Yahsat, Thales Group, Raytheon Technologies (RTX Corporation), Lockheed Martin Corporation, BAE Systems plc, Northrop Grumman Corporation, Leonardo S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The UAE digital battlefield market is poised for significant evolution, driven by ongoing technological advancements and a heightened focus on national security. As defense budgets continue to rise, investments in AI, autonomous systems, and cybersecurity will likely accelerate. Collaborative initiatives with global defense firms will enhance capabilities, while the integration of smart defense solutions will redefine operational strategies. The emphasis on training and simulation technologies will also play a crucial role in preparing military personnel for future challenges, ensuring readiness in an increasingly complex security landscape.

| Segment | Sub-Segments |

|---|---|

| By Platform | Land (Ground) Platforms Airborne Platforms Naval Platforms Space and Satellite Platforms Joint / Multi-domain Command Platforms |

| By Solution | Hardware Software Services |

| By Application | Command, Control, Communications, Computers, Intelligence, Surveillance and Reconnaissance (C4ISR) Cyber and Electronic Warfare Battlespace Management and Situational Awareness Training, Simulation and Mission Rehearsal Logistics, Maintenance and Support |

| By Technology | Artificial Intelligence and Machine Learning Internet of Things (IoT) and Connected Sensors G and Advanced Communications Cloud Computing and Edge Computing Big Data Analytics Augmented and Virtual Reality (AR/VR) |

| By End-User | UAE Armed Forces (Joint Forces Command, Land, Air, Naval) Presidential Guard and Special Operations Forces Ministry of Interior and Homeland Security Agencies Intelligence and Cybersecurity Agencies Defense R&D and Training Institutions |

| By Procurement and Deployment Model | On-premise / On-platform Deployments Cloud-based and Hybrid Deployments Turnkey Programs and System Integration Contracts Managed Services and Long-term Support Contracts |

| By Emirate | Abu Dhabi Dubai Sharjah Ras Al Khaimah, Fujairah, Ajman, Umm Al Quwain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Technology Adoption | 120 | Defense Analysts, Military Strategists |

| Cybersecurity in Defense | 100 | Cybersecurity Experts, IT Managers |

| AI Applications in Warfare | 90 | AI Researchers, Defense Technology Developers |

| Data Analytics for Military Operations | 80 | Data Scientists, Operations Analysts |

| Digital Training Programs for Armed Forces | 70 | Training Coordinators, Military Educators |

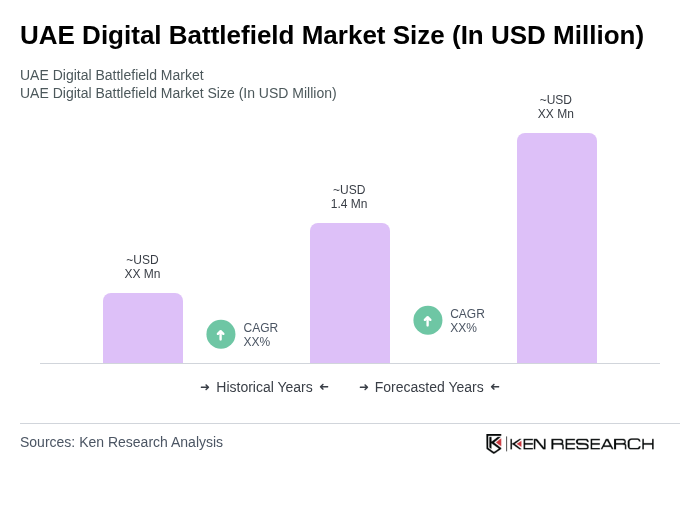

The UAE Digital Battlefield Market is valued at approximately USD 1.4 million, reflecting significant growth driven by increased defense budgets and the demand for advanced military technologies, including cybersecurity and artificial intelligence.